-

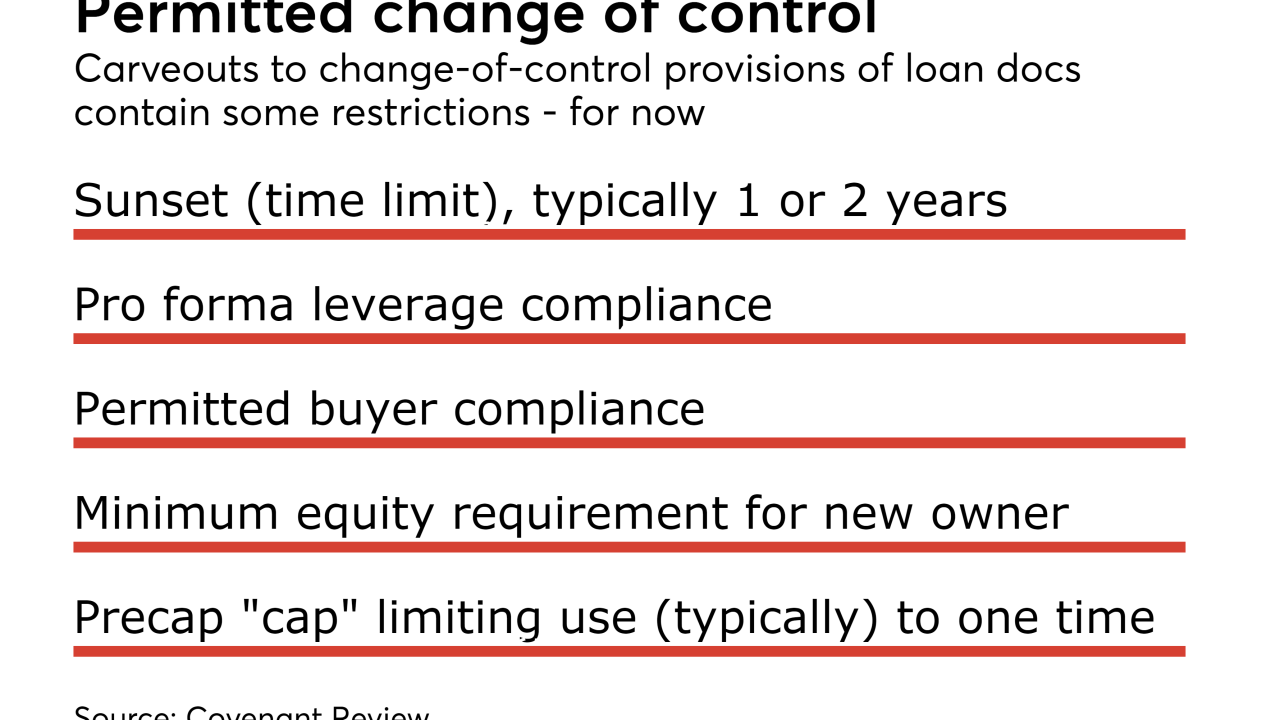

Corporate borrowers have started to ask lenders for leeway to be acquired by another company, under certain circumstances, without having to refinance their debt, according to Covenant Review.

January 8 -

With ideal macroeconomic fundamentals of economic growth and low interest rates still in place, S&P Global sees no reason for issuance to slow in 2018.

January 3 -

Carlyle has raised an additional $800 million for "opportunistic" debt and equity investments of third-party CLOs, in a planned expansion of its $19.4B in structured credit business assets under management.

January 2 -

AXA Investment Advisors' two primary-issue CLOs in 2017 were each priced within the past month.

December 29 -

Many raised large amounts of capital to put to work in the equity, or riskiest slices of their deals, allowing them to resume issuing new deals just as new loan issuance was taking off.

December 22 -

Exposure to PetSmart's now triple-C rated loan will strain the distressed debt limits of 24 collateralized loan obligations, while two other deals face potential interest-diversion test failures.

December 21 -

Banking regulatory agencies Thursday announced that they would raise the aggregate loan commitment threshold for syndicated loans to be included in the Shared National Credit program from $20 million to $100 million.

December 21 -

Only 2.6% of speculative-grade rated firms with public financials carry Moody's weakest liquidity rating, a drastic reduction since March 2016, helped by a recovery in the oil and gas sector.

December 20 -

The collateralized loan obligation market is ending the year at nearly full throttle with nearly $18 billion in new deal/refi volume month-to-date, with more on the way.

December 20 -

The first refinancing, in January, was primarily intended to extend the life of the post-reinvestment period deal; this time, the manager is also lowering the interest paid.

December 18