-

Cryptocurrency development in the mortgage industry has accelerated in no small part from easing regulation and a push from FHFA Director Bill Pulte.

January 13 -

Across-the-board decreases across all loan types drove the Mortgage Bankers Association's full credit availability index to its lowest in three months.

January 8 -

A rise in issuance of nonqualified mortgages and seconds is in the forecast but home prices, credit and the GSEs may impact private-label bonds' trajectory.

December 24 -

Our experts expect a mortgage market reset in 2026 with an uptick in originations, but warn lenders not to skimp on compliance even as the reins loosen.

December 22 -

November rate locks fell seasonally but hit their strongest level since 2021, led by refis, while lenders shifted more loans to the GSE cash window.

December 10 -

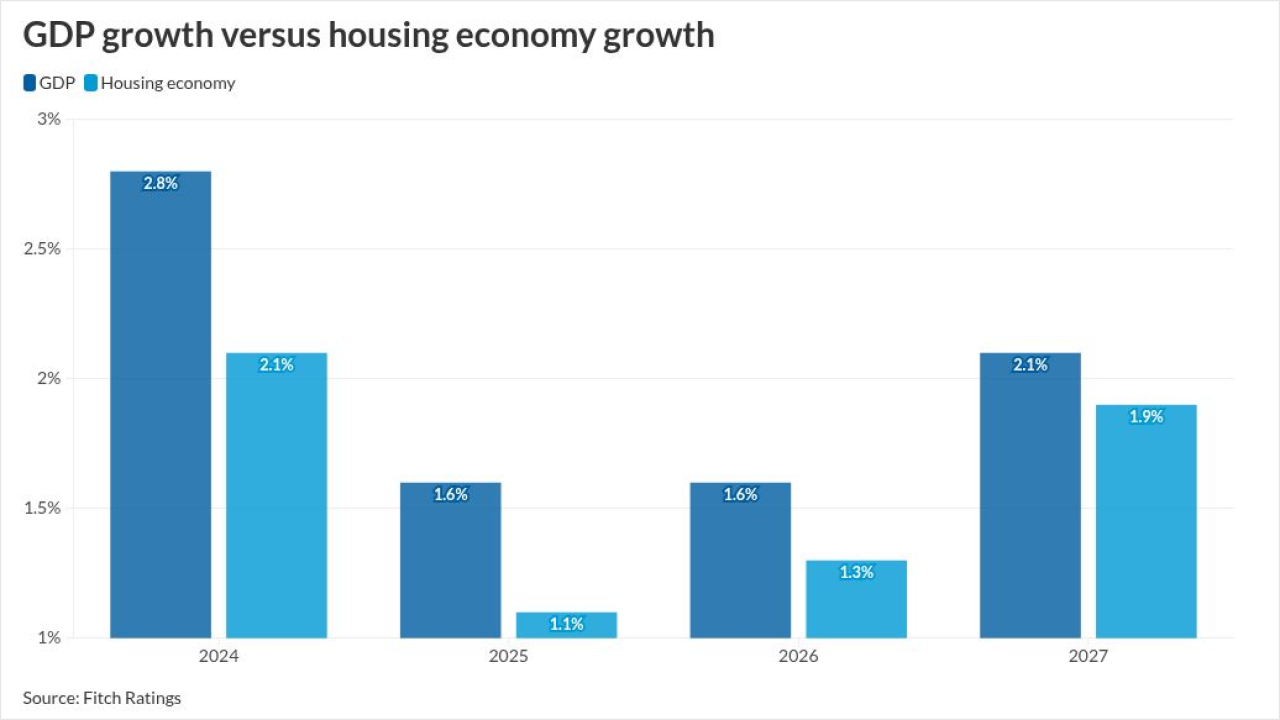

While Fitch and Kroll have differing views on mortgage rates next year, both are looking for mortgage delinquencies to rise in their rated portfolios.

November 14 -

Two government-sponsored enterprises are looking into expanding mortgage transfers between borrowers, according to the head of their oversight agency.

November 11 -

Bill Pulte's X post has the industry excited that loan level price adjustments could change, but the impact would not be as beneficial as some think, KBW said.

October 27 -

The NRMLA/Riskspan Reverse Mortgage Market Index set a new high of 502.42, with the dollar amount of home equity for those 62 or over reaching $14.4 trillion.

October 21 -

The lender, which reported over $200 million in home equity line of credit volume in the recent quarter, suggests the business can deliver massive scale.

October 21 -

Intermediary automation has increased the immediate availability of product, pricing and eligibility information to both sides of the mortgage business.

September 18 -

Most lenders said they had already priced in the widely-anticipated decision to cut short-term rates for 30-year home loans but other products will benefit.

September 17 -

Falling interest rates led to a rush in refinancing, but slowing purchase activity brought a decline in overall lock volumes, according to Optimal Blue.

September 10 -

As Washington weighs a national housing emergency, U.S. homeownership has slipped year-over-year, according to Redfin.

September 3 -

The increase in purchase volume was not enough to offset the drop in refinance application submissions as conventional rates increased week-over-week.

August 27 -

Lagging tech adoption, issues with credit, and originators' rush to close refinances earlier this year contributed to deterioration, a study found.

August 21 -

July's growth in products correspond with a noticeable rise in new applications for adjustable-rate mortgages as borrowers respond to recent rate movements.

August 12 -

As high interest rates make refinancing impossible for many homeowners, increasing numbers of them are turning to HELOCs and home equity loans for cash.

July 28 -

The agreement with D2 Asset Management doubles the firm's previous commitment to Unlock, as current economic trends provide momentum for the growing sector.

July 23 -

A "large institutional investor" will provide funding to assist Rithm in acquiring as much as $1.5 billion worth of residential transition loans.

July 22