-

The French specialty lender, owned by a consortium of mutual insurers, is pooling over 54,000 loans it originated and services for clients of its shareholders.

October 4 -

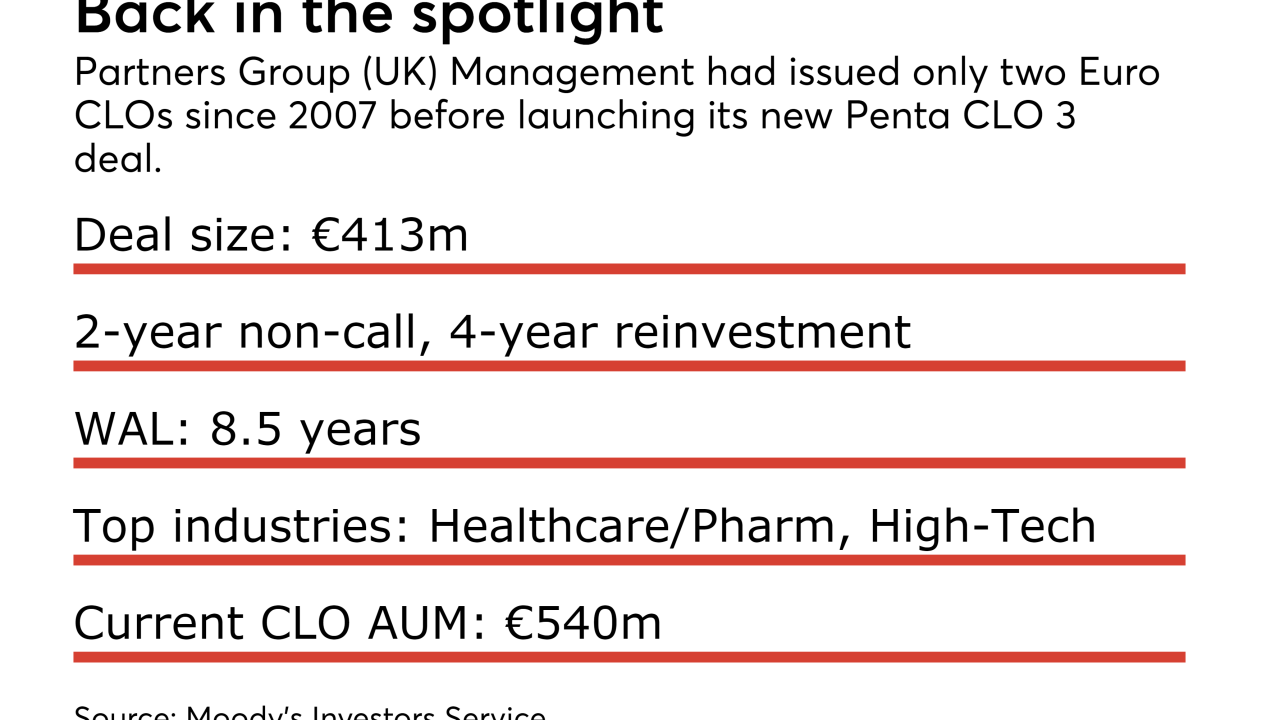

Penta CLO 3 is the first CLO since 2015 for the UK subsidiary of Swiss global asset management Partners Group Holdings AG.

October 2 -

The deal, Sunrise SPV 20 S.r.l., is collateralized by more than 120,000 auto, furniture and personal loans originated by the Italian lender.

September 28 -

Most of the 181 jets used as collateral were acquired from GE Capital Corp. in 2015; proceeds from prepayments and liquidations can be used to acquire additional aircraft.

September 27 -

The loans have an average balance of €18.5k (US$22.1k) and went to 39,698 borrowers; they are secured by a pool of new (46.8%) and used (53.2%) cars, according to Moody's Investors Service.

