-

Fannie Mae's current tack could help it weather some of the new challenges confronting the government-sponsored enterprises, including the planned expiration of its qualified mortgage rule exemption and rate-driven earnings volatility.

August 1 -

Some believe the administration will delay action on Fannie Mae and Freddie Mac to avoid any political fallout. Others say the window for reform is closing.

July 29 -

The mortgage industry was caught off guard by regulators’ decision to cease special treatment for Fannie Mae and Freddie Mac in complying with underwriting rules. But how big of an impact will the new policy have?

July 28 -

The agency’s director said it will let a temporary GSE exemption from the “qualified mortgage” regulation expire.

July 25 -

Although the presidentially directed reports on housing finance reform are "essentially done," FHFA Director Mark Calabria doesn't expect them to be published until August or September.

July 18 -

Treasury and HUD are close to unveiling administrative and legislative options for ending the conservatorships of Fannie Mae and Freddie Mac. Will their findings be heavy on detail or leave a lot unanswered?

July 9 -

The agency had decided not to challenge a recent court ruling that its structure violates the separation of powers, but newly confirmed Director Mark Calabria now appears willing to the fight the case.

July 9 -

Former Freddie Mac CEO Donald Layton has joined the Harvard Joint Center for Housing Studies as a senior industry fellow focused on reform of the government-sponsored enterprises.

July 1 -

There is bipartisan agreement in the Senate that Fannie Mae and Freddie Mac are "too big to fail," but some lawmakers are skeptical that a SIFI designation is appropriate.

June 25 -

As officials prepare plans for the government-sponsored enterprises' exit from conservatorship, there's no shortage of speculation about what those plans might look like and how they might affect the mortgage industry.

June 19 -

The little-known unit was launched in the wake of efforts by the CFPB and HUD to cut back on fair-lending activities, but the reach of the 10-month-old office is still unclear.

June 18 -

There are clear actions that regulators at the CFPB, SEC and FHFA can take to help attract investors into the housing market, argues former FHFA Director Ed DeMarco.

June 14

-

The Federal Housing Finance Agency has appeared willing to take its own steps to reform Fannie Mae and Freddie Mac, but legislation would be necessary to create an explicit guarantee of the mortgage system.

June 13 -

Director Mark Calabria urged lawmakers to grant the agency chartering authority similar to that of bank regulators to boost competition in the mortgage market.

June 12 -

Treasury Secretary Steven Mnuchin was adamant that the Trump administration won’t just let Fannie and Freddie build up their capital buffers and then release the companies. He also said he backed an explicit government guarantee, something only Congress can do.

June 10 -

The Federal Housing Finance Agency has far more authority to upend the status quo than most realize, according to a new report.

June 7 -

The consolidation of the two companies' securitization platforms into a single bond market became official on Monday.

June 3 -

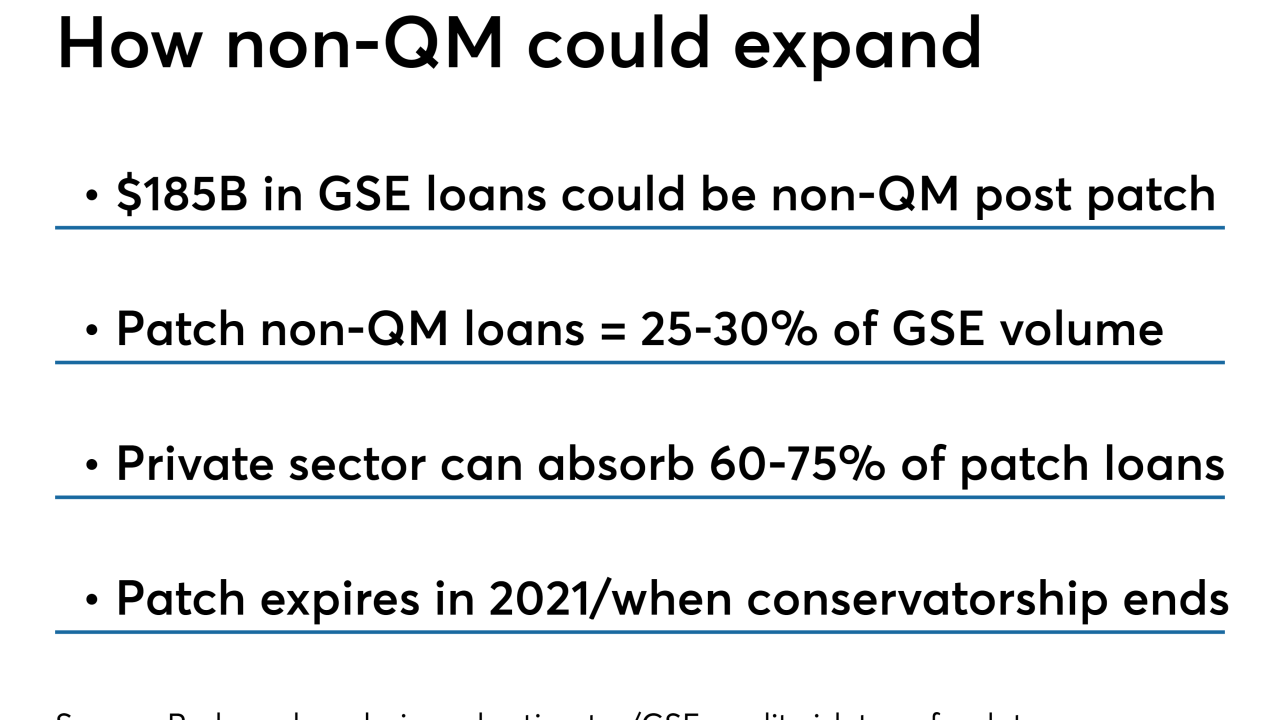

The nonconforming market is ready to absorb most of the government-sponsored enterprise loans covered by the QM patch, but not all of them, according Redwood Trust.

May 31 -

The launch of a combined securitization platform for Fannie Mae and Freddie Mac is meant to ease the transition to a new housing finance system. But questions remain about how the mortgage sphere will adapt to the single security.

May 31 -

Government-sponsored enterprise executives say they want to continue to offer credit risk transfers and guarantee-fee parity after the GSEs are released from conservatorship, but they might not be able to.

May 22