-

The $340.5 million transaction, GoodGreen 2018-1, is backed by a mix of residential and commercial PACE assets in 42 California counties and 13 Florida counties.

April 20 -

The $185 million transaction features a higher exposure to borrowers entering bankruptcy than the sponsor's 2016 deal; it's also more seasoned, since it recycles 2014 collateral.

April 19 -

The 860 loans backing its latest transaction, the $258.4 million Verus Securitization Trust, 2018-INV1, are all "business purpose investor loans,” according to S&P.

April 18 -

A large portion of the collateral for the $1.06 billion IH-2018-SFR1 is being rolled over from two transactions originally issued in 2015.

April 17 -

A class action filed last week alleges that Renovate America and Renew Financial failed to provide consumer protections promised to L.A. County, that this constitutes elder abuse, and the county is complicit.

April 16 -

HELOCs make up just 2.9% of the $281 million pool of collateral; 81.8% of the HELOC borrowers are currently ineligible to make draws; another 18.2% are permanently frozen.

April 16 -

It is backed by $499.8 million of trust preferred securities and subordinated debt issued by 63 banks and $380 million of TruPS and surplus notes issued by four insurance companies.

April 13 -

The higher rating from Kroll Bond Rating Agency came at a steep price: The senior tranche of notes to be issued benefits from 78% credit enhancement; Dividend's prior deal was rated single-A.

April 12 -

Proceeds from the $75 million issuance, the 10th from a master trust created in 2009, will fund new loans and repay the remaining outstanding notes issued from a 2008 master trust.

April 11 -

Nearly 86% of the loans have been modified; by comparison, a higher percentage of loans backing Citi's previous deal, 97.2%, were modified.

April 11 -

While the sponsor is borrowing more heavily against the 1,283 properties being rolled over, their values have also increased, resulting in a decline in the combined LTV, to 66.5% from 72%.

April 10 -

The latest transaction is the first to include fees associated with the Take 5 Oil Change brand acquired in 2016; they will rank pari passu with outstanding notes issued in 2015 and 2016.

April 9 -

Explosive growth in student lending was putting pressure on the capital ratios of the company, formerly Darien Rowayton Bank; a securitization got a big chunk of servicing strips off its books.

April 2 -

The sponsor has only identified $552 million of collateral for the $610 million deal; it has another four months to put the remaining $88 million to work in additional assets.

March 26 -

Together with $26.4 million of unrated notes that the REIT will retain in order to comply with risk retention rules, the total amount outstanding from the American Tower I master trust will be nearly $1.81 billion.

March 22 -

The majority of the collateral for the $326 million OBX 2018-1 comes from two called Bear Stearns deals originally issued in 2005; the remainder was acquired by the mortgage REIT in the whole-loan market.

March 22 -

DBRS has assigned a BBB rating to a single tranche of certificates issued in what may be the first-ever rated securitization of servicing fees left over after subcontracting payment collections.

March 20 -

The $1.1 billion BENCHMARK 2018-B3 is backed by 45 loans secured by 89 properties contributed by Deutsche Bank (42.8%), JPMorgan Chase (35.3%) and Citibank (21.8%), according to rating agency presale reports.

March 19 -

Medical residents are considered to be good credits but have less free cash flow than fully practicing doctors; the loans did not have a big impact on overall credit metrics of the $900 million deal.

March 19 -

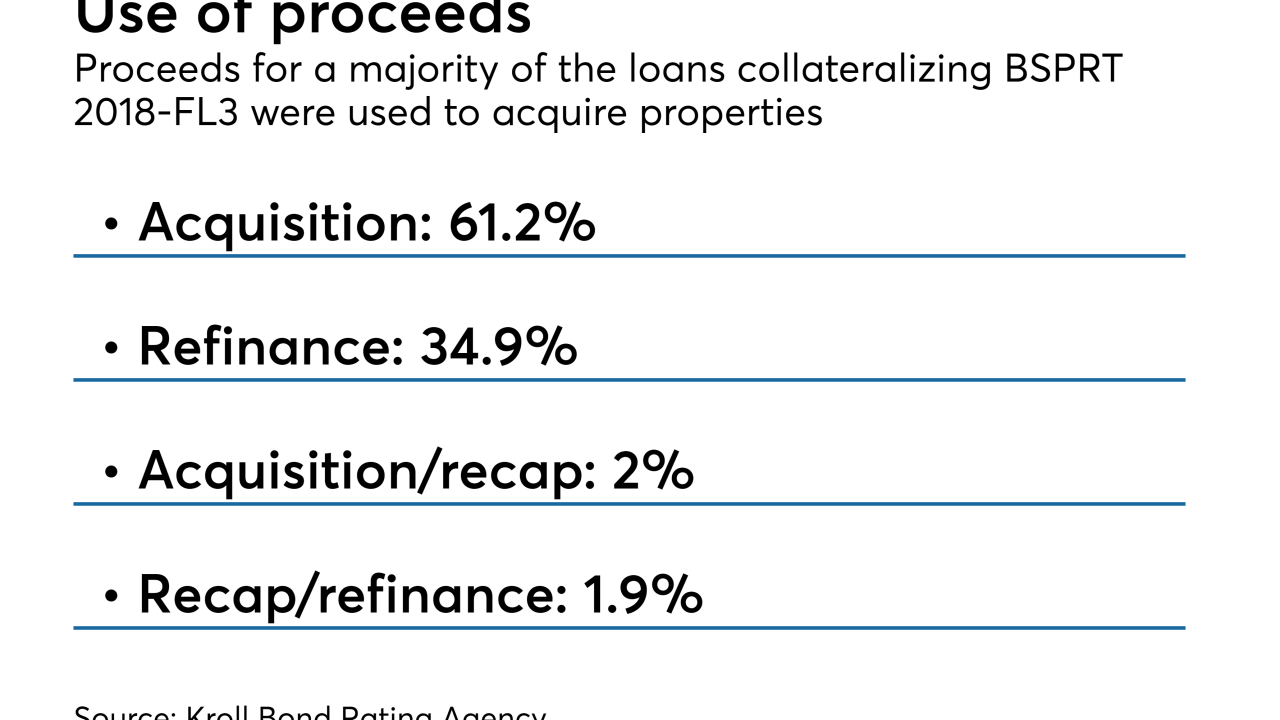

Nonbanks are originating more commercial mortgages on fixer-uppers in response to a sharp drop in the cost of funding in the securitization market. These deals are said to be "vastly different" than other CRE instruments that sustained big losses in the crisis — so far.

March 16