-

Now that the Consumer Financial Protection Bureau says it will scrap an unpopular standard for so-called qualified mortgages, the big question is what will take its place.

February 2 -

Director Kathy Kraninger has told lawmakers that the agency will delay the expiration of the so-called QM patch, now set for January 2021.

January 21 -

Fannie Mae is sponsoring a $1.03B CRT transaction, while Caliber Homes Loans, New Residential and Onslow Bay fill the non-QM pipeline

January 14 -

And the government-sponsored enterprises could hold initial public offerings in 2021 or 2022 to ensure they hold adequate capital, FHFA Director Mark Calabria said.

November 13 -

Fannie Mae and Freddie Mac’s exemption from the Qualified Mortgage rule is on borrowed time, but a House bill would allow lenders to use the mortgage giants’ guidelines for documenting borrower income.

November 12 -

The end of the qualified mortgage patch should further accelerate non-QM origination growth, but is the mortgage industry ready?

October 8 -

The recapitalization of Fannie Mae and Freddie Mac prior to the 2020 election is unlikely even if the net worth sweep ends, according to a Keefe, Bruyette & Woods report.

September 23 -

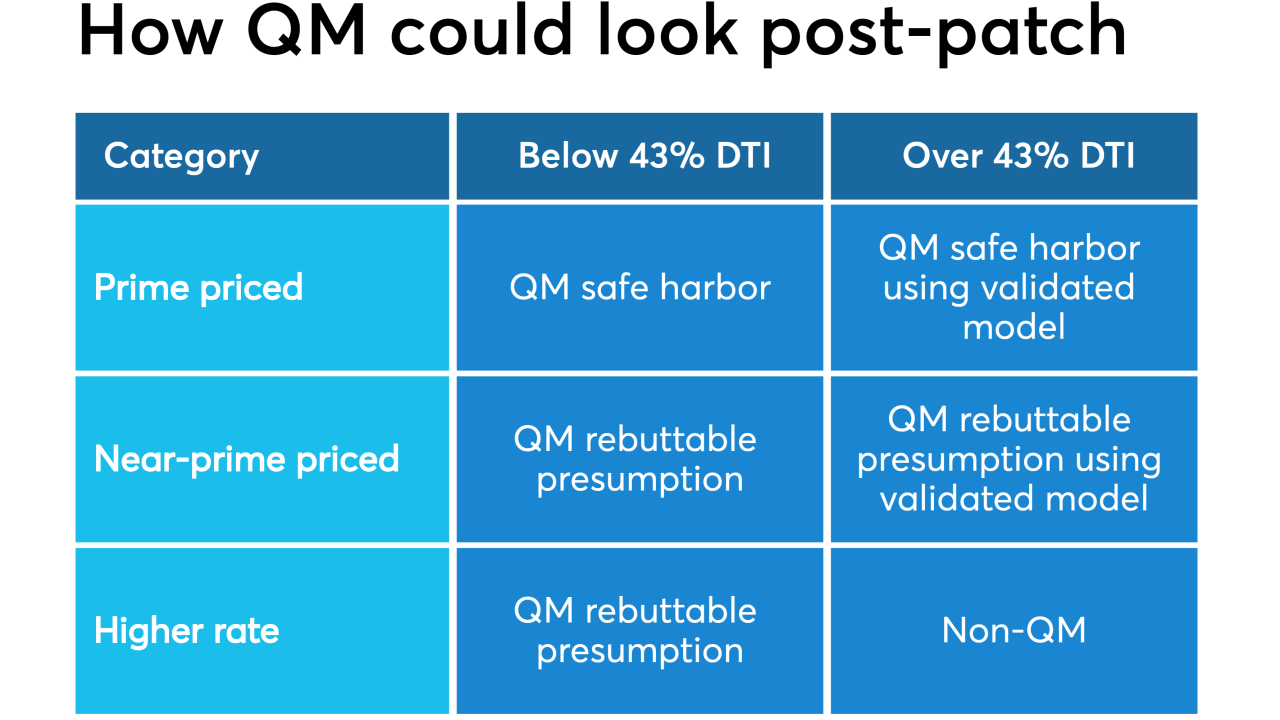

Though advocates and industry are rarely aligned, they are starting to coalesce around a plan that would call for the elimination of the CFPB’s 43% debt-to-income limit as part of its qualified mortgage rule.

August 27 -

Angel Oak is now offering mortgage brokers and correspondent loan sellers a prequalification tool to determine borrower eligibility for non-qualified mortgages.

August 14 -

With the agency mulling changes to the “Qualified Mortgage” regulation, mortgage lenders say little-known standards for how they document a borrower’s income would be a good place to start.

