-

The $50.4 million participation is the largest loan in UBS' next $807.3 million commercial mortgage securitization.

October 15 -

The developer of the newly constructed Washington, D.C., headquarters for Fannie Mae is securitizing part of its $525 million, 10-year mortgage through a single-asset, mortgage-backed transaction.

October 10 -

BX Commercial Mortgage Trust 2019-XL, via Citigroup, features 11 note classes backed by a floating-rate, first-lien mortgage on 406 Blackstone-owned properties with a tenant roster of over 2,000 lessees — including Home Depot, UPS, FedEx and Amazon.

October 7 -

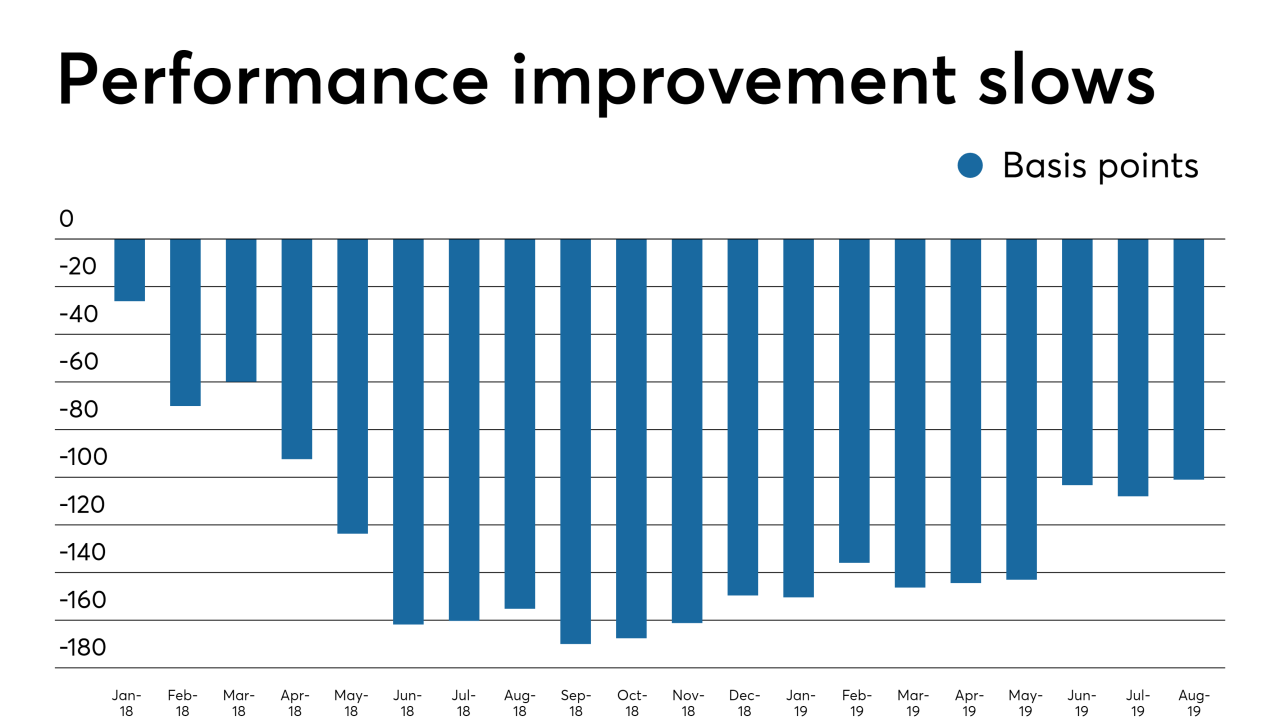

The commercial mortgage-backed securities sector will weather the fourth quarter's slowing but steady growth in the U.S. economy, as better loan performance counters a continued decline in volume, Morningstar said.

October 2 -

The $460 million BFLD Trust 2019-DPLO will be secured by a two-year mortgage loan that will refinance $401.3 million of existing debt, plus pay $147.5 million of equity.

September 26 -

A Philadelphia commercial property developer is refinancing a loan for a renovated complex, according to S&P Global Ratings.

September 20 -

Out of 83 commercial mortgages in the transaction, the collateral pool contains 75 loans secured by multifamily/manufactured housing properties, according to presale reports.

September 17 -

While delinquent loans in commercial mortgage-backed securities continued trending downward overall, there was an uptick in the rate for more recent originations, a Standard & Poor's report noted.

September 6 -

Gaw Capital Partners and DJM Capital partners are sponsoring $211.3 million large-loan securitization that will include as collateral the famed Hollywood Walk of Fame.

August 29 -

A Silicon Valley mega-office-tower complex that is home to both Amazon and Facebook corporate offices is making another appearance in a conduit commercial mortgage-loan securitization.

August 28