-

Personal loan balances hit an all-time high in 2018, while fintech lenders widened their market share lead over banks and credit unions, according to new data from TransUnion.

February 21 -

The online consumer lender trimmed its losses in the fourth quarter and says an adjusted, non-GAAP metric suggests it's on the path to getting out of the red later this year.

February 19 -

Credit enhancement and expected loss levels in Upstart's 2019 securitization debut have risen from its previous deal last August.

February 14 -

Barclays, BMO, Citibank, Goldman Sachs and ING contributed to the online student lender, which last year made over $1 billion in loans.

February 14 -

The bureau wants to further remove the threat of legal liability for firms that test products benefiting consumers, but the attorneys general say the agency cannot provide immunity from state law.

February 12 -

The online lender founded by Renaud Laplanche contributed half of the collateral for the $226.9 million transaction. It's also retaining a 5% economic interest in the deal.

February 12 -

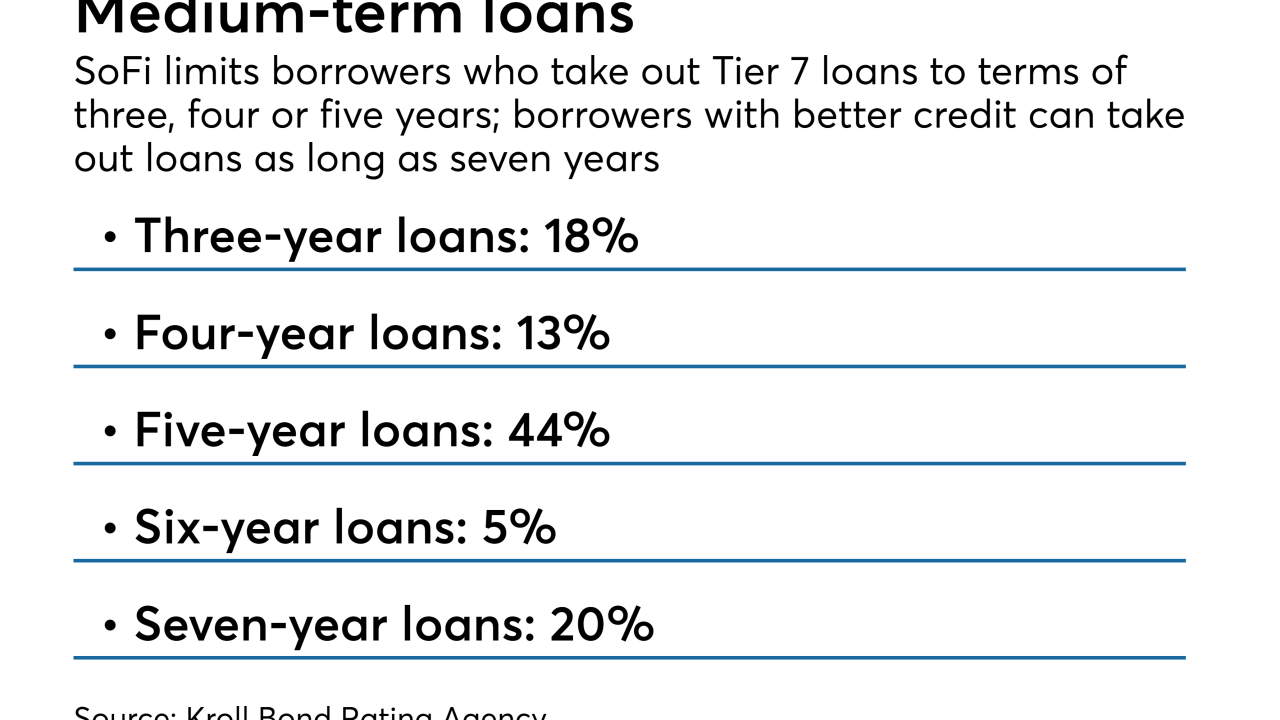

Tier 7 loans, which have lower limits on free cash flow and allow negative personal income, account for 7.26% of the collateral for the online lender's next transaction, according to Kroll.

February 8 -

As the consumer lender announced its seventh consecutive profitable quarter, its CEO bragged that his company is better positioned than the likes of Goldman Sachs and LendingClub.

February 1 -

The remainder of the collateral was contributed by Goldman Sachs, which is also holding onto 5% of the risk in the deal to comply with risk retention rules.

January 28 -

Federal regulators should consider applying guidance that is nearly two decades old to end uncertainty about the legality of particular bank partnerships.

January 17 Pepper Hamilton

Pepper Hamilton