August 12 -

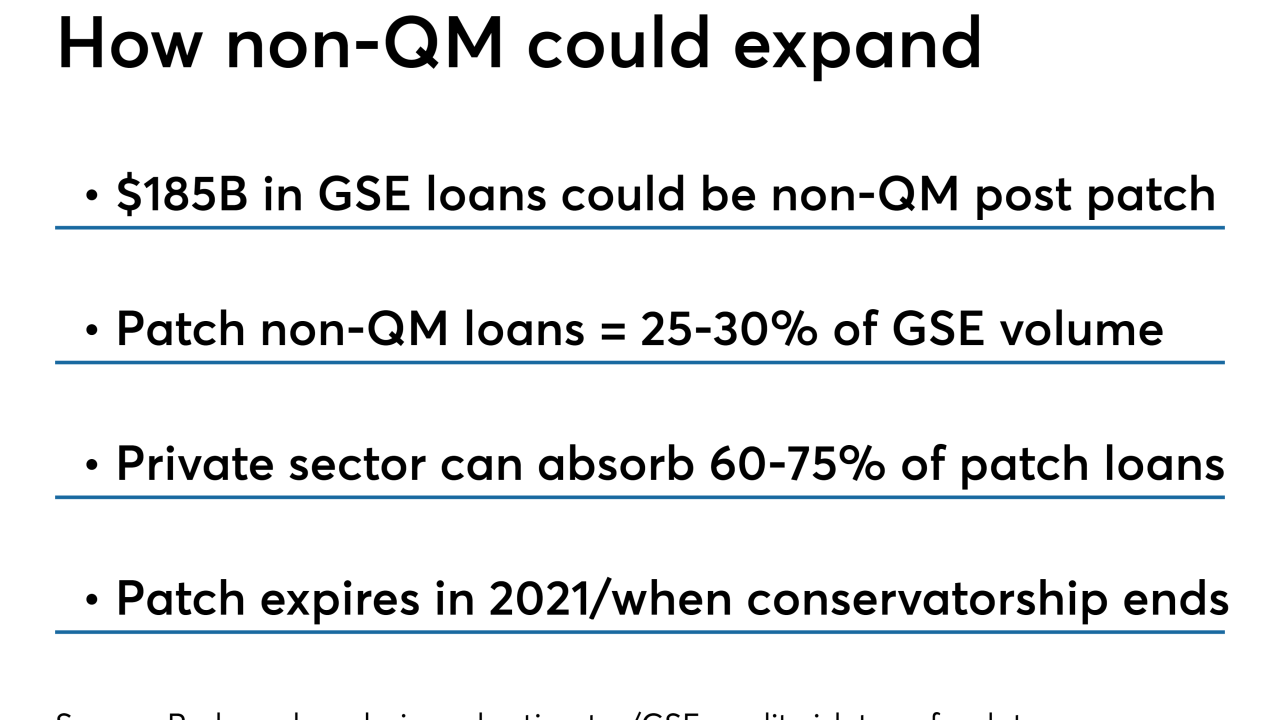

A gradual approach would help the market absorb loans affected by the government-sponsored enterprises' expiring qualified mortgage exemption, a Redwood Trust executive told analysts during a recent earnings call.

August 5 -

Many in the industry say releasing GSE-backed loans from stringent underwriting rules has helped the housing market recover, but a new level of regulatory burden could reverse those gains.

August 2 -

Fannie Mae's current tack could help it weather some of the new challenges confronting the government-sponsored enterprises, including the planned expiration of its qualified mortgage rule exemption and rate-driven earnings volatility.

August 1 -

The mortgage industry was caught off guard by regulators’ decision to cease special treatment for Fannie Mae and Freddie Mac in complying with underwriting rules. But how big of an impact will the new policy have?

July 28 -

The agency’s director said it will let a temporary GSE exemption from the “qualified mortgage” regulation expire.

July 25 -

After the government-sponsored enterprise patch expires, "near prime" loans over the 43% debt-to-income ratio should be qualified mortgages if they have compensating factors, according to the Center for Responsible Lending.

July 9 -

Mortgages using alternative documentation like bank statements for underwriting performed stronger than expected, but uncertainty remains about their default rates in stressed environments, Fitch Ratings said.

July 2 -

Alternative investment manager Pretium plans to buy Deephaven, a residential mortgage-backed securities issuer that operates outside the qualified mortgage market, from Varde Partners.

June 18 -

The nonconforming market is ready to absorb most of the government-sponsored enterprise loans covered by the QM patch, but not all of them, according Redwood Trust.

May 31 -

The transaction represents one of the biggest mortgage-backed bond offerings of large-balance home loans this year — behind only Wells first prime jumbo RMBS in January.

May 8