-

So far farm loans are holding up well, but bankers gathered at an industry conference this week said they are growing increasingly concerned that credit quality will weaken if the U.S. and China don’t reach a deal soon.

November 12 -

The outlook for hotels and suburban offices is still questionable, but the prognosis for other property types in the securitized commercial real estate market remains fairly strong, according to Moody's Investors Service.

October 23 -

GameStop's plan to shutter up to 200 stores could adversely affect commercial mortgage-backed securities loans with a combined allocated property balance of almost $42 million, according to Morningstar Credit Ratings.

October 21 -

As apps like Uber and Lyft gain more traction, the need for new cars — and loans — is expected to diminish.

October 11 -

The Federal Housing Administration chief has already been serving as the acting deputy secretary of the Department of Housing and Urban Development.

October 8 -

The industry had welcomed the Consumer Financial Protection Bureau plan allowing debt collectors to use electronic communication, but some worry about the effect of a court decision concerning email correspondence.

October 7 -

The $533 million Transportation Equipment Trust (TFET) 2019-1 is the first-ever transport finance business securitization serviced and sponsored by BMO Harris' commercial bank, which picked up the business from GE Capital in 2015.

October 3 -

Rising demand and plummeting mortgage rates pushed multifamily origination dollar volume above 2017's record to a new peak, according to the Mortgage Bankers Association.

September 27 -

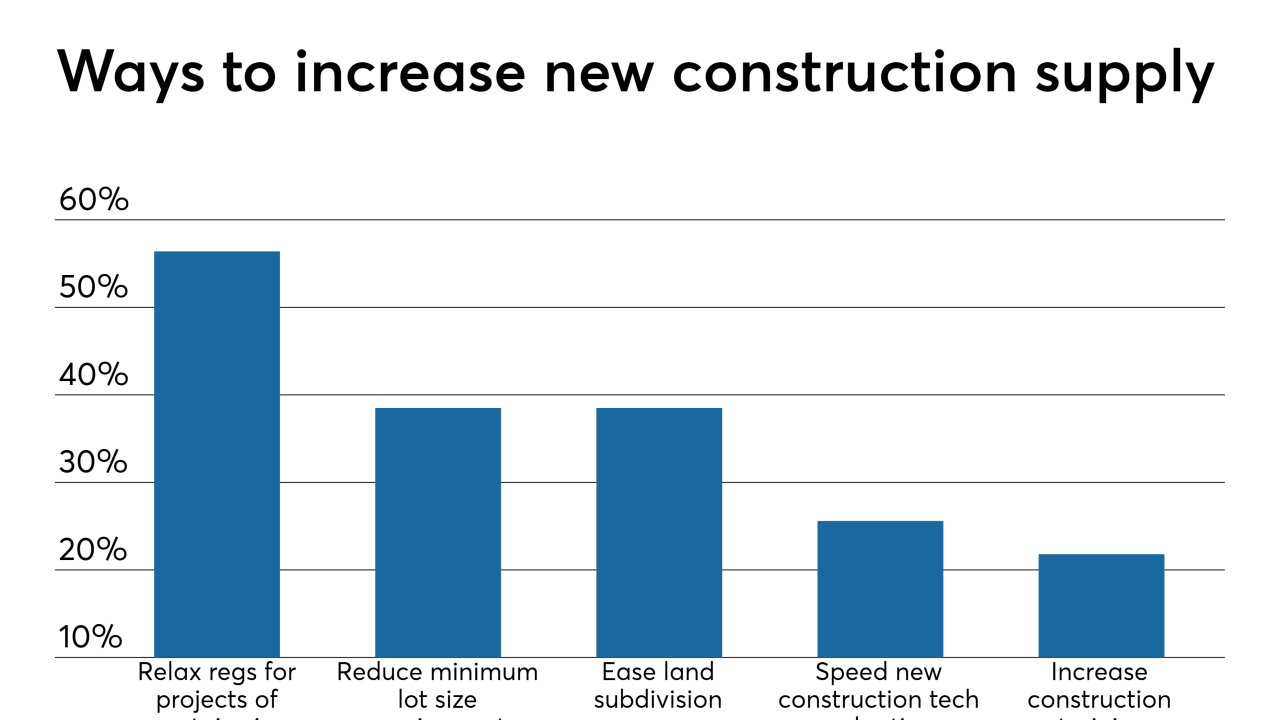

Property values recovered, and in some cases even surpassed housing bubble peaks, but the same can't be said for waning new construction activity, which won't return to historic norms for years, according to Zillow.

