-

Golub Capital Partners' first CLO of 2018 is pooling small and medium-size enterprise loans into a $903.8 million portfolio, more than twice the size of its previous middle-market CLO.

February 25 -

GoldenTree's dual-market CLO manager affiliate is launching its first European CLO after debuting with two U.S. deals totaling more than $1.4 billion in 2017.

February 23 -

In January, the closed end fund put $36.6 million to work acquiring the most subordinate securities issued by several CLOs, following the $52.6 million it spent in the fourth quarter.

February 23 -

The $410 million Ares XXXVIII CLO was the first U.S. collateralized loan obligation to reset, reprice or be issued since Angelo Gordon completed its Northwoods Capital XVI transaction on Feb. 15.

February 21 -

It's now calling for volume of $110 billion, 10% higher than its previous forecast, based on the view that the repeal of risk retention will spur smaller managers and new managers to enter the market.

February 20 -

KKR is resetting a 2012-vintage deal for the second time; it now has a reinvestment period of just 1.8 years compared with the more typical four or five years.

February 20 -

Onex reset a deal, agreeing to a higher coupon on the AAA-rated senior notes, in order to gain a five-year reinvestment period extension; it substantially narrowed spreads on subordinate notes.

February 15 -

Eliminating the requirement that CLO managers keep skin in the game of deals should boost issuance, but this could result in weaker credit quality of collateral as competition for loans increases.

February 13 -

There could be a pause in new issuance as CLO managers wait to see if the government will appeal; longer term, the pace will pick up as the playing field is leveled for smaller managers.

February 12 -

A three-judge panel for the D.C. Circuit Court of Appeals has sided with the LSTA in its lawsuit seeking to reverse rules requiring CLO managers to hold "skin in the game" under Dodd-Frank.

February 9 -

Players as small as Oxford Lane and as large as the Carlyle Group have money to put to work funding risk retention and investing opportunistically; trends could attract more first-time managers.

February 8 -

The deal is backed by an unusually concentrated portfolio of just 19 loans on properties being rehabbed or converted to a new use; by property type, the biggest exposure is to hospitality, at 19.7%.

February 8 -

Voya Alternative Asset Management is replacing and consolidating seven fixed- and floating-rate tranches with five new variable-rate classes that each gained lower rates than predecessor notes.

February 7 -

The Los Angeles-based distressed-debt specialist has $20.5 billion in dry powder, including over $8.8 billion in uncommitted capital stored in a dormant opportunities fund.

February 7 -

S&P Global Rating's London office made the rare move to downgrade the junior-most notes in a 2016 CLO issued by a Danish credit manager due to a deterioration in portfolio maintenance levels.

February 2 -

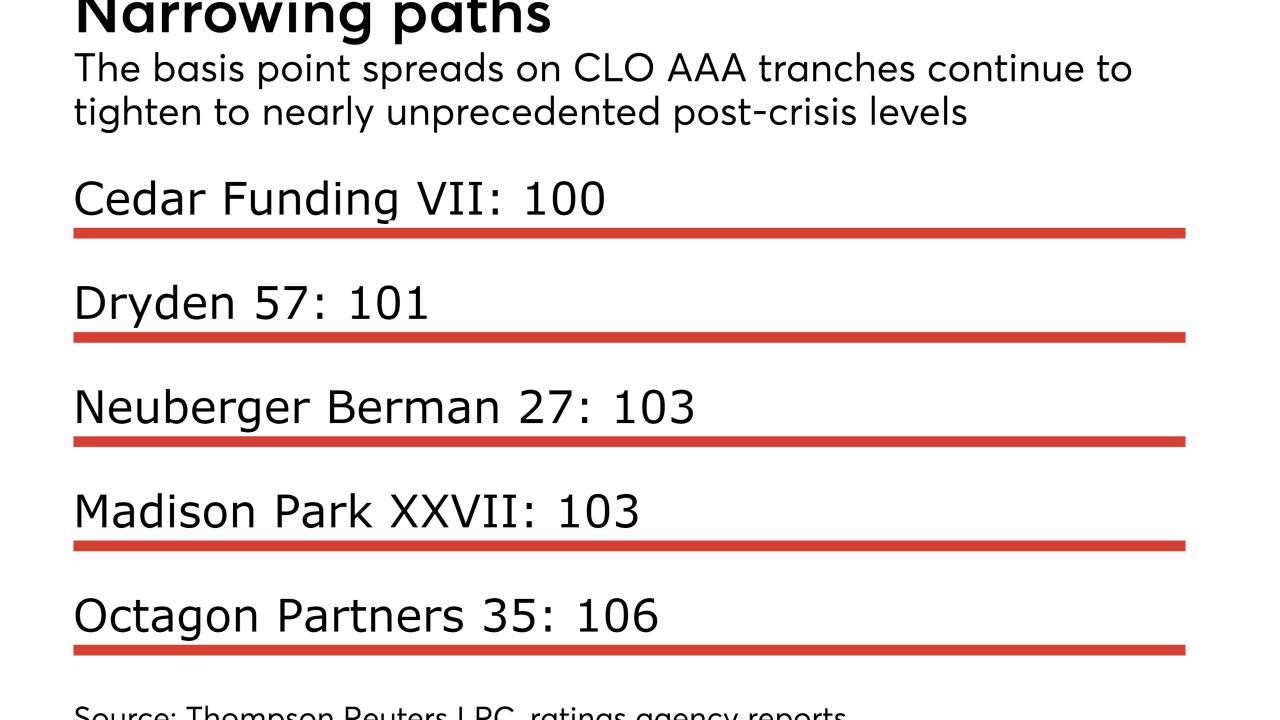

Aegon Asset Management's new Cedar Funding CLO VII is expected to price its senior triple-A notes at 100 basis points above Libor, carrying on a 2017 trend of tightening spreads.

January 31 -

While tightening down on cov-lite and subordinate loans, Marathon CLO XI's rules give the asset manager more room to trade in lower-credit and DIP loans.

January 31 -

Returns for equity investors are increasingly under pressure because of demand for the underlying loan assets, but strategies to boost returns can investors in other CLO securities at risk.

January 29 -

The $407 million Crown Point 4 is also the first CLO in nearly three years for Valcour, which was last in the market with the $400 million Crown Point III in March 2015.

January 26 -

Traditional refinancings are document intensive, time-consuming and costly; the SEC has given the green light to more efficient mechanism that resets coupons at periodic auctions.

January 22 Seward & Kissel’s Structured Finance and CLO Group

Seward & Kissel’s Structured Finance and CLO Group