-

The private investment firm has obtained a $471 million mortgage from Goldman Sachs secured by 85 properties with a total of 10,764 keys operating under the InTown Suites flag.

January 24 -

Refi loans that the servicing behemoth is making through Earnest do not require the same amount of seasoning as new in-school loans, and so can be securitized much sooner.

January 24 -

The largest loan is a $94 million portion of a $340 million mortgage originated by Wells, Deutsche and Goldman secured by three interconnected buildings whose sole tenant is Apple.

January 24 -

The Blackstone affiliate is cashing out over $200 million of home price appreciation in the process, resulting in a loan-to-value ratio that is unchanged from the original Colony American Homes transactions.

January 23 -

Previously a partner at Winston & Strawn, he brings more than 25 years of experience handling complex structured finance and specialty finance transactions.

January 19 -

The Taxs Cuts and Jobs Act preserves most of existing benefits for owners, operators, and investors, and provides a few new perks as well; there are some trade-offs to be made, however.

January 19 -

The global real estate and investment management firm took ownership of the portfolio after the 2013 CMBS that it originally backed failed to pay off at maturity, according to Kroll Bond Rating Agency.

January 19 -

The nation's largest private student lender plans to use $30 million of its anticipated tax-cut windfall to speed up its diversification plan and strengthen its digital capabilities.

January 18 -

A $235 million deal is backed by a 27-story Manhattan office building; another, for $150 million, is backed by a portfolio of office and research and development buildings in Silicon Valley.

January 18 -

Blackstone used the $189 million mortgage to help finance its purchase of the Turtle Bay Resort; it's planning to add rooms, but the new development will be held outside the trust.

January 17 -

Hertz Vehicle Financing II LP, Series 2018-1, is a master trust, and the notes share collateral on a pari passu, or equal basis, with Hertz’ other outstanding series of notes.

January 15 -

A fund controlled by the PE group obtained a $192 million loan from Wells Fargo; proceeds, along with $127 million in subordinate financing, funded the $300 million purchase.

January 12 -

The findings by consulting firm Oliver Wyman dispel a misconception that the increase in the use of its credit scores is being driven principally by its free availability to consumers, VantageScore says.

January 10 -

It’s the second such transaction; in 2016; New Residential completed a $126 million transaction that included some of the same collateral that it acquired from Ocwen. The original deal has since been repaid

January 9 -

Marketplace lenders bringing securitization in-house seized the top spot in 2017; readers also focused on Blackstone's big entry into an esoteric corner of the CRE market and the PACE industry's embrace of consumer protections.

January 9 -

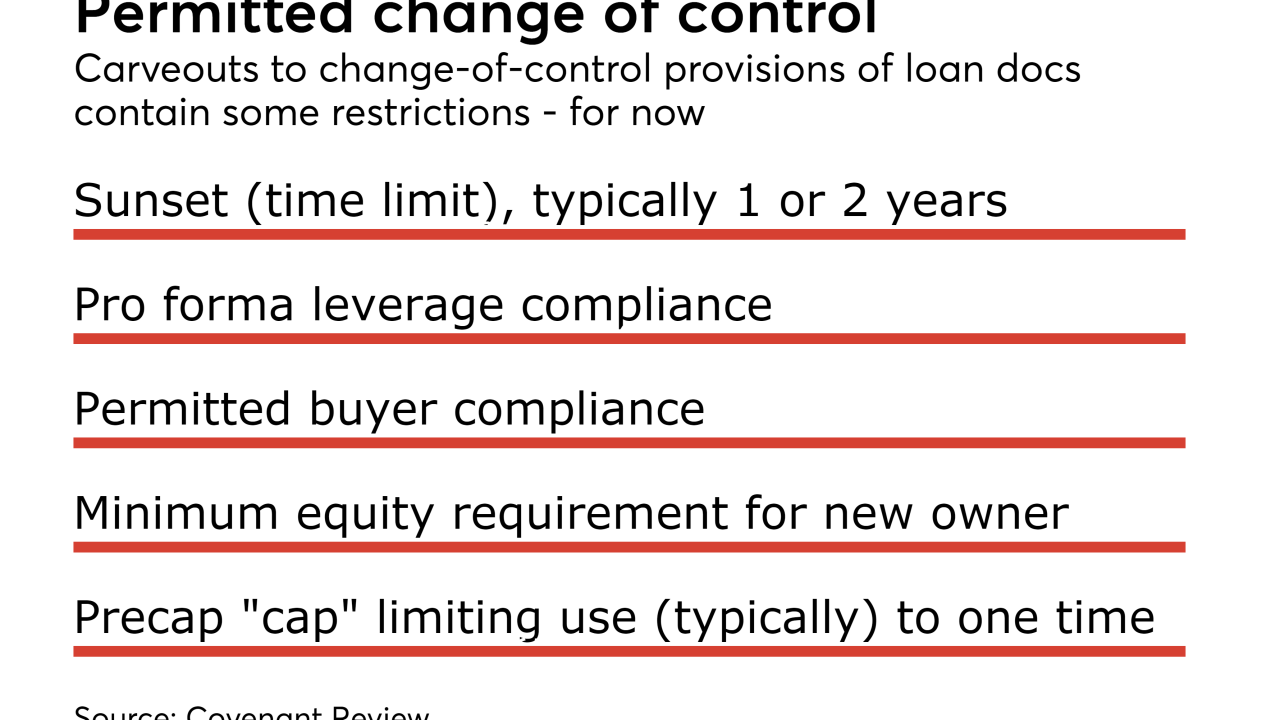

Corporate borrowers have started to ask lenders for leeway to be acquired by another company, under certain circumstances, without having to refinance their debt, according to Covenant Review.

January 8 -

In a rare example of a rating agency calling out a competitor, Fitch Ratings published an unsolicited report on the deal, which was rated by Kroll Bond Rating Agency; this caused some investors to take a closer look.

January 5 -

Limiting the deductibility of interest to a percentage of a taxpayer's income will make securitization uneconomical for auto and equipment rental companies, the Structured Finance Industry Group says.

January 4 -

A group of reinsurers has committed to provide up to $650 million of coverage for credit risk on some $21 billion of 30-year, fixed-rate loans that the government-sponsored agency will acquire over the next two years.

January 4 -

The $1.24 billion deal is the first GMCAR transaction to be rated by Fitch; it looks a lot like the three deals completed last year, with high FICOs, a high (but declining) concentration of long-term loans, and high concentration of trucks.

January 4