-

Since 2013, CLO Managers have been issuing notes with rates that are initially low, but step up after 18 to 24 months, betting that they can refinance them more cheaply; so far their success has been mixed.

July 21 -

Leveraged loan market participants will have to wait a little longer for a big change meant to speed up trade settlement.

July 12 -

An unusual way of attracting investors in the riskiest slices of collateralized loan obligations is coming under scrutiny.

July 5 -

Many energy lenders have begun to sour on shared national credits after years of using the hefty loans to bulk up their balance sheets.

June 30 -

U.S. CLO issuance gained traction in the second quarter, as the dollar volume of deals more than doubled after a sluggish start to the year. Nearly half the respondents in the survey now project CLO issuance to reach about $45 billion for the full year, well below forecasts made at the start of the year.

June 30 -

An eventual "Brexit" from the European Union could exclude CLO managers and investors from the CLO market under existing and proposed EU rules that restrict risk-retention and market activity to EU regulated firms.

June 30 -

DFG Investment Advisors has raised a $100 million fund that it will use to satisfy impending regulations enacted as part of the Dodd-Frank Act requiring CLO managers to have skin in the game of their deals.

June 22 -

The economics of actively managing a pool of leveraged loans for the benefit of several different classes of investors is not good. So some CLO managers are putting their deals on autopilot.

June 20 -

A spring survey of European asset-backed portfolio managers shows a vast majority expects to increase their securitization holdings in 2016. But many see a muted level of issuance in which to add securities, according to the DBRS polling.

June 16 -

EU Parliament member Paul Tang shocked the regions securitization industry last week when he proposed increasing the amount of skin in the game for asset-backeds, by four-fold, to 20% from 5%. He's giving the keynote at IMN's Global ABS conference

June 15 -

The $2.8 billion in CLOs that have priced this month is not enough to reverse the sluggish 2016 CLO market, which is down over 50% in both deal count and dollar volume compared to mid-2015. But six deals to date in June are pacing toward a third straight month of collateralized loan obligation deal volume topping $5 billion.

June 14 -

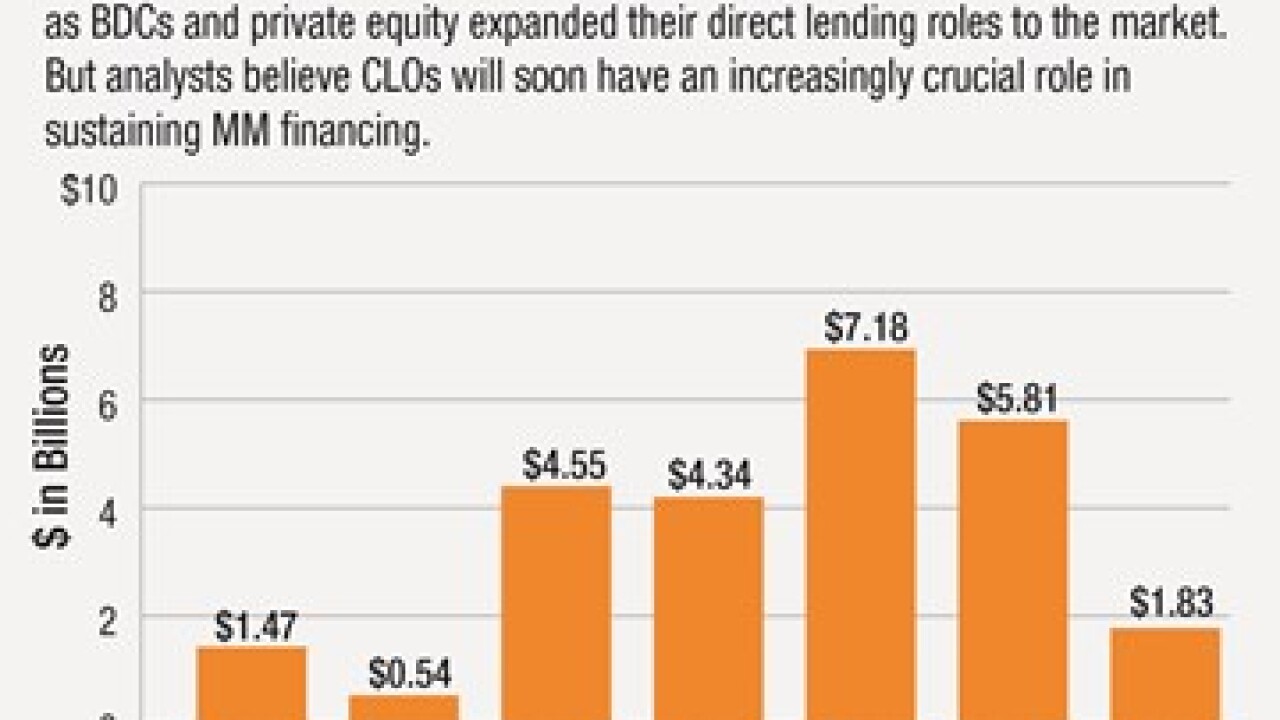

Middle market CLOs have never recovered the role that they played in lending to small and medium-sized companies before the financial crisis; that could change now business development companies and other alternative lenders are under pressure.

May 29 -

In a report published Tuesday, Wells said that retailer loans held by collateralized loan obligations are performing as well, if not better, than most of other loans in CLO portfolios, outside of the oil and gas industries. In addition, only 8% of retail loans in CLOs are trading under $80.

May 24 -

A committee convened by the Federal Reserve to examine potential replacements for widely used interbank offered rate benchmarks has published its interim conclusions, identifying two potential alternatives.

May 22 -

Marketplace lenders may be able to teach banks a thing or two about speeding up loan origination, but when it comes to securitization, they could use a few pointers themselves.

May 17 -

The ranks of CLO investors may have thinned this year amid broader bond market turmoil, but it can still be difficult to put money to work with the best managers.

May 17 -

Speaking at IMNs 5th annual conference on leveraged loans and collateralized loan obligations, LSTA executive Meredith Coffey and SFIG executive director Richard Johns each gave sobering assessments of the inevitable, and possibly debilitating, arrival of new capital ratio and risk retention standards to CLOs and other ABS deals.

May 17 -

Some 69% of collateralized loan obligations completed so far comply with impending risk retention rules, according to Meredith Coffey, research director at the Loan Syndications and Trading Association..

May 17 -

Despite a recent pickup in new issuance of both collateratlized loan obligations and the leveraged loans used as collateral, many participants at an industry conference see more trouble ahead.

May 16 -

Theres a real downside to extremely low or even negative interest rates. Existing CLOs may not earn enough from their euro-denominated assets to pay the interest on the notes they issue.

May 12