-

HPS Investment Partners is adding a new name to one of its legacy Highbridge CLOs, as well as piling on extensive changes to note structure, deal terms and restrictions on some higher-risk assets.

October 10 -

Nissan's second U.S. lease-securitization of 2017 pools more than 71,000 contracts with $1.5 billion outstanding on cars, SUVs and cross-overs. Delinquencies remain low, but residual values are growing volatile.

October 2 -

GM Financial is following similar actions by American Honda, Santander, Fifth Third and USAA to limit Texas exposure in securitizations, but the captive-finance lender has extended the exclusion to Florida loans as well.

September 28 -

The deal, Sunrise SPV 20 S.r.l., is collateralized by more than 120,000 auto, furniture and personal loans originated by the Italian lender.

September 28 -

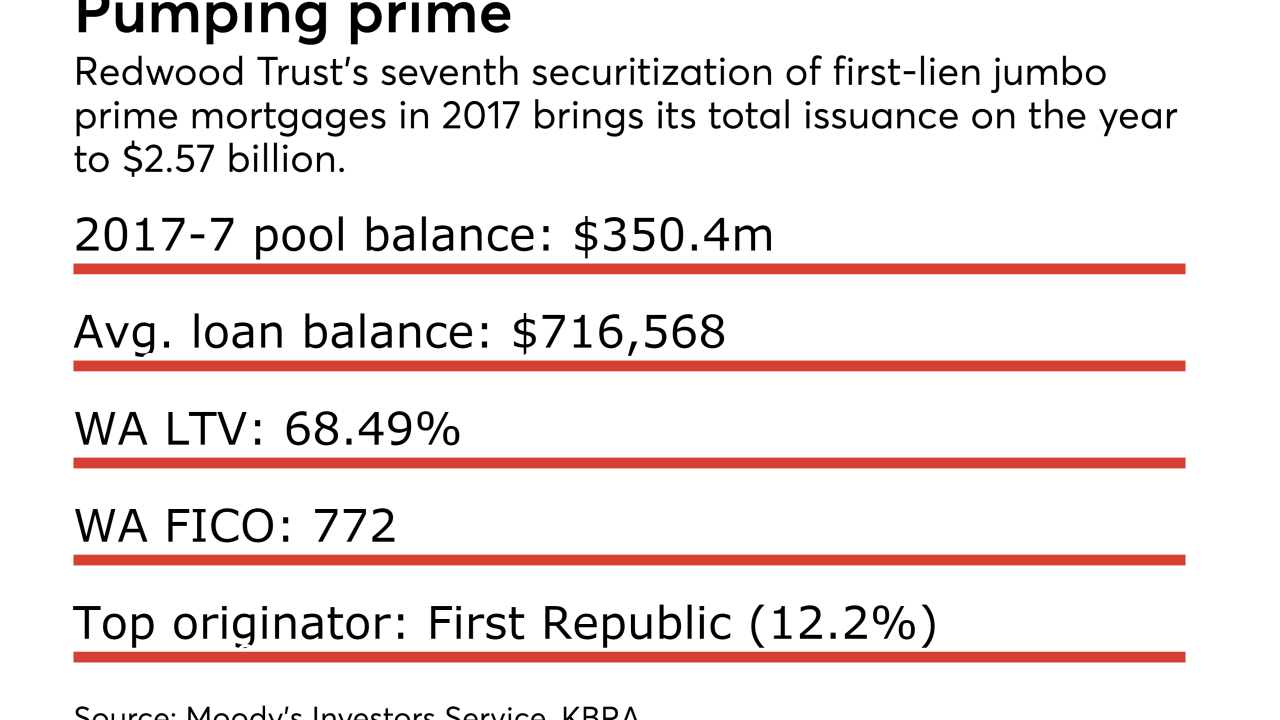

The deal is the real estate investment trust's seventh of 2017; the collateral was