Blackstone is tapping the commercial mortgage bond market to refinance yet another trophy property, the Hotel del Coronado in San Diego.

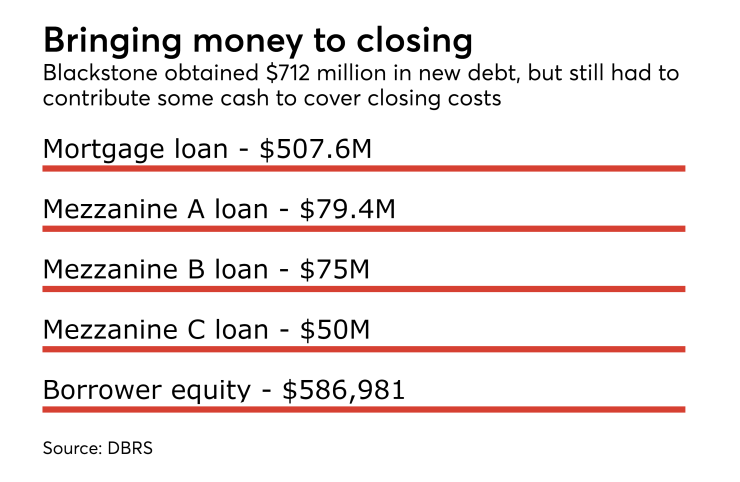

The private equity group initially acquired a 60% interest in the 130-year-old resort in 2011 and later acquired the full interest in late 2015 for approximately $1 billion. Debt on the property has been securitized several times, most recently in two 2013 vintage transactions that were subsequently refinanced early in 2016. Blackstone recently obtained $712 million in new debt, using the proceeds to pay off the $703 million of debt it took out last year and pay closing costs. The private equity firm also contributed $586,981 in cash equity to close, according to DBRS.

Part of the new debt, a $507.6 million first mortgage from Barclays, is being securitized in a new transaction dubbed BBCMS 2017-DELC. Both DBRS and Moody’s Investors Service expect to assign triple-A ratings to the senior tranche of notes to be issued.

The mortgage has an initial term of two years and can be extended by one year up to five times; it pays only interest and no principal for its entire term.

The property is also encumbered by three mezzanine loans totaling $204.4 million that are not being securitized in this transaction.

Moody's puts the loan-to-value ratio for the first mortgage at 110.9%; however, this rises to 155.6% after taking into account the subordinate financing.

Both Moody’s and DBRS cite the high quality of the iconic hotel and its desirable location as credit strengths. “With its unique historic status and highly desirable location with over 1,400 linear feet of ocean frontage and relatively substantial meeting and event space footprint of over 135,000 square feet of indoor and outdoor space, the hotel has no true direct competition in the vicinity or even in the larger Southern California market overall,” DBRS states in its presale report.

And, while hotels are generally considered a riskier type of commercial property, due to their volatile revenue, the performance of the Hotel del Coronado has historically been quite stable. Moody’s noted that net cash flow margin has averaged 31.1% since 2004 with a low of only 26.0%, recorded in 2010.

While the hotel has always been operated independently, Blackstone recently reached an agreement with Hilton Worldwide Holdings giving it access to Hilton's global brand distribution system and 67 million Hilton Honors members.