-

Senate negotiators are working on a bill that would place Fannie Mae and Freddie Mac into receivership and replace them with multiple mortgage guarantors, according to sources.

January 18 -

MountainView is brokering a nonrecourse $3.5 billion package of Fannie Mae and Freddie Mac mortgage servicing rights on behalf of an unnamed seller.

January 5 -

Fannie Mae's serious delinquency rate climbed to a high not seen since March 2017, but remained lower than it was 12 months prior.

January 2 -

The GSEs are on their way to paying back the money they owed the government under the original bailout deal made at the height of the financial crisis, making 2018 an opportune time for an overhaul of the housing finance market.

December 29

-

Fannie Mae and Freddie Mac will be allowed to build capital buffers to protect against losses under an agreement between the Treasury Department and the Federal Housing Finance Agency announced on Thursday.

December 21 -

The two government-sponsored enterprises have relied on the “classic” FICO credit scoring model for the past 12 years. But the Federal Housing Finance Agency is weighing whether the GSEs should upgrade to more recent scoring alternatives.

December 20 -

Just over half of the collateral for the $883 million deal is eligible to be purchased by Fannie or Freddie; the bank itself contributed nearly half.

December 12 -

Until recently, there was a consensus among policymakers that Fannie Mae and Freddie Mac needed to be eliminated. That just changed. Here's why.

December 8 -

House Financial Services Committee Jeb Hensarling shifted tactics on housing finance reform Wednesday, acknowledging that a bill he’s pushed for years to virtually eliminate the government’s role in the mortgage market lacks the support to become law.

December 6 -

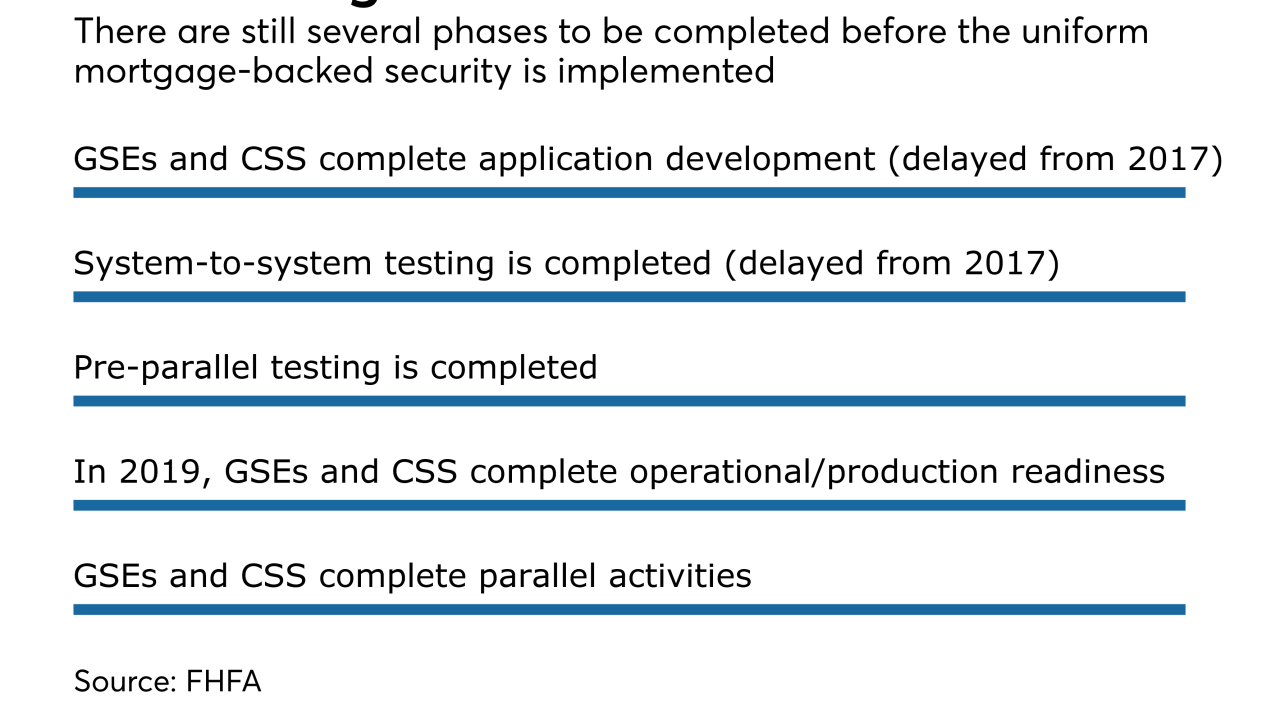

Testing of the common securitization platform is taking longer than expected, but the Federal Housing Finance Agency said it won't delay the 2019 launch of Fannie Mae and Freddie Mac's new single "uniform mortgage-backed security."

December 4 -

A provision in the original Senate tax reform bill would have required companies acquiring mortgage servicing rights to pay taxes upfront for their anticipated servicing income.

December 1 -

The financial services industry has cheered a proposed reduction in the corporate tax rate, but a lower rate could force Fannie Mae and Freddie Mac to write down assets, increasing the odds that the companies will need Treasury support.

November 29 -

New Residential Investment Corp. is planning to purchase Shellpoint Partners in the first half of next year for $190 million with an additional earn-out over the next three years.

November 29 -

Conforming loan limits for mortgages bought by Fannie Mae and Freddie Mac will increase for the second consecutive year in response to the rapid rise in home prices, the Federal Housing Finance Agency said.

November 28 -

The Show Me State passed legislation enabling residential and commercial PACE financing in 2010; however, Renovate America only started funding assessments through the Missouri Clean Energy District three months ago, in August 2017.

November 27 -

That’s an about-face from the bank’s previous transaction, completed in October, which was backed by fixed-rate mortgages, nearly half of which were underwritten to standards for purchase by Fannie Mae or Freddie Mac.

November 16 -

Mark Calabria, the chief economic adviser to Vice President Mike Pence, said the administration is focused for now on more pressing issues than GSE reform, including addressing housing damage from recent hurricanes.

November 1 -

Called Structured Agency Credit Risk Securitized Participation Interests, the new securities are backed by mortgage loans, and are not general obligations of the government-sponsored enterprise.

October 18 -

Many of the prime jumbo loans backing the transaction, JP Morgan 2017-4, were contributed by originators with limited history in that product, according to DBRS.

October 18 -

Though FHFA Director Mel Watt stopped short of saying he would break with a Treasury agreement that forces all profits of the GSEs to go to the government, he emphasized that it couldn’t continue indefinitely.

October 3