-

The initial portfolio for the $601.7 million deal features high exposure to lower-rated single-B loans, though that will likely drop when it is fully ramped.

April 16 -

The transaction is the fourth by the New York-based affiliate of Hayfin Capital Management since its merger with the U.K. asset manager.

April 16 -

Investors who do not consent to proposed changes in the terms of the $655.9 million Magnetite XXII must sell their bonds (at full par) to the money manager.

April 8 -

The New York-based CLO management firm also plans to change its name to reflect its parent firm, Vibrant Capital Partners.

April 4 -

The CLO manager has priced a reissued CLO at spreads signficantly higher than rates paid since a 2017 limited refinancing.

April 4 -

Dryden 36 Senior Loan Fund, originally issued in 2014 and previously refinanced in December 2016, is also being upsized, to $712.9 million.

April 2 -

The $410 million Maranon Loan Funding 2019-1 will be backed by assets initially included in a December 2016 transaction.

April 1 -

Ares' transaction priced at spreads similar to its prior deal in February but wide of its initial 2019 transaction in January; Golub beat the spread of its prior BSL CLO, in February.

March 27 -

These deals offer clear benefits for managers looking to lower funding costs; a survey from JPMorgan indicates investors have their own reasons for liking them.

March 25 -

THL Credit is marketing its first middle-market CLO in a $410.5 million portfolio backed by receivables from its direct-lending originations.

March 25 -

Moody's assigned an Aa1 to the Class A notes to be issued by the $215.8 million BFNS 2019-1; that's one notch higher than the comparable tranche of its prior deal.

March 22 -

The $155.7 million secured combo note offering is backed by the full face value of three classes of mezzanine notes plus a majority portion of the residual notes from Oaktree's first CLO of 2019.

March 21 -

The $503.3 million Madison Park XXXIV has a 133-basis-point spread for its $294.5 million Class A-1 loan tranche.

March 21 -

The boutique investment bank will retain a 45% minority stake in its former credit advisors unit, which was renamed and infused with additional capital by its new parent.

March 20 -

The refinancing also extends the reinvestment period of the $410 million Garrison BSL CLO 2016-1 by two years; the deal is non-callable for two years as well.

March 19 -

Gleysteen's return builds on a recent trend of old-school issuers revving up new CLO platforms

March 19 -

The JFSA published a final rule outlining the hoops U.S. CLO managers will have to jump through if Japanese banks are to avoid a higher risk weighting on their holdings; it remains to be seen how much of a burden this will be.

March 19 -

There are six tranches of AAA rated notes, including fixed-rate, some variable rate, and even a rare tranche of AAA rated loans.

March 13 -

Nick Robinson, a 15-year Milbank veteran in advising CLO arrangers, managers and investors, joins as a partner in the New York office of the London-based firm.

March 11 -

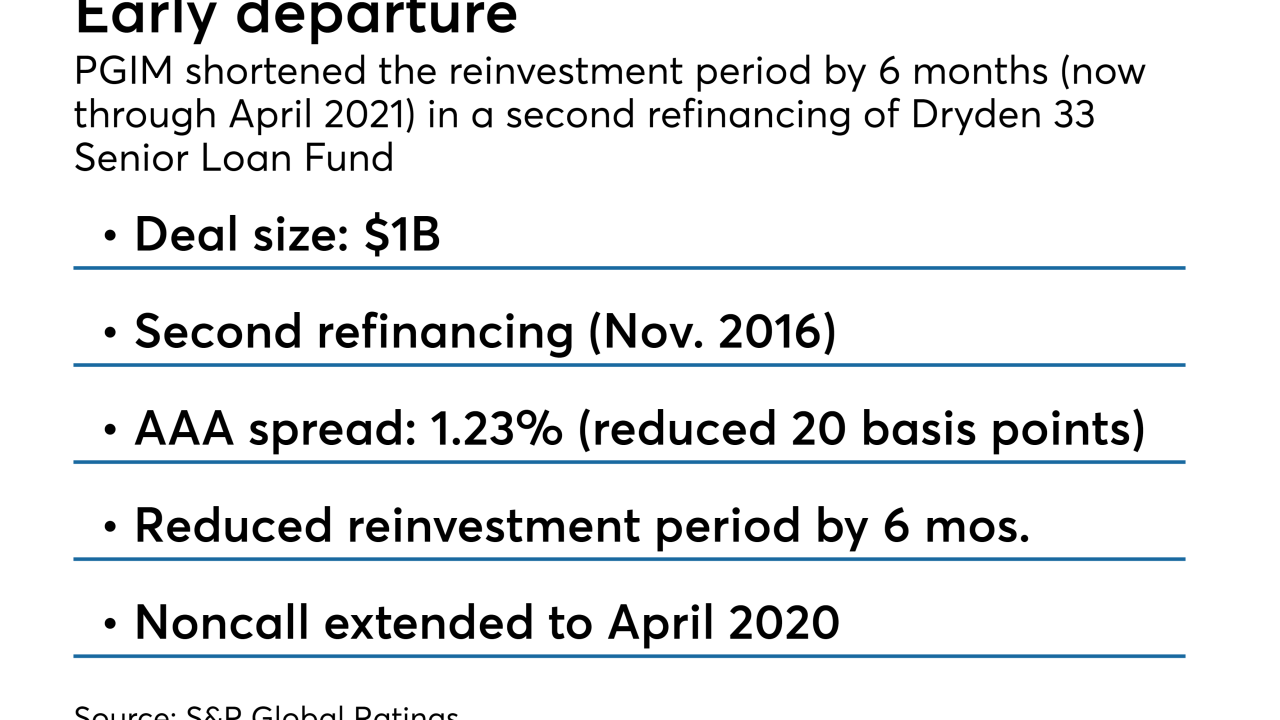

PGIM gains a 20 basis-point reduction in the AAA note coupon as it reduces the reinvestment period by six months

March 6