-

Freddie Mac is automating a manual form submission process used to correct post-settlement and real estate owned data, and adding policy changes aimed at accommodating electronic signatures on loss mitigation documents.

August 20 -

The industry has long worried that the ability-to-repay rule gives borrowers an avenue to fight foreclosure, but one plaintiff’s experience may discourage others from trying.

August 15 -

Increased consumer debt and the threat of an economic downturn increase the default risk for government-sponsored enterprise mortgages during the first quarter, according to Milliman.

August 7 -

Steeper rate declines contributed to a deeper quarterly net loss at Ocwen Financial, forcing it to extend its timeline for returning to profitability.

August 6 -

Mr. Cooper Group reported a second-quarter net loss of $87 million as the company took a $231 million fair value hit to its mortgage servicing rights portfolio.

August 1 -

New Residential Investment Corp. took a $32 million net loss in the second quarter as it diversified its business lines and repositioned to protect its mortgage servicing rights from falling rates.

July 30 -

The incentives are stronger than ever to work toward standardizing the documentation, language and process for loans in commercial mortgage-backed securities to be combined with PACE financing.

July 23 Alston & Bird

Alston & Bird -

While seasonal factors were attributed to the monthly rise in mortgage delinquencies for June, the jump was still much higher than last year's fairly steady increase, according to Black Knight.

July 23 -

Mortgages using alternative documentation like bank statements for underwriting performed stronger than expected, but uncertainty remains about their default rates in stressed environments, Fitch Ratings said.

July 2 -

Will the runoff of MSRs leave a hole in the capital of the mortgage finance industry?

June 25 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

Although the performance of the government-sponsored enterprises' single-family loans continues to improve, the deeply delinquent totals remain significant in states with court-processed foreclosures.

June 21 -

The mortgage agency has hired Eric Blankenstein, who sparked controversy while at the consumer bureau over past revelations of racially charged writings.

June 19 -

Prepayment speeds for loans included in agency mortgage-backed securities were up approximately 20% both monthly and annually during May as the decline in interest rates boosted activity, according to Keefe, Bruyette & Woods.

June 11 - LIBOR

The Mortgage Bankers Association created a template for originators to notify new borrowers when their adjustable-rate mortgage switches to a different index once publication of the London interbank offered rate discontinues.

June 6 -

The large number of overleveraged commercial mortgage-backed securities loans coming due in 2019 is likely to cause the payoff rate to drop an additional 9 percentage points by December, a Morningstar report said.

May 29 -

Delinquencies associated with the government-sponsored enterprises high loan-to-value ratio programs that target low-to-moderate income homebuyers are slightly better than expected, at least early on, according to Fitch.

May 23 -

The potential for longer homeowner recovery times from hurricanes could hurt mortgage companies that need to advance funds to investors from missed payments.

May 15 -

Private-label mortgage securitizations with variable servicing fee arrangements could become more common going forward as issuers look to increase investor cash flow while reducing the loan servicer's economic exposure, Fitch said.

May 6 -

Commercial mortgages placed into special servicing grew last year, but default and foreclosure dollar volume fell as legacy loan resolutions outpaced newly distressed loans, according to Fitch Ratings.

April 29 -

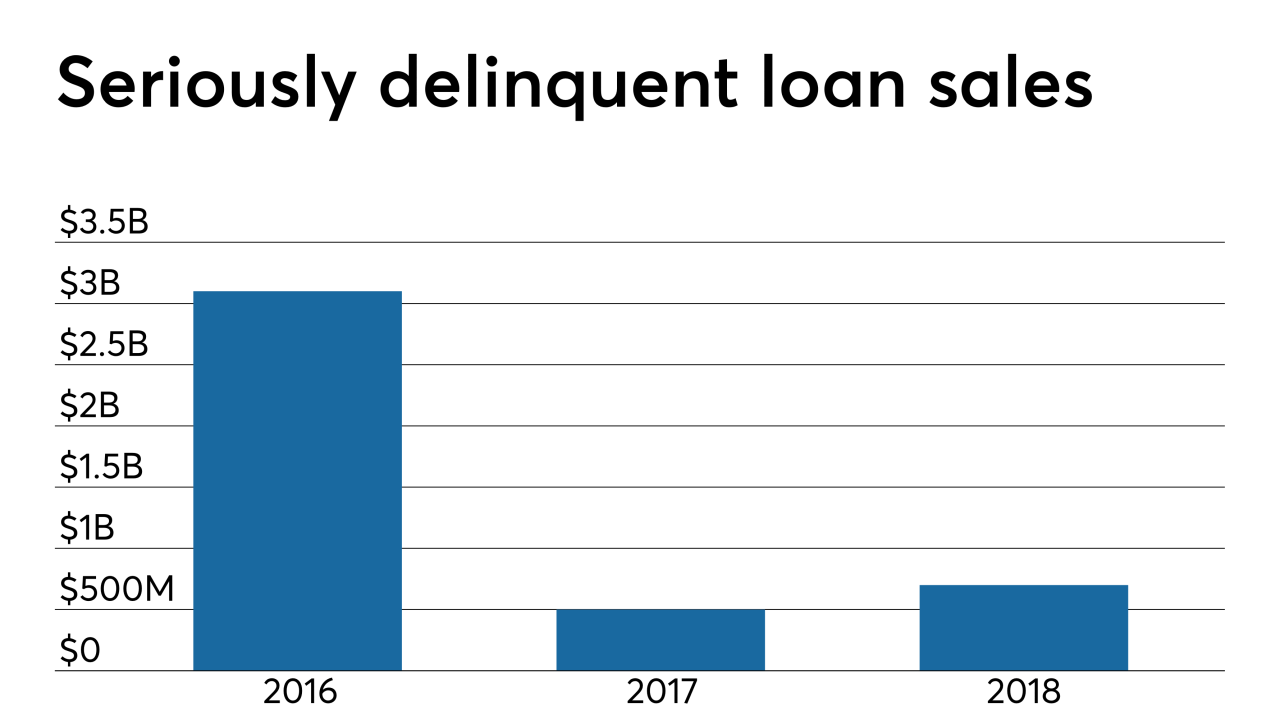

Freddie Mac's latest nonperforming mortgage auction will include one pool targeted to smaller investors like nonprofit organizations.

April 12