-

A provision in the original Senate tax reform bill would have required companies acquiring mortgage servicing rights to pay taxes upfront for their anticipated servicing income.

December 1 -

The financial services industry has cheered a proposed reduction in the corporate tax rate, but a lower rate could force Fannie Mae and Freddie Mac to write down assets, increasing the odds that the companies will need Treasury support.

November 29 -

New Residential Investment Corp. is planning to purchase Shellpoint Partners in the first half of next year for $190 million with an additional earn-out over the next three years.

November 29 -

Conforming loan limits for mortgages bought by Fannie Mae and Freddie Mac will increase for the second consecutive year in response to the rapid rise in home prices, the Federal Housing Finance Agency said.

November 28 -

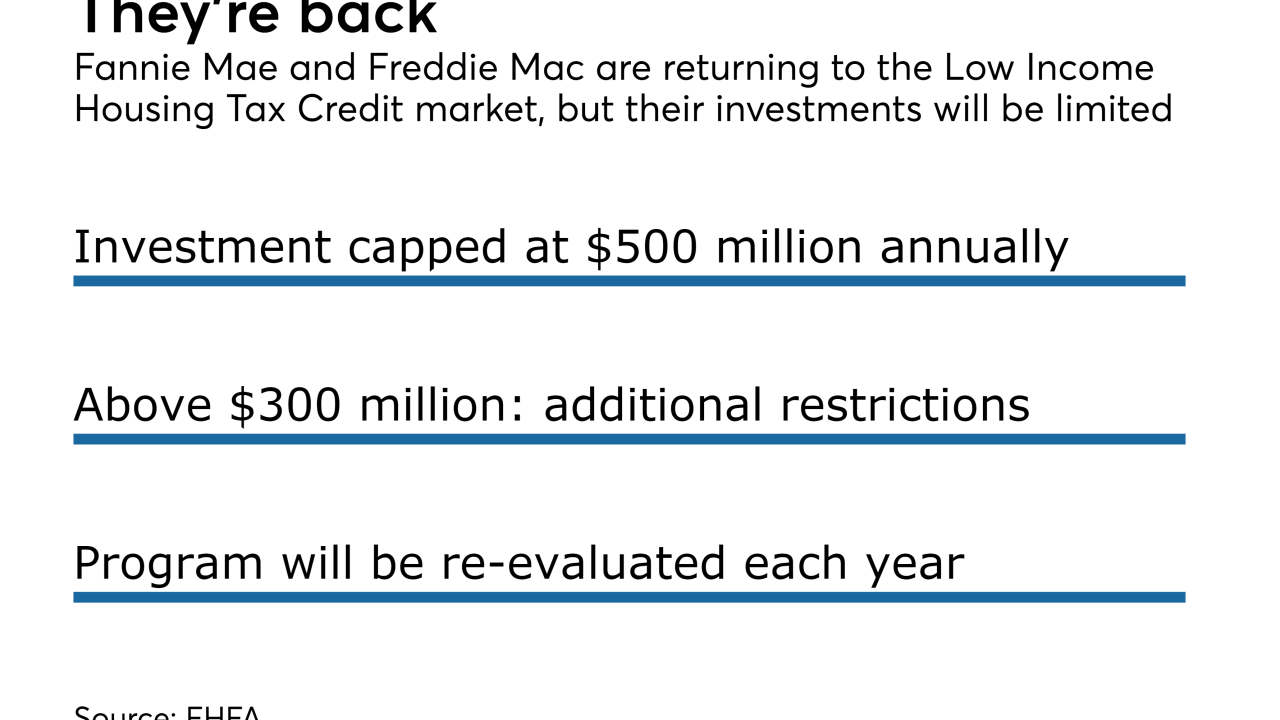

The FHFA is allowing Fannie Mae and Freddie Mac to invest in the credits for the first time since they entered conservatorship. Its purpose is to promote affordable housing in underserved markets.

November 16 -

Benefit Street Partners is securitizing 20 short-term commercial real estate loans it originated or acquired for transitional properties currently with unstable cash flow.

November 15 -

A bill that would ease Basel III capital requirements on commercial real estate loans could level the playing field between depository and nonbank lenders and spur more construction lending if it passes in the Senate.

November 10 -

Hopes that tax reform might soften a weakening of the mortgage interest deduction were quickly dashed as the GOP plan landed a double punch on the incentive cherished by the mortgage and housing industries.

November 2 -

Mark Calabria, the chief economic adviser to Vice President Mike Pence, said the administration is focused for now on more pressing issues than GSE reform, including addressing housing damage from recent hurricanes.

November 1 -

Commercial and multifamily originations are projected to surpass the 2007 market peak this year, according to the Mortgage Bankers Association.

October 27