September 24 -

The €684.8 million transaction is backed primarily by new-car leases to German prime borrowers. It's the 21st German securitization by FCE Bank, Ford's UK-based captive finance arm.

September 13 -

New issuance of U.S. collateralized loan obligations reached $11.9 billion across 24 deals, taking year-to-date volume past $72.3 billion, according to Thomson Reuters LPC. The eight-month total is higher than the total issuance for all of 2016.

September 10 -

The proceeds will be used to repay three existing bonds series, as well as pay down commercial paper and credit line debt of the real estate investment trust, formerly known as Land Securities.

September 7 -

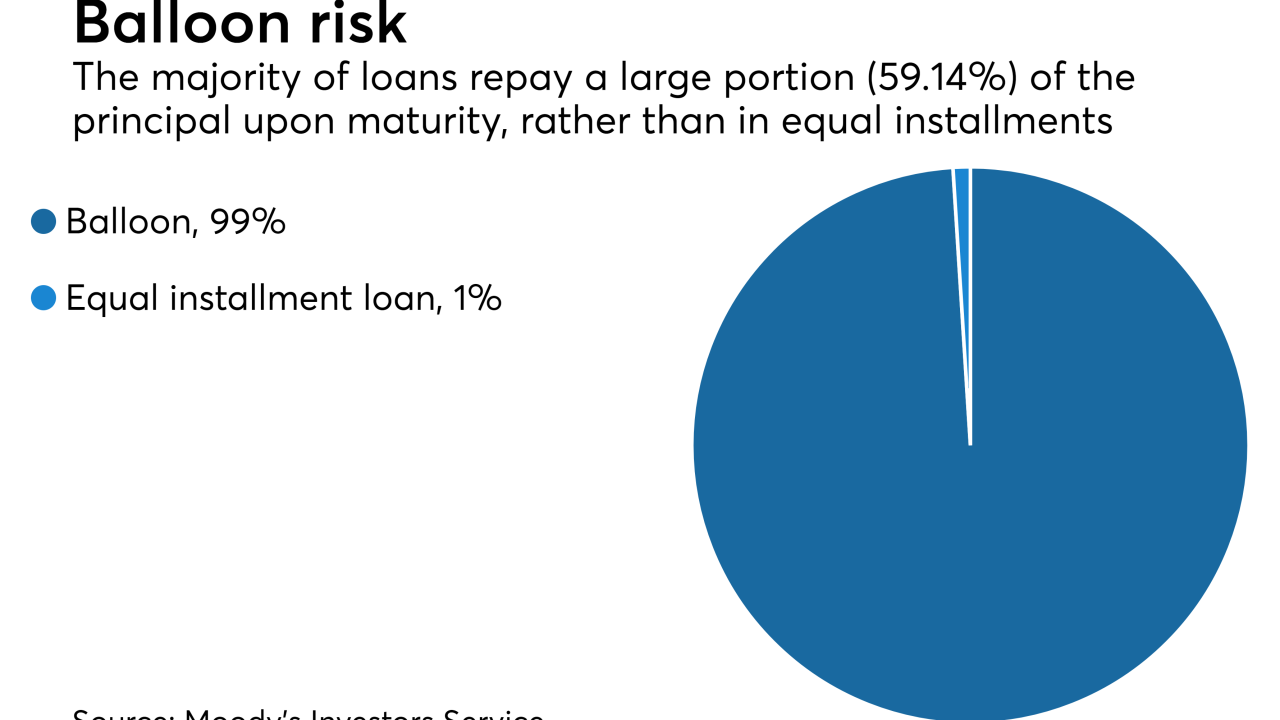

S&P says exclusion of the value of "personal contract purchase" balloon payments from Santander's Motor 2017-2 transaction will benefit the deal through excess spread and recoveries from contract defaults.

September 4 -

CVC Cordatus Loan Fund IX is CVC's ninth overall Euro-denominated CLO, and only the second that will price since early June, according to Thomson Reuters LPC.

September 1