-

The bill, part of the omnibus spending package, would force banks and other critical infrastructure providers to tell the government right away when they’ve been breached.

March 11 -

Infrastructure will command most of lawmakers’ attention, but expect banks to keep pushing for bills that would ease the transition away from a key benchmark rate and help them serve legal cannabis businesses.

August 24 -

Some say Equifax, Experian and TransUnion are too slow to investigate grievances, prompting more complaints to the Consumer Financial Protection Bureau. But the big three say other forces are at work.

April 30 -

As it attempts to craft policy on access to consumers’ financial account information, the agency is wading into a battle between those who want data to flow more freely and those who prioritize security.

November 12 - LIBOR

Federal Reserve Chairman Jerome Powell told senators that the central bank is willing to explore a credit-sensitive interest benchmark in addition to the secured overnight financing rate, which some banks say could cause problems during economic stress.

February 12 -

The agency’s semiannual report warned institutions to be mindful of operational risks from the innovation in core banking systems, and detailed supervisory steps to monitor the adoption of a new reference rate.

December 9 -

A report from the Financial Stability Oversight Council cited a bigger share of originations and servicing by nonbanks as a potential vulnerability in the financial system.

December 4 -

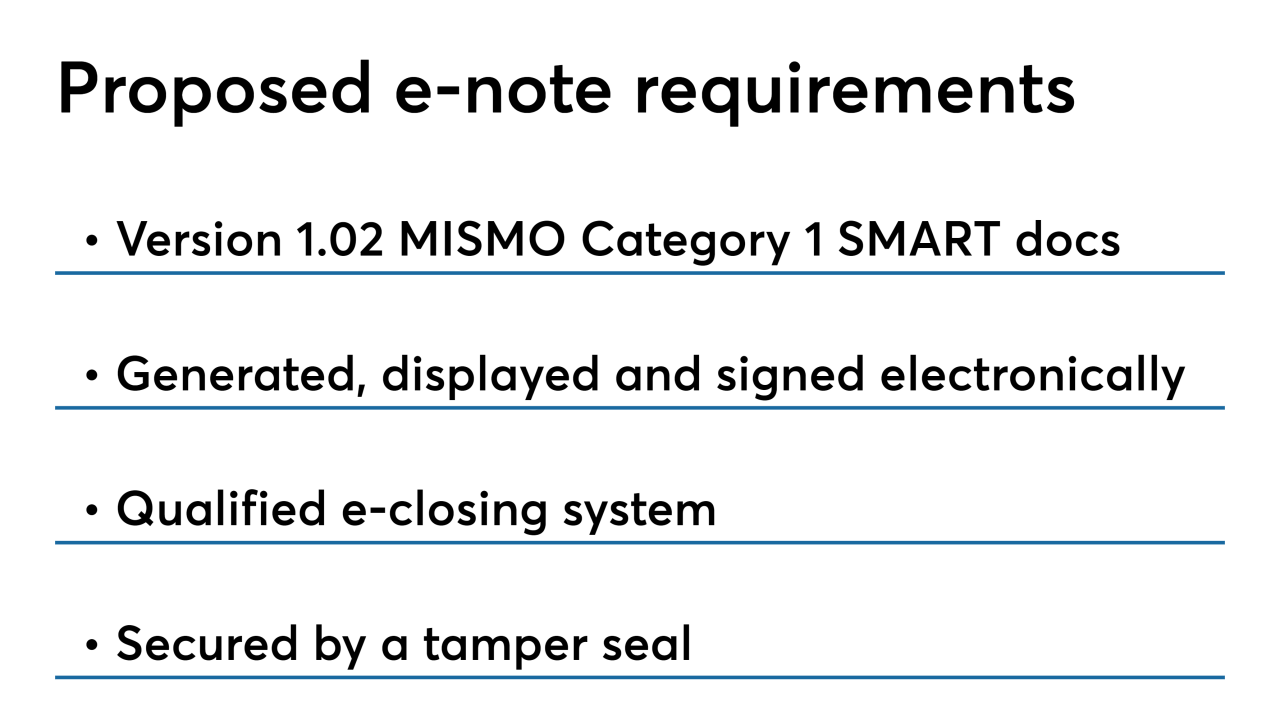

Ginnie Mae is looking for input on its proposed guidelines for electronic promissory notes and other mortgage documents that it plans to test through a digital collateral pilot.

October 28 -

Members of the House Financial Services Committee cited leveraged lending, cybersecurity and the switch to a new interest rate benchmark among potential systemic risks that keep them up at night.

September 25 -

Apple's new credit card isn't just another virtual card in its virtual wallet. It borrows a lot of features from the most successful brands in payments and technology.

August 8 -

A bill by Rep. Patrick McHenry, R-N.C., would give the CFPB authority to oversee cybersecurity efforts at the credit bureaus.

July 19 -

The agency's vote Thursday threatens to block many of the industry's communications with customers, though banks did win one concession.

June 6 -

The watchdog’s report — requested by Sen. Elizabeth Warren, D-Mass., and Rep. Elijah Cummings, D-Md. — called for civil money penalty authority and better supervision to guard consumer data.

March 26 -

The 2020 budget would add the Consumer Financial Protection Bureau and FSOC to congressional appropriations, charge lenders for FHA upgrades and require universities to have skin in the game on student loans.

March 11 -

Fixing the housing finance system is "the last piece of unaddressed business from the financial crisis," according to a summary of to-do items released by the Banking Committee's chairman.

January 29 -

A security lapse left millions of mortgage records exposed online without proper data protections, according to security researchers.

January 23 -

“We have actually discouraged banks from innovating,” FDIC Chairman Jelena McWilliams said in announcing a move that other agencies have made.

October 23 -

The Trump administration is making more than 80 recommendations to encourage financial innovation within a regulated space, including endorsing the creation of a federal fintech charter.

July 31 -

Credit reporting firms with significant operations in New York will face new cybersecurity and registration requirements to stave off concerns related to a breach of Equifax's systems last year.

June 25 -

Startup Block66 is using blockchain to create a mortgage audit trail for fraud prevention purposes and also plans to enable trading of securities lenders can use to increase their liquidity.

June 22