-

The $470 million transaction has some features rarely seen now that the market for bridge loan securitization has been rehabilitated, including a "blind ramp" and a "blind reinvestment" period.

June 21 -

It's another example of what appears to be tailoring tranches to meet the tenor and yield requirements of specific investors; the deal, GMS Euro CLO 2014-1, was also upsized to €508 million from €368.3 million originally.

June 20 -

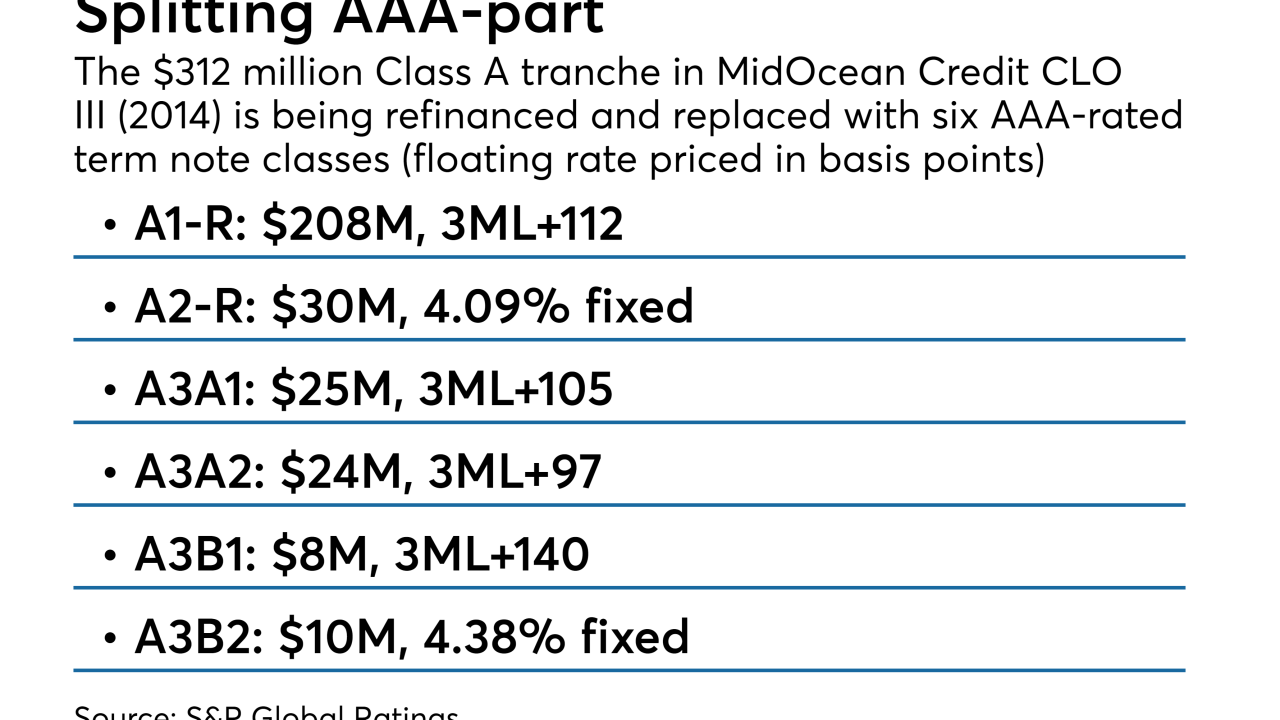

The original $312 million triple-A notes are being replaced with six separately priced Class A note tranches, including two fixed-rate securities classes

June 18 -

CLO securities pay out interest pegged to the three-month London interbank offered rate, but loans used as collateral are increasingly switching to one-month Libor and the spread between the two benchmarks has widened significantly.

June 14 -

The $278.3 million RCMF 2018-FL2 also has unusually heavy exposure to apartment buildings, offices and industrial properties that are either vacant or have low occupancy levels, according to Kroll Bond Rating Agency.

