-

DFG Investment Advisers, led by former Goldman and HVB Group veterans, will exceed $4.2B in CLO assets under management with the latest deal.

August 26 -

The $502 million Diamond CLO represents the first securitization of small/medium enterprise loans since Blackstone in the second quarter relaunched a direct lending business.

August 21 -

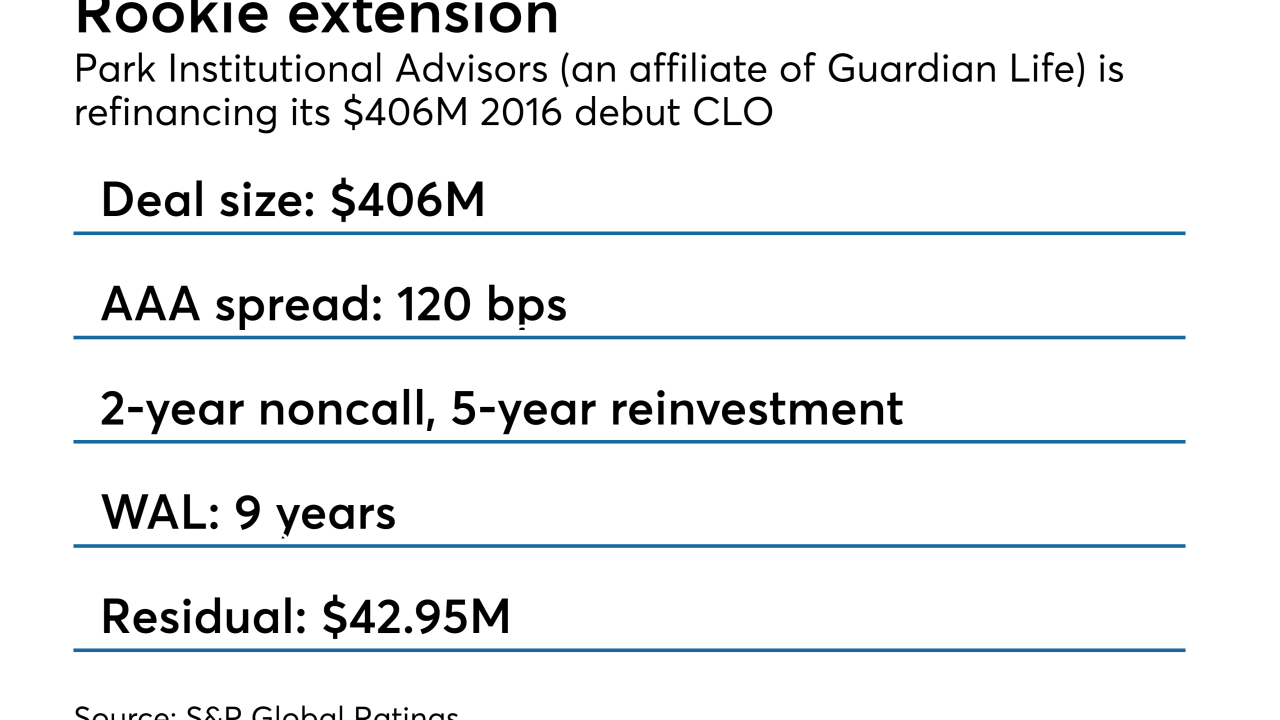

Once refinanced, the $406 million Park Avenue Institutional Advisors CLO 2016-1 will be non-callable for two years and can be actively managed for up to five years.

August 17 -

The $449.2 million Carlyle Direct Lending CLO 2015-1R is the 11th deal the global alternative asset manager has refinanced this year.

August 16 -

Execs at both closed-end funds say expectations for an eventual rise in defaults are driving their strategy to extend reinvestment periods on CLOs in their portfolios.

August 15 -

The investors initially won the right to sue as a group in 2015 before an appeals court reversed the ruling; the $13 billion lawsuit can now proceed as a class action.

August 15 -

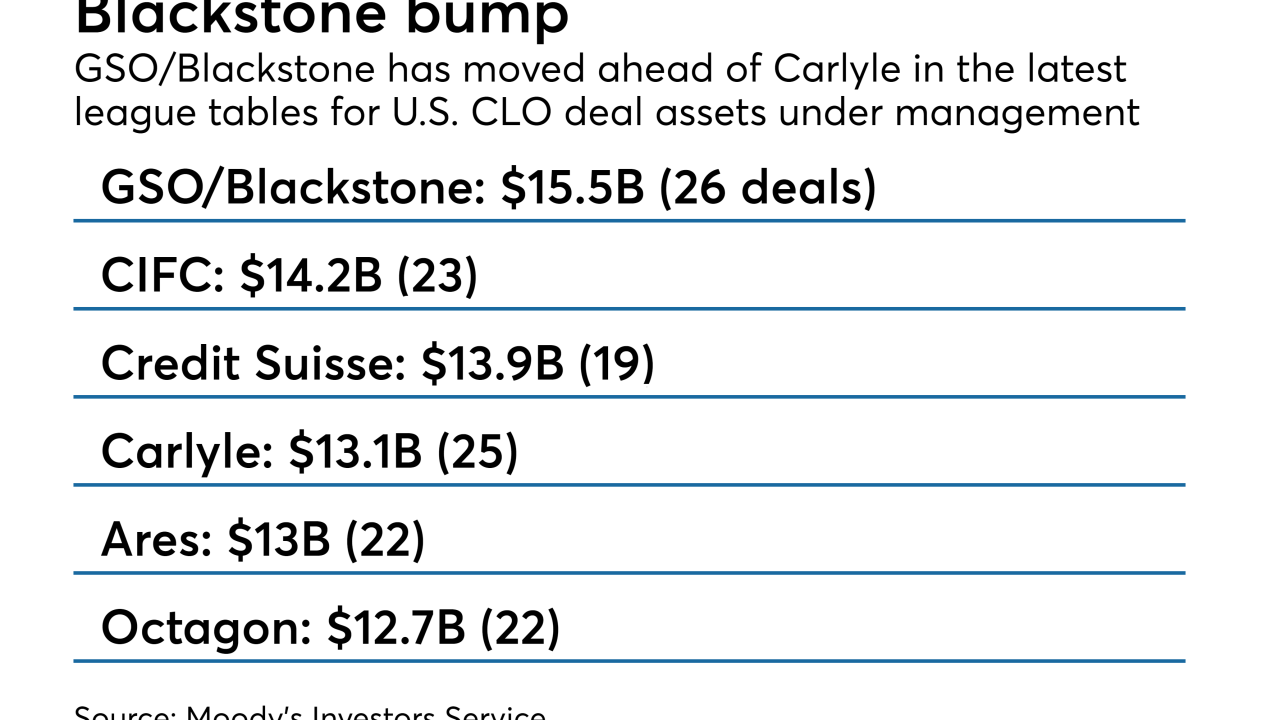

The distressed-debt manager now manages 26 U.S. CLOs totaling $15.5 billion, the most of any domestic CLO market manager.

August 13 -

The £325 million Dryden 63 CLO, sponsored by PGIM, will issue six classes of sterling-denominated notes; Barclays’ £4.5 billion Sirius Funding is issuing three tranches in three different currencies.

August 6 -

The eligibility criteria for loans that can be acquired are “more liberal” than recent CRE CLOs rated by Kroll; they are also more liberal than those of Hunt’s initial CRE CLO, completed last year.

August 3 -

While Carlyle has been judicious with new issuance, it had a busier second quarter in refinancing older deals; several more will be ripe for refinancing in the third quarter.

August 2