Citigroup and Bank of America have teamed up with five other banks to form Octaura Holdings, an electronic trading platform for syndicated loans and collateralized loan obligations.

Brian Bejile, a longtime trading executive with Citigroup, was tapped as chief executive officer of the independent company, according to a statement. Credit Suisse Group, Goldman Sachs Group, JPMorgan Chase, Morgan Stanley and Wells Fargo — along with Moody’s Analytics — are also founding institutions of the firm.

“It’s one thing to have liquidity from one or two banks, it’s another thing to have liquidity from seven major institutions,” Bejile said. “We went to investors and asked them ‘What do you think about the platform we have put together?’ The response was very emphatically ‘We’re excited.’ ”

Octaura got its start as a joint initiative between Citigroup and Bank of America. The push — which originally had the internal code name of Project Octopus — was inspired by technology the two firms developed separately before they started working together on the initiative last year.

The new platform will be a central place for trading desks to see data and perform analytics on assets within the structured credit and leveraged finance markets. Octaura plans to debut the venue for loans first with the one for CLOs to follow. The company ultimately hopes to expand to other credit market products.

Game of telephone

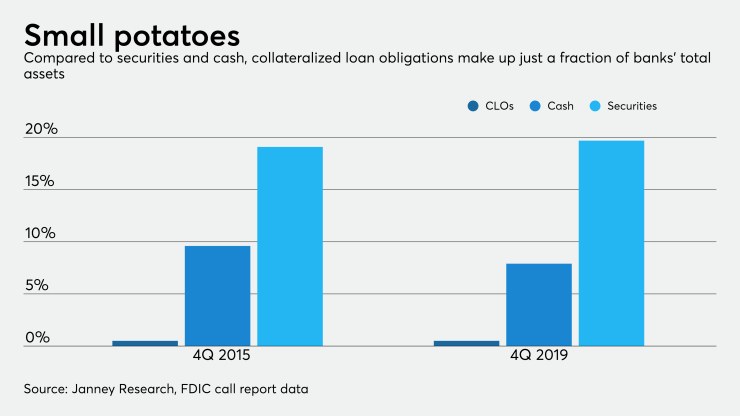

Even though the markets for CLOs and syndicated loans have more than doubled to more than $1 trillion each in the last decade, it’s still a largely manual process to trade the products. Prices can be hard to come by and regulators have warned that investors may not fully understand the risks of investing in funds that hold such hard-to-sell assets.

Take, for instance, a CLO auction: An investor submits a bid to a salesperson at their preferred dealer by placing a phone call or starting an instant-messaging chat. That salesperson, in turn, often phones the trader who is collecting similar bids from salespeople across their firm.

That trader ultimately submits the best bid to the salesperson representing the seller. The process can stretch on for hours, and traders and salespeople usually aren’t able to offer investors feedback on their bids midway through, Bejile said.

“It’s like a giant game of telephone,” Bejile said. “The two or three hour auctions are now, in our product, as short as 10 to 15 minutes.”

Three years ago, Citigroup debuted an electronic bidding capability for CLOs on its Citi Velocity platform to try to solve this problem for its own clients. Almost instantly, the bank saw a 50% jump in the volume of bids it was seeing in auctions. That technology is part of what formed the basis for Octaura.

Loan markets

The market for loans is also largely manual, said David Trepanier, head of structured products, global credit and special situations at Bank of America. That’s why the firm created its electronic platform Instinct Loan Match in 2016, which also helped form the basis for Octaura.

“We were trying to build what each other had built: I was going to try to build out CLO electronification at Bank of America and Brian wanted to move into loan trading,” Trepanier said. “We got together and said, ‘Why are we trying to replicate each other’s great work? Why wouldn’t we just combine it and allow the user to have one portal and one experience to trade loans and CLOs?’ ”

Citigroup and Bank of America ultimately tapped Genesis Global Fintech to help it develop the technology underlying Octaura’s venues. From there, the two began pitching other dealers on joining them in the initiative.

“We came to the other dealers with an actual business plan and we had the experience of dealing with other trading venues and trading platforms and we had actual technology,” said Katya Chupryna, head of Citigroup’s spread products investment technologies group, which helped lead the work inside the bank. “That ultimately led to a very quick acceleration.”

Now, Bejile said he’s already fielding interest from other dealers looking to join Octaura’s venues.

“We hope this platform can save clients time by 60% to 70%,” said Vitaliy Kozak, Citigroup’s global co-head of secondary CLO, asset-backed securitization and collateralized debt obligation trading. “There’s a lot of excitement, both in the dealer and client communities to make this space more efficient and bring it into the 21st century.”