June 14 -

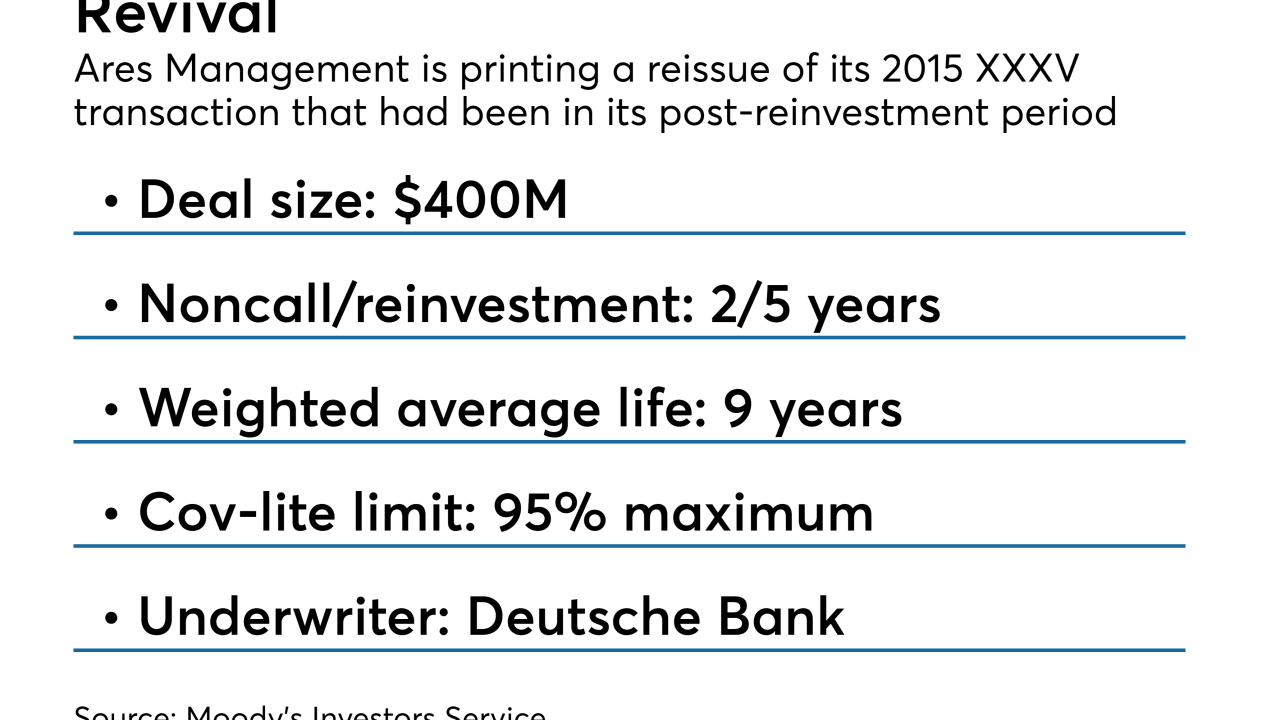

The $71.7 billion-asset manager is replacing notes from a 2015-vintage CLO that had been squeezed on asset quality prior to its October 2017 post-reinvestment period.

June 12 -

The Dallas-based money manager has launched a UCITS that invests in both U.S. and European loans, investment-grade CLO securities, and obligations and other kinds of structured products.

June 12 -

The $52 billion in year-to-date volume in resets of collateralized loan obligations is nearly outpacing new-paper issuance of $53.5 billion, reports LPC.

June 11 -

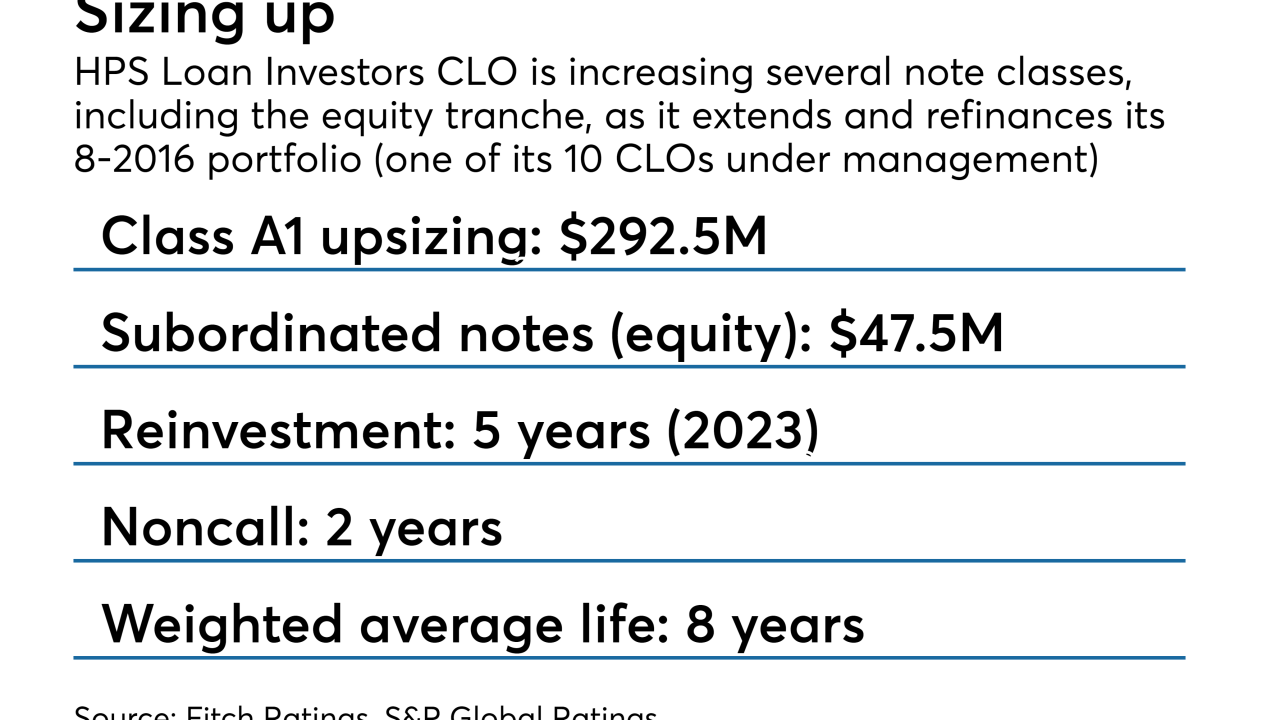

The new notes are not being distributed proportionally across the capital stack, however; instead the refinancing will result in slightly higher subordination for the senior, triple-A-rated Class A notes.

June 8 -

The holdings demonstrate “resiliency over several credit cycles, with low realized principal losses and robust returns for CLO equity,” managers say.

June 7