-

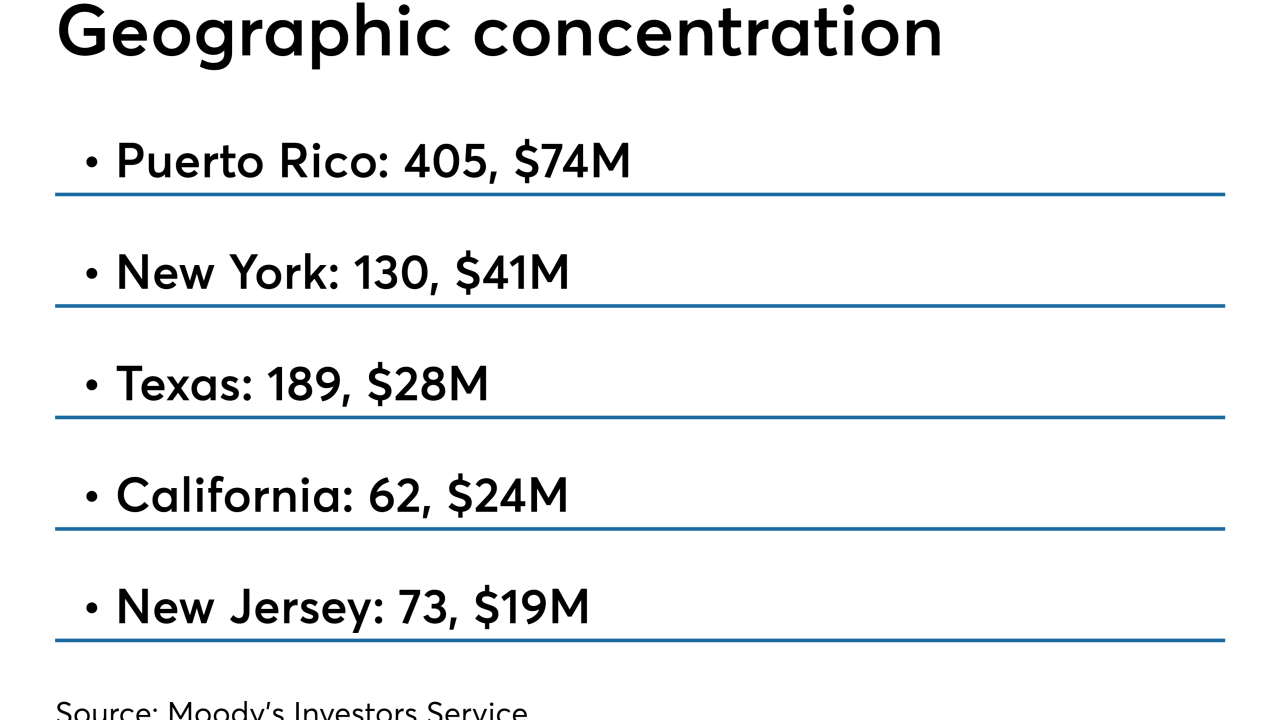

Citigroup Mortgage Loan Trust 2019-RP1 is a pool of 1,330 first-lien mortgage loans with a remaining balance of $262.8 million. Nearly 89% of the loans were previously modified.

April 26 -

An industry working group might seek legislation to eliminate the need for investor consent in the shift to a new benchmark interest rate. But any legislative fix is almost certain to be challenged because choosing an alternative to Libor will inevitably favor one party in a transaction over another.

April 21 -

Nearly 67% of the loans in the $309 million loans and repossessed properties backing FASST 2019-HB1 were obtained from a 2017 deal that was recently collapsed.

