-

Subprime lender Foursight Capital has been extended its first initial triple-A rating for a structured finance transaction in its new $173.03 million auto loan securitization.

April 5 -

Furniture, electronics and appliance retailer Conns is marketing another $469.83 million of bonds backed by subprime consumer loan receivables.

April 5 -

Renovate America has brought in former Freddie Mac executive Paige Wisdom as chief financial officer as the provider of Property Assessed Clean Energy Loans seeks to expand its expand across the U.S.

April 4 -

Students who took out big loans to attend college or graduate school have lower rates of homeownership than those with little or no educational debt, according to research published Monday.

April 3 -

A Houston-based energy firm is marketing its first rated securitization of solar panel installation leases and power-purchase agreements (PPAs) in a $245.75 million bond issuance.

April 3 -

Steve Eisman, the Neuberger Berman Group fund manager who featured in Michael Lewis's book "The Big Short," said he's concerned about the U.S. subprime-auto market, even though credit quality across the banking system has improved significantly.

March 31 -

GM Financial Services is marketing its first auto loan securitization of the year, according to Standard & Poors.

March 29 - Europe

Banco Bilbao Vizcaya Argentaria (BBVA) and Banco Popular Español are securitizing consumer loans issued in Spain. Banco Popular's 510 million two-year revolving securitization is its first-ever in its home country.

March 28 -

The Rhode Island Student Loan Authority (RISLA) is issuing $50.26 million in new revenue bonds backed by a pooling of new and consolidated loans to be originated through the states private loan program.

March 27 -

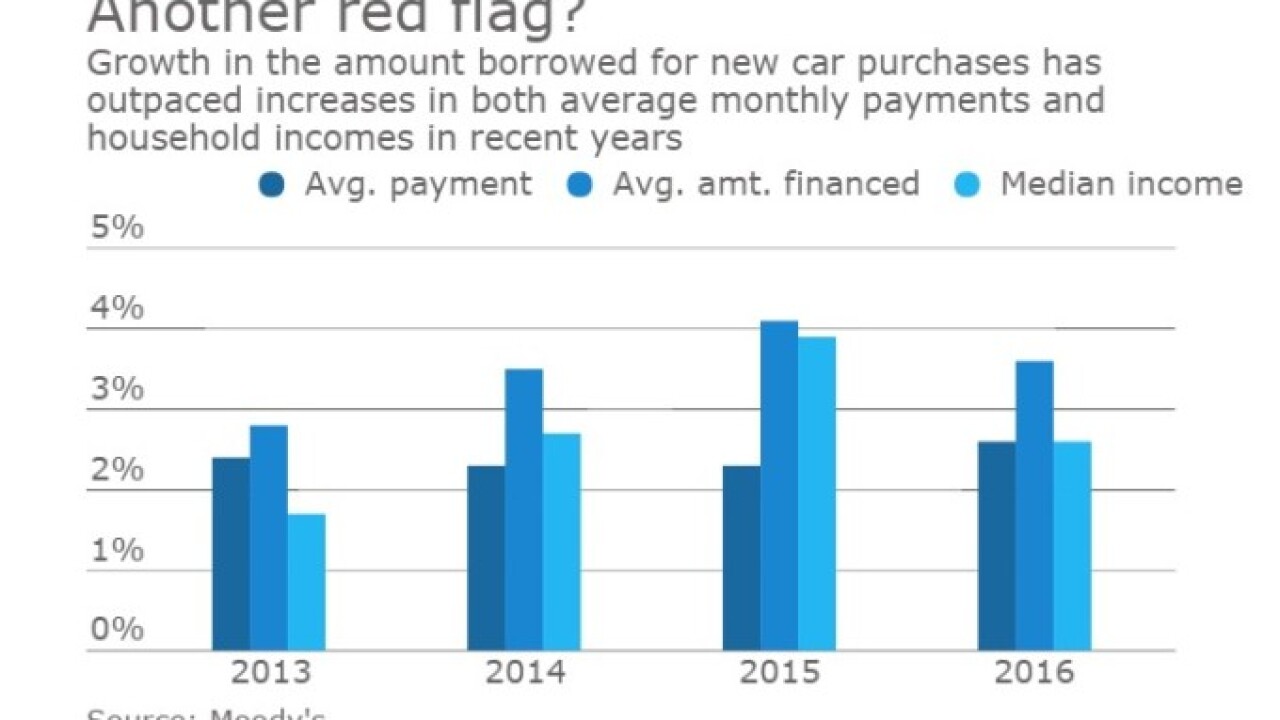

Trade-ins represent a growing risk for auto lenders, according to Moody's Investor Service.

March 27