-

The initial offering is just $80 million, but transaction documents allow RFS to issue up to $500 million, as long as certain conditions are met, which could dilute the control and voting rights of the existing noteholders.

December 24 -

The wireless carrier has issued a total of $6.7 billion to year-to-date via four transactions; that's up from $2.65 via two deals in 2017 and a single, $1 billion deal in 2016.

December 19 -

Carlyle Aviation Capital's AASET 2016-1 and ACG-affiliated Merlin 2016-1 each have a single aircraft on lease to Small Planet, according to Deutsche Bank Securities.

December 11 -

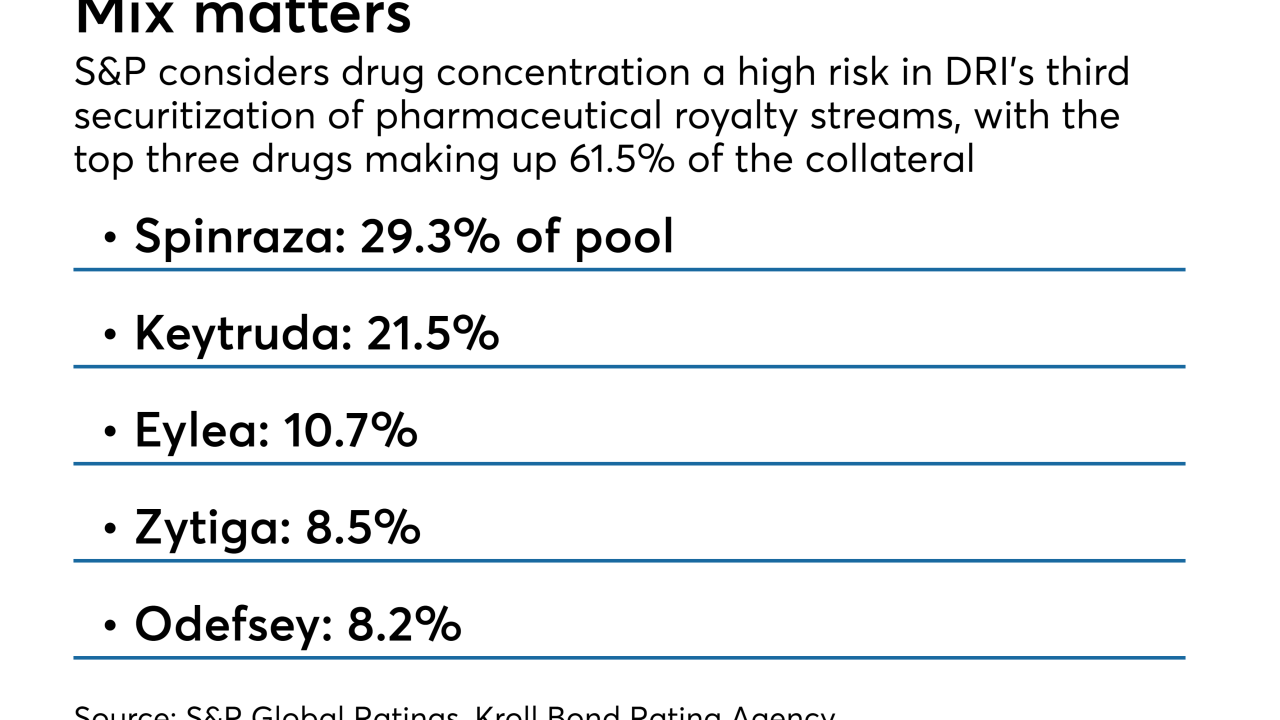

The bonds will be collateralized by payments from 15 royalty streams on 14 patent-protected drugs and technologies and will rank pari passu with securities issued from the same master trust in 2017.

November 28 -

Commercial aircraft are considered end-of-life after 18 years, but older passenger planes are often converted to freighter cargo. Nearly 4% of the planes in Vx’s collateral pool exceed 30 years of age, according to Kroll.

November 20 -

The $378.5 million transaction is more heavily leveraged than the sponsor's prior deal, completed in 2015; it is also rated one notch lower by Kroll.

November 16 -

Proceeds from the deal, which is rated by Kroll Bond Rating Agency, will be used to repay unrated notes that the company issued earlier in 2018.

November 15 -

The transaction, which consists of a single tranche of notes with a preliminary A rating from Kroll Bond Rating Agency.

November 7 -

The $612 million Horizon Aircraft Finance 1 carries preliminary single-A ratings from Fitch and Kroll, on par with the $1.2 billion deal the sponsor completed in 2015.

November 6 -

The firm's risk profile has not altered, executives said on a third-quarter earnings call Wednesday; it remains "appropriately cautious."

November 1