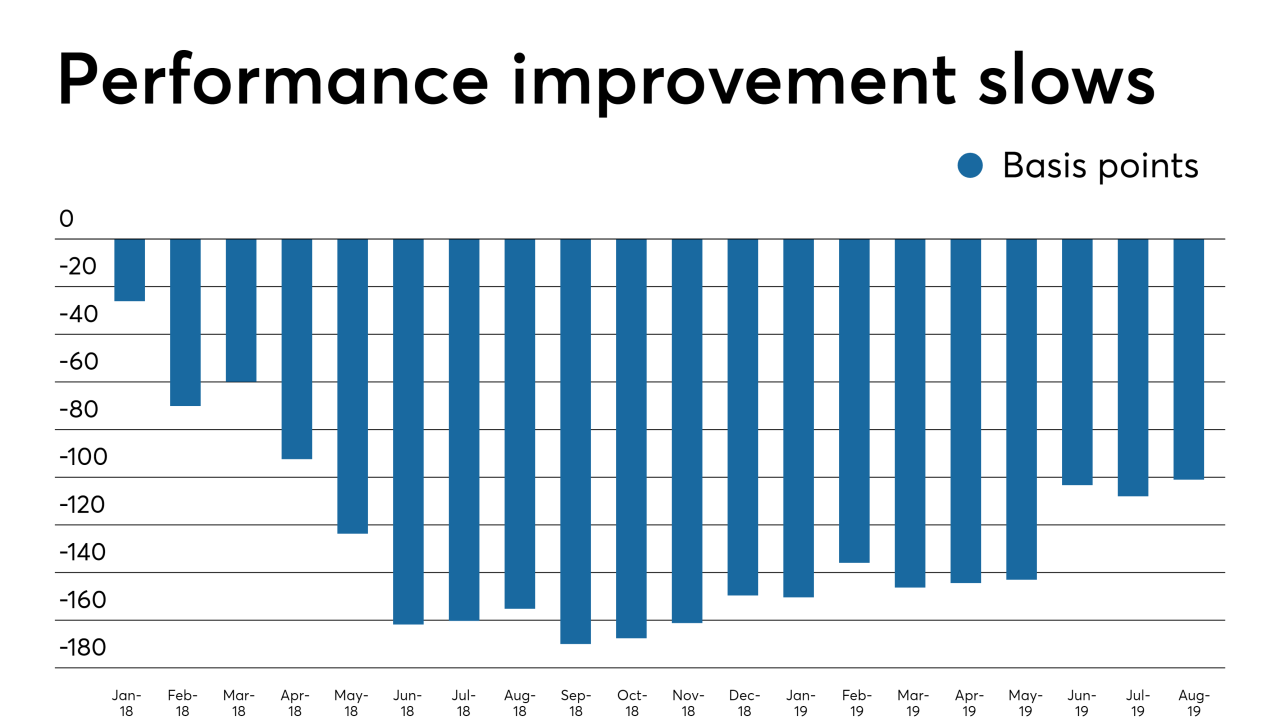

Borrower debt continues to rise, late payments are up and interest rates are at their highest levels since at least 1994. A new report raises questions about the sustainability of the card industry's boom.

-

It hasn't stimulated loan demand in ways banks hoped it might, and some CEOs fear future rate cuts might cause companies to hunker down.

September 10 -

JPMorgan CEO Jamie Dimon said at an investor conference that the Trump administration's plan for Fannie and Freddie would provide more opportunities for financial institutions. He also called for an end to the U.S.-China trade war and weighed in on the prospect of interest rates falling to zero.

September 10 -

HPEFS 2019-1 is the debut $807 million offering sponsored by Hewlett-Packard Financial Services Co. (HPEFS), in an asset-backed offering backed by business leases and loans that are financing small-ticket PC, networking and mobility equipment for both large and small businesses.

September 10 -

The bureau issued three policies removing the threat of legal liability for approved companies that test new products.

September 10 -

The Treasury secretary said he hopes lawmakers will back reforms of Fannie Mae and Freddie Mac within three to six months.

September 9

-

The idea of forgiving student debt has gained traction in the Democratic presidential debates. Undiscussed so far: the significant impact any program could have on the roughly $175 billion of securities backed by student loans.

September 9 -

A federal judge in Florida dismissed the Consumer Financial Protection Bureau's lawsuit against Ocwen Financial Services, stating the agency improperly asserted an excessive number of claims without specifying the particular count to which they applied.

September 6 -

The Trump administration raised the goal posts for ending the conservatorships of Fannie Mae and Freddie Mac, but how officials get there is still highly uncertain.

September 6 -

Managers appear to be increasingly safeguarding portfolios from a potential downturn by dumping distressed assets.

September 6 -

The event is the bureau's second in a series on consumer protection policy. The first dealt with the agency's authority to penalize firms for unfair, deceptive or abusive acts and practices.

September 6 -

While delinquent loans in commercial mortgage-backed securities continued trending downward overall, there was an uptick in the rate for more recent originations, a Standard & Poor's report noted.

September 6 -

The Treasury Department made clear in a much-anticipated report that it prefers Congress take up reform of the government-sponsored enterprises, but it also recommended steps that federal agencies could take without legislation.

September 5