-

While tightening down on cov-lite and subordinate loans, Marathon CLO XI's rules give the asset manager more room to trade in lower-credit and DIP loans.

By Glen FestJanuary 31 -

Returns for equity investors are increasingly under pressure because of demand for the underlying loan assets, but strategies to boost returns can investors in other CLO securities at risk.

By Glen FestJanuary 29 -

Lease contracts from the newly acquired business account for 5% of collateral for the $305.7 million transaction; the remainder is leases on construction and transportation equipment.

By Glen FestJanuary 29 -

The single-B rated company is facing a large cash requirement as it ramps up production of its Model 3; but leases backed by electric vehicles pose additional risks for investors in asset-backeds.

By Glen FestJanuary 26 -

The credit quality of the collateral appears to have improved, but investor protections have also decreased; as a result, Kroll is only assigning an 'A' to the senior tranche of notes.

By Glen FestJanuary 26 -

The $407 million Crown Point 4 is also the first CLO in nearly three years for Valcour, which was last in the market with the $400 million Crown Point III in March 2015.

By Glen FestJanuary 26 -

The deal is the first vehicle loan securitization for the London affiliate of South Africa's FirstRand Group since November 2016.

By Glen FestJanuary 24 -

The captive finance lender for Toyota dealers in the Southeast U.S. returns with its 11th overall transaction sized at $800 million, with a potential upsizing to $1B.

By Glen FestJanuary 23 -

The Salt Lake City-based lender homes in on troubled borrowers whose subprime status is primarily tied to a recent bankruptcy protection filing.

By Glen FestJanuary 23 -

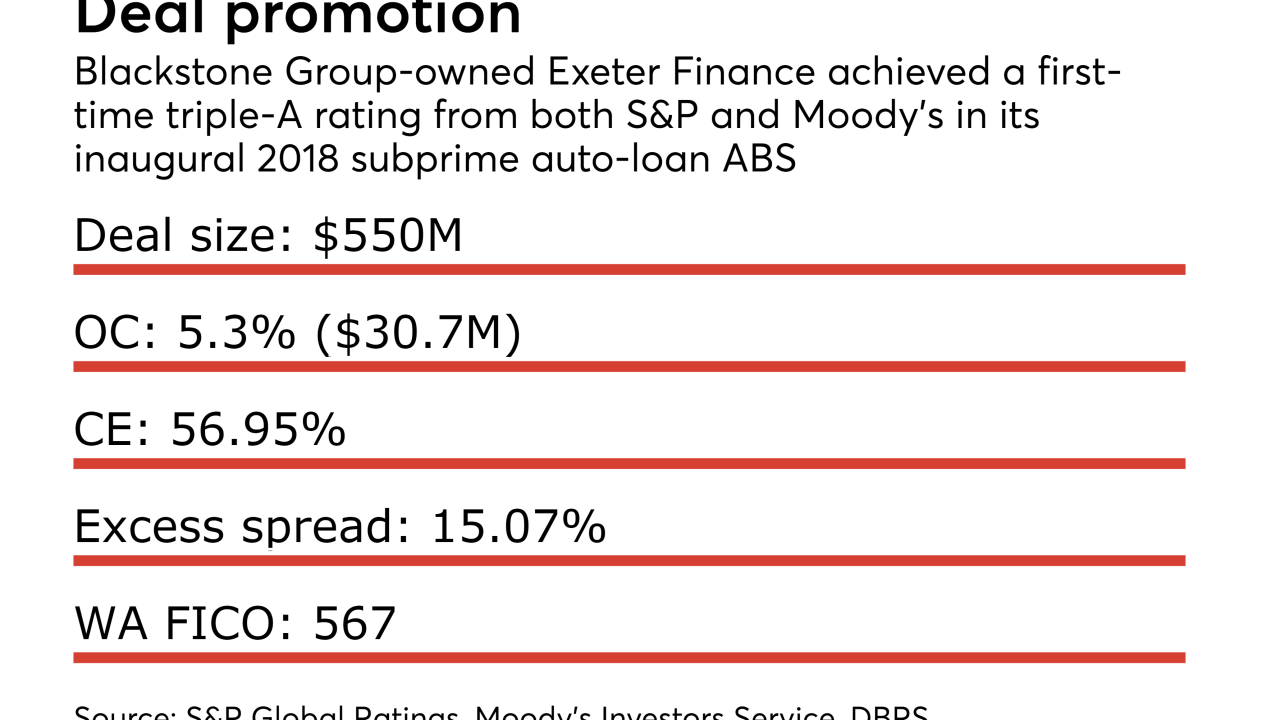

The Irving, Tex.-based specialty lender boosted senior-note credit enhancement levels and has stabilized portfolio losses to break the AA ratings cap on its deals, according to S&P Global Ratings.

By Glen FestJanuary 19