-

The collateral includes both QM and non-QM loans; however, certain loans are designated as QM even though the borrower’s DTI may be above 43%, due to a temporary exemption for GSE-eligible loans.

July 13 -

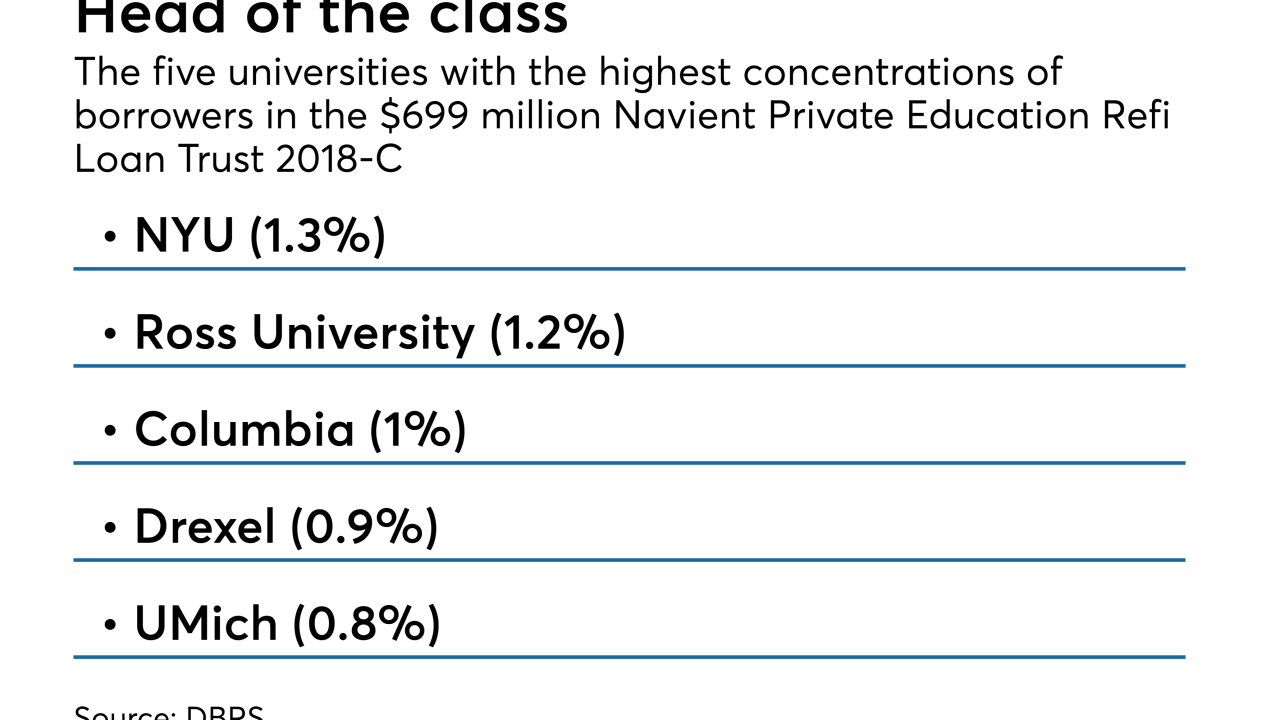

Just 66% of the collateral Navient Private Education Refi Loan Trust 2018-C consists of loans to borrowers with graduate, medical, law or other advanced degrees, down from 72% in a similar transaction in February.