September 16 -

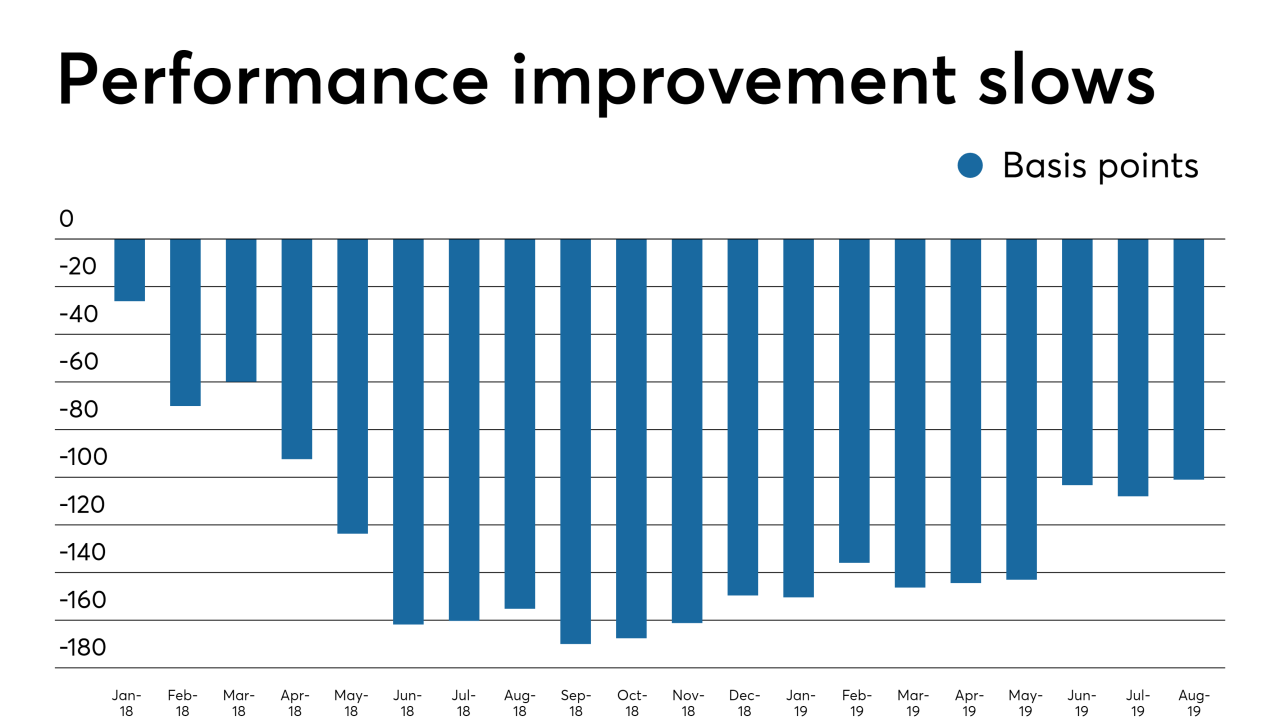

While delinquent loans in commercial mortgage-backed securities continued trending downward overall, there was an uptick in the rate for more recent originations, a Standard & Poor's report noted.

September 6 -

Nonbank lenders Monroe Capital and MGG Investment Group have made a combined $115 million of loans to firms that make cannabidoil and supply products to the cannabis and hemp industries.

August 26 -

Blooma has developed a software product that combs databases to create property profiles for commercial real estate lenders. It can drastically cut origination costs and approval times and help banks identify safer loans, the company says.

August 23 -

The Delaware company, best known for issuing prepaid cards, has ramped up commercial real estate securitizations. The shift promises to deliver big fees, but it could also cause headaches if defaults spike.

July 30 -

The incentives are stronger than ever to work toward standardizing the documentation, language and process for loans in commercial mortgage-backed securities to be combined with PACE financing.

July 23 Alston & Bird

Alston & Bird -

Life insurance companies increased their mortgage investments to levels higher than historical norms, creating more potential danger for their portfolios in the event of a real estate downturn, a Fitch Ratings report said.

July 15 -

While mortgage rate optimism kept consumer confidence about the home purchase market high in June, affordability worries pulled overall sentiment lower, a Fannie Mae survey said.

July 8 -

Because automated valuation models have not been subjected to a stressed housing market, their increased use holds negatives and positives for residential mortgage-backed securities credit quality, a Moody's report said.

June 24 -

A DBRS report states rising concentrations of light-duty truck collateral adds risks to vehicle securitization portfolios, but risk may differ among ABS types.

June 20 -

James Cotins and Matthew Lyons will work with lead partners Lee Askenazi and Robert Villani at the New York-based firm, joining from Alston & Bird.

June 14 -

The large number of overleveraged commercial mortgage-backed securities loans coming due in 2019 is likely to cause the payoff rate to drop an additional 9 percentage points by December, a Morningstar report said.

May 29