-

“Why we think we know better or how to protect consumers in your state surprises me,” acting CFPB Director Mick Mulvaney told a group of state attorneys general. “I don’t think we’ll being do much of that anymore.”

February 28 -

Despite riskier terms, rising delinquencies and falling used car values, investors keep buying bonds backed by prime and subprime auto loans and leases.

February 28 -

Comptroller of the Currency Joseph Otting said reform of Community Reinvestment Act regulations is a "key element" of how regulators aim to recalibrate rules a decade after the financial crisis.

February 27 -

So far, consumers have not had much voice in the discussion of a suitable replacement for the benchmark rate; lenders and servicers want to limit any harm, and their liability.

February 26 -

The subprime auto lender paid $2.9 million to Connecticut consumers and a $100,000 fine for miscalculating balances owed on repossessed cars and for charging improper fees. It says the settlement is part of an effort to clean up "legacy issues."

February 20 -

The three offerings push the first-quarter volume of subprime auto loan asset-backeds past $5 billion, an indication of unwavering demand for the risky asset class.

February 9 -

If the Fed order is lifted quickly — a big if — then the impact on Wells should be minimal. But if it lingers past 2018, then the bank could find itself on the losing end of the battle for customers and top talent.

February 5 -

Credit standards for commercial loans to medium and large firms showed some signs of easing over the last three months of 2017, even though demand stayed relatively unchanged.

February 5 -

The Detroit company recorded an 11% increase in car loans and leases originated during the fourth quarter, as well as a jump in yields. Ally appears to be benefiting from Wells Fargo's substantial retrenchment in auto lending.

January 30 -

Social Finance has acquired the engineering and product teams of mortgage startup Clara Lending, bolstering the financial technology company's offerings beyond student-loan refinancing, according to people familiar with the matter.

January 26 -

The credit quality of the collateral appears to have improved, but investor protections have also decreased; as a result, Kroll is only assigning an 'A' to the senior tranche of notes.

January 26 -

David Nelms said that many digital lenders do not understand how to underwrite personal loans properly, and he took a dig at their lack of profitability. The upstarts say their industry's ability to attract capital speaks for itself.

January 25 -

The deal is the first vehicle loan securitization for the London affiliate of South Africa's FirstRand Group since November 2016.

January 24 -

Refi loans that the servicing behemoth is making through Earnest do not require the same amount of seasoning as new in-school loans, and so can be securitized much sooner.

January 24 -

Stepping in after co-founder Mike Cagney's resignation, Twitter's Anthony Noto needs to overhaul the firm's corporate culture, lay the groundwork for an IPO and determine whether to renew SoFi's pursuit of a bank charter.

January 23 -

The Salt Lake City-based lender homes in on troubled borrowers whose subprime status is primarily tied to a recent bankruptcy protection filing.

January 23 -

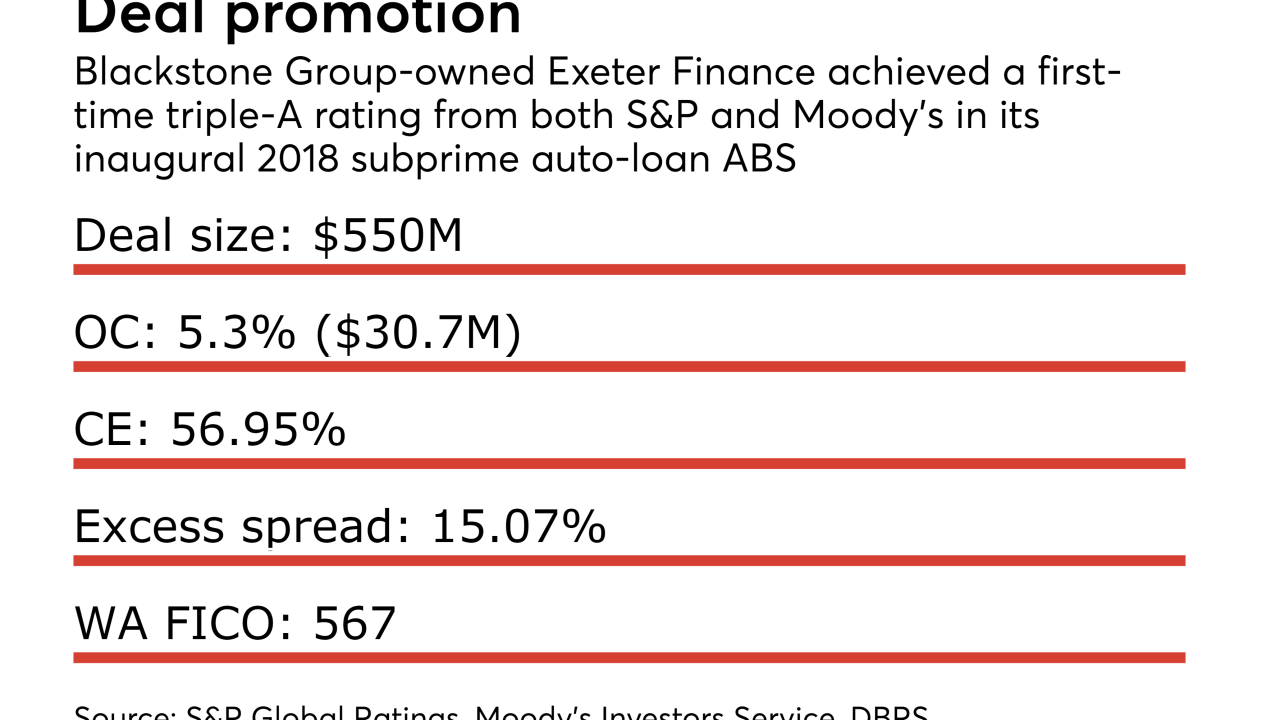

The Irving, Tex.-based specialty lender boosted senior-note credit enhancement levels and has stabilized portfolio losses to break the AA ratings cap on its deals, according to S&P Global Ratings.

January 19 -

The nation's largest private student lender plans to use $30 million of its anticipated tax-cut windfall to speed up its diversification plan and strengthen its digital capabilities.

January 18 -

The weighted average FICO credit scores of securitized reperforming loans are deteriorating a little, according to a DBRS study of the bonds.

January 16 -

Initial expectations for cumulative net losses on the $1.15 billion transaction are higher than those of the sponsor's three prior deals, according to credit rating agency reports.

January 12