July 11 -

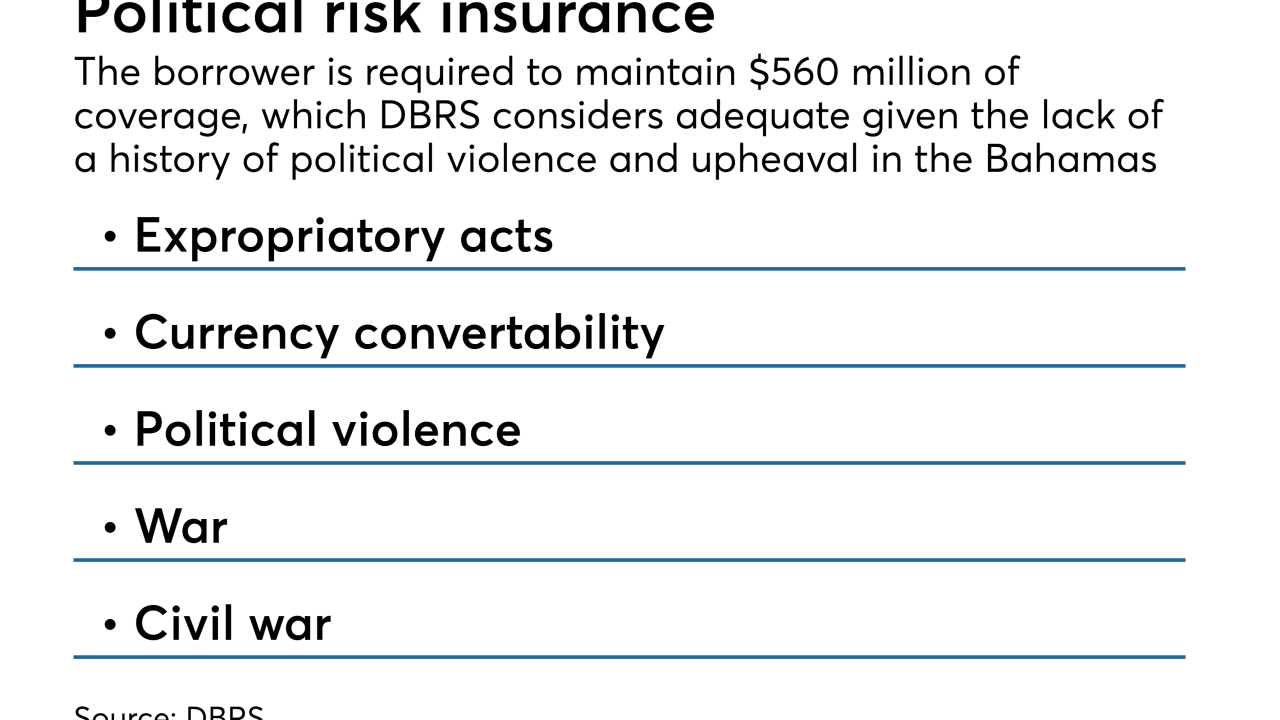

It has obtained a $1.2 billion loan on Atlantis Paradise from Citigroup and Goldman Sachs that will be used as collateral for an offering of mortgage bonds; proceeds will be used to repay existing debt and cash out $149 million of equity.

July 9 -

Private student loans made before the financial crisis were once considered a toxic asset. A recent $414 million securitization by FirstKey, an affiliate of Cerberus Capital Management, shows how much things have changed.

July 9 -

Loans originally securitized in three 2013 transactions account for some 11.4% of the initial collateral for the $230 million CPS Auto Receivables Trust 2018-C, according to S&P Global Ratings.

July 6 -

The AAA-rated Class A notes benefit from 61.79% “hard” credit enhancement, which is 30.25 percentage points higher than the senior tranche of the previous deal rated by Fitch, which was rated two notches lower at A.

July 5 -

Aluko counsels clients on legal aspects of investment management, private investment funds including real estate funds, private equity funds, and hedge funds, derivatives, and regulatory matters; he joins the firm from SECOR Asset Management.

July 2 -

That's a departure from the state student loan authority's previous offering, completed in 2017, which was backed by a mix of private and federally guaranteed student loans, and was rated one notch lower by S&P Global Ratings.

July 2 -

The notes, which are rated by DBRS, are backed by a mix of products to borrowers with weak credit; the pool of collateral will revolve over the first two years of the transaction.

June 29 -

The deal, which is expected to close this summer, would bring THL Credit’s assets in collateralized loan obligations under management to approximately $12 billion and its total assets under management to over $15.5 billion.

June 27