April 18 -

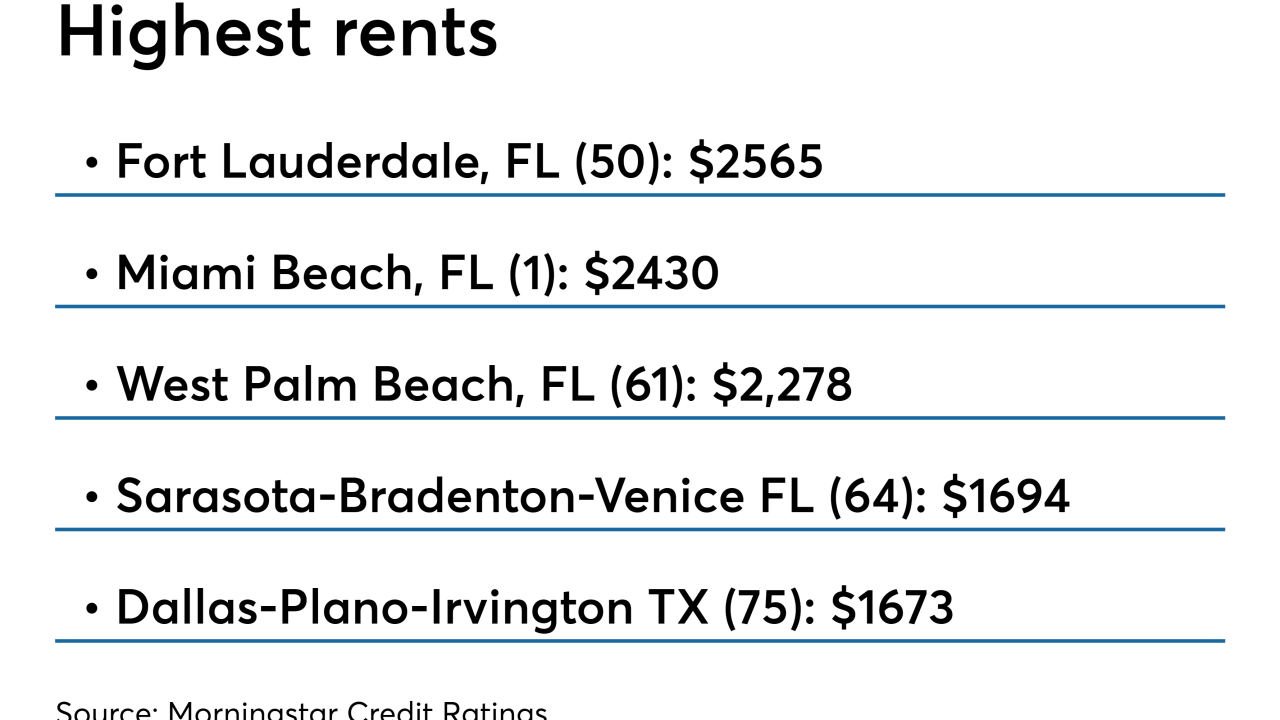

The $479 million Progress Residential 2019-SFR2 Trust is backed by 2,459 single-family residences, 2,452 of which were previously securitized in Progress 2016-SFR2.

April 9 -

Non-qualified mortgage-backed securities record issuance in the first quarter puts it on pace to top full-year volume predictions, according to Keefe, Bruyette & Woods.

April 9 -

The bank agreed to modify loans to struggling U.S. borrowers as part of a 2017 settlement. Instead, it’s receiving credit for financing new mortgages that likely would have been made anyway.

April 8 -

The Structured Finance Industry Group wants Treasury and the IRS to issue a notice that a change from Libor to an alternative index would not be treated as a taxable exchange.

March 31 -

While reinsurers are becoming more comfortable with the risk it is offloading, the GSE wants to maintain control of the workout process for loans that go bad.

March 27 -

Depending on market conditions and demand from whole loan buyers, it could fund 25% to 35% of fix-and-flip loans through deals like the $219 million one it just completed.

March 26 -

At $230 million, GSMBST 2019-PJ1 is notably smaller than recent transactions from JPMorgan and Redwood Trust; borrowers also have less equity in their homes.

March 25