-

Jamba collateral has been added to the master trust, which will issue $300 million of new notes; proceeds will repay $200 million of existing notes.

October 15 -

The rating agency feels that “late-cycle credit behavior” is allowing less established issuers to rely on the securitization market more heavily for funding.

October 15 -

The REIT is purchasing another $500 million of credit risk transfer notes through Fannie's L Street Securities program; this is its first deal rated by Fitch.

October 15 -

Refinance loans account for just 21% of the collateral, and even among those borrowers, just under half have advanced degrees.

October 12 -

The collateral for the new notes will revolve over a period of two years; during this time, the notes will pay only interest and no principal.

October 11 -

Wells Fargo’s first private-label mortgage securitization since the financial crisis doesn’t break any new ground — and that’s probably the point.

October 10 -

The transaction comes six months after Adams said it was in talks about a possible merger with Fairway Outdoors and REIT conversion.

October 9 -

Wyndham Destinations has increased the level of investor protection on its next offering of bonds backed by timeshare loans to offset the slightly weaker collateral.

October 9 -

A two-year-old lawsuit by the CFPB may be languishing, but nine members of the Teachers Federation of America sued the student loan servicing giant alleging that it misled borrowers in public service professions in order to line its pockets.

October 3 -

FASST 2018-1 has a lower weighted average loan-to-value ratio than prior deals by either the sponsor or rival Nationstar; this lessens the risk of loss, though liquidation timelines may be longer.

October 3 -

The $226.5 million transaction looks very similar to the previous one; the heaviest concentration of receivables is long-haul trucks (23.3%), followed by trailers (21.2%), heavy equipment (11.9%) and short-haul trucks (9.3%).

October 3 -

Blackstone Real Estate Income Trust obtained a $257 million mortgage from Barclays on 17 hotels with a total of 2,189 rooms across seven states; it still has $177 million of equity in the properties.

October 1 -

Similar to estimates published by Moody's and Morningstar, the data provider reckons that more than half of the loans are securitized by Fannie, Freddie or Ginnie.

October 1 -

The initial collateral for J.G. Wentworth XLII Series 2018-2 is 97.4% structured settlements, up from 96.6% for the prior deal and the highest concentration of any deal over the past five years.

October 1 -

Zephyrus, which is owned by Virgo Investment Group (98%) and Seabury (2%), is marketing $336.6 million of fixed-rate loans with a final maturity of 2038 and a preliminary A rating from Kroll Bond Rating Agency.

September 28 -

Fitch and S&P recently trimmed default expectations for payment plans of customers with various tenures; this allows the carrier to offer less credit enhancement on its next securitization; Moody's is also rating the deal for the first time.

September 27 -

The £571.6 million Elvet Mortgages 2018-1 is the first mortgage bond offering rated by Moody's Investors Service to include loans that were originated using a mobile phone application.

September 27 -

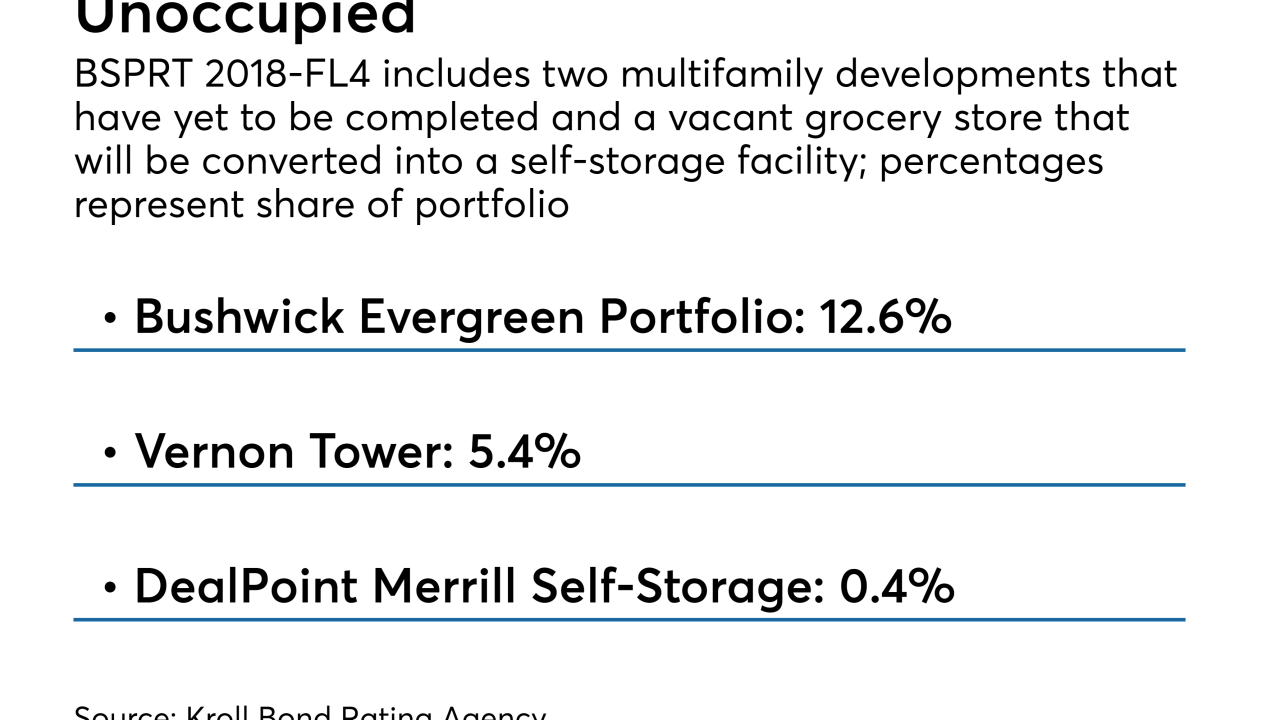

Three of the loans backing the $868.4 million BSPRT 2018-FL4 representing 18.4% of the collateral are either still under construction or have yet to be redeveloped, according to Kroll Bond Rating Agency.

September 24 -

Moody's sees $10.7 billion of securitized commercial mortgages at risk, Morningstar just $1.49 billion; both say loans in Freddie Mac K-deals account for a significant portion of exposure.

September 21 -

A conflict between risk retention rules and prohibitions against self-dealing were limiting options for some lenders to hold skin in the game; a no-action letter issued to Golub Capital creates a "clear path" to compliance.

September 20