-

While the sponsor is borrowing more heavily against the 1,283 properties being rolled over, their values have also increased, resulting in a decline in the combined LTV, to 66.5% from 72%.

April 10 -

The latest transaction is the first to include fees associated with the Take 5 Oil Change brand acquired in 2016; they will rank pari passu with outstanding notes issued in 2015 and 2016.

April 9 -

Explosive growth in student lending was putting pressure on the capital ratios of the company, formerly Darien Rowayton Bank; a securitization got a big chunk of servicing strips off its books.

April 2 -

The sponsor has only identified $552 million of collateral for the $610 million deal; it has another four months to put the remaining $88 million to work in additional assets.

March 26 -

Together with $26.4 million of unrated notes that the REIT will retain in order to comply with risk retention rules, the total amount outstanding from the American Tower I master trust will be nearly $1.81 billion.

March 22 -

The majority of the collateral for the $326 million OBX 2018-1 comes from two called Bear Stearns deals originally issued in 2005; the remainder was acquired by the mortgage REIT in the whole-loan market.

March 22 -

DBRS has assigned a BBB rating to a single tranche of certificates issued in what may be the first-ever rated securitization of servicing fees left over after subcontracting payment collections.

March 20 -

The $1.1 billion BENCHMARK 2018-B3 is backed by 45 loans secured by 89 properties contributed by Deutsche Bank (42.8%), JPMorgan Chase (35.3%) and Citibank (21.8%), according to rating agency presale reports.

March 19 -

Medical residents are considered to be good credits but have less free cash flow than fully practicing doctors; the loans did not have a big impact on overall credit metrics of the $900 million deal.

March 19 -

Nonbanks are originating more commercial mortgages on fixer-uppers in response to a sharp drop in the cost of funding in the securitization market. These deals are said to be "vastly different" than other CRE instruments that sustained big losses in the crisis — so far.

March 16 -

The transaction is backed by 6,857 loans with a total balance of $835 million, or roughly 13% of the $6.4 billion of commercial vehicle and equipment loans in Mercedes-Benz Financial Services USA.

March 16 -

Just one year after it got a $1.05 billion loan from a trio of banks (Goldman, BofA and Citi), Blackstone has obtained a new, $1.3 billion loan from two more banks: Barclays and Deutsche.

March 15 -

The security that was incorporated into the index is backed exclusively by loans on green building certified properties; the GSE is still working on acceptance of financing for green upgrades.

March 15 -

As in prior transactions, the company itself contributed only a small portion (7.55%) of the collateral for CLUB 2018-NP1; but this time only three unaffiliated parties were invited to contribute the remainder.

March 13 -

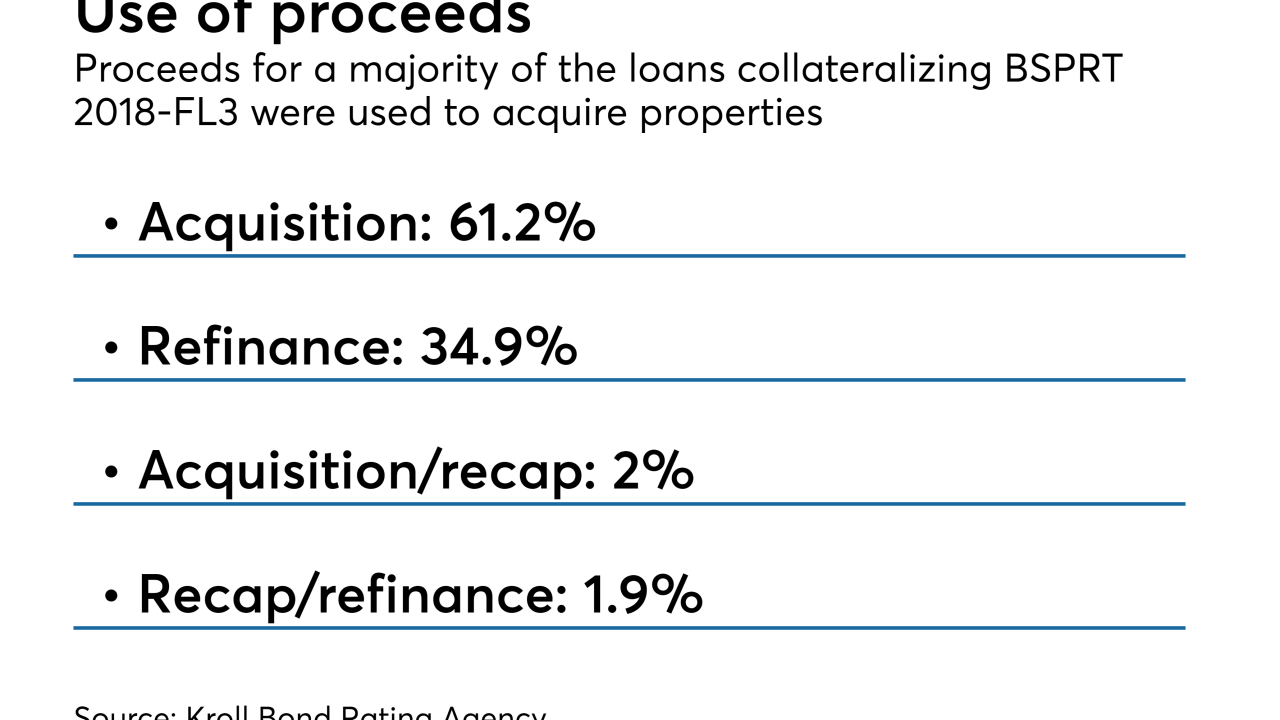

Commercial banks typically compete with CMBS, but this Delaware state chartered bank is securitizing 30 floating-rate loans secured by 35 apartment complexes, retail and office buildings.

March 12 -

The fintech lender's latest offering of $234 million bonds were priced at a 27-basis-point improvement from its previous deal; cheaper funding will allow it to better compete for borrowers in a rising rate environment.

March 12 -

Essent Guaranty is marketing $360.75 million of notes linked to the performance of a pool of residential mortgages that it insures; its following in the footsteps of Arch Capital.

March 12 -

Department of Education Secretary Betsy DeVos says the companies hired by the government to service its own loans should only be subject to federal oversight.

March 9 -

Over 40% of the collateral is from two 2016-vintage transactions that were recently "collapsed" because proceeds from liquidations had slowed. Then there's the exposure to Puerto Rico.

March 9 -

The pool of 41 mid-life aircraft backing Sapphire I has a weighted average age of 12 years and is "largely liquid," according to Fitch Ratings, and there does not appear to be any sort of negative asset selection.

March 8