-

The $12.9 billion in collateralized loan obligations issued last month brings the 11-month total to $108 billion, just shy of the 2014 record of $124 billion.

December 8 -

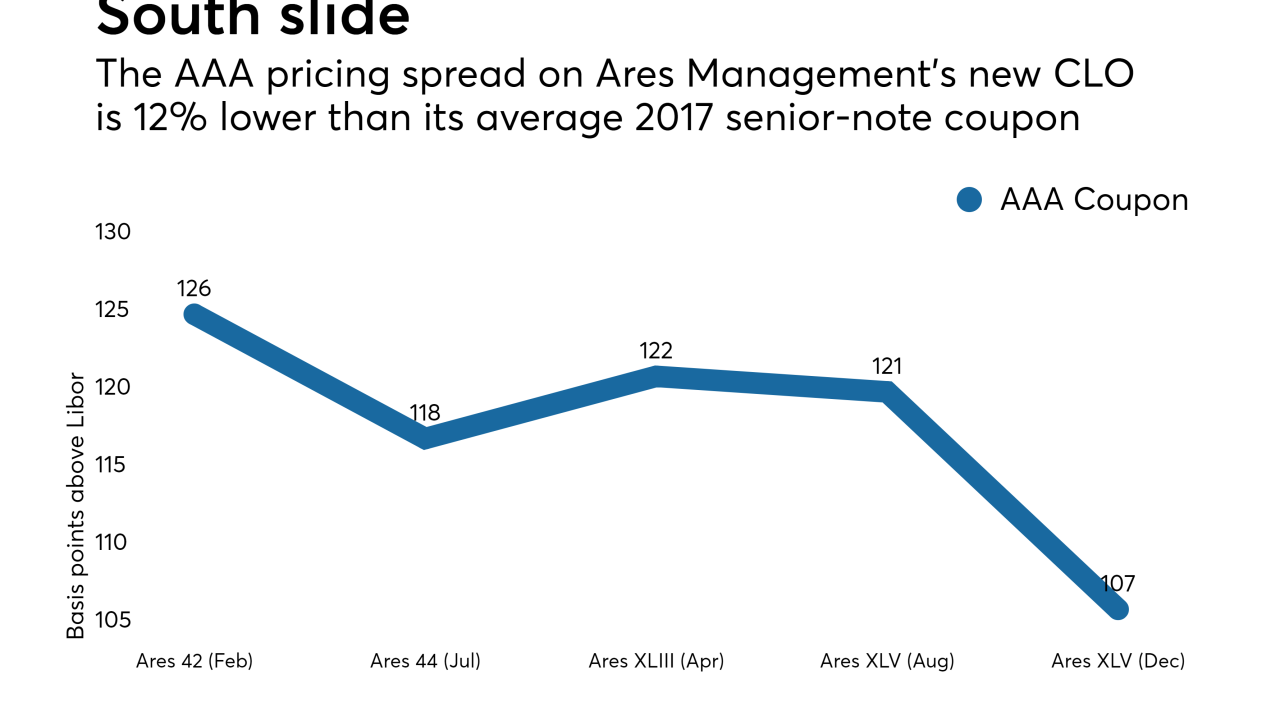

Three broadly syndicated deals printed in December have senior, AAA-rated tranches that pay just 107 basis points over Libor - the lowest coupon of the year.

December 6 -

Junk-rated firms pay little tax, and so won't benefit much from a lower corporate rate. And this benefit could be offset by a limit on the interest deduction.

December 4 -

The dramatic tightening in loan spreads this year made it difficult for the CLO manager to manage to various performance metrics of its deals, and this required building flexibility into deals being refinanced.

December 4 -

Carlyle Euro CLO 2017-3 is the latest under its new shelf managed by affiliate CELF Advisors, with a AAA coupon of just 75 basis points over three-month Euribor.

November 28 -

The deal will relaunch with a weighted average spread (4.22%) and excess spread (2.86%) well above the three-month industry average for issued U.S. CLOs.

November 22 -

CBAM Asset Management's $1B CBAM 2017-4 is not its largest deal among the four BSL portfolios it has issued in less than eight months; but the latest transaction is still almost double the average peer CLO deal size of $511 million since the third quarter.

November 17 -

The unwinding and rebuilding of the struggling portfolios of Fifth Street's business development companies could take two to three years, Oaktree management stated in an earnings call Thursday.

October 27 -

Neuberger Berman Loan Advisors CLO 26 builds the Dallas-based manager's assets under management to $5.5 billion.

October 25 -

The U.S. Second Circuit ruled that Momentive Performance Materials should use what's known a a "market rates" formula to determine the appropriate payout for a series of replacement notes issued to bondholders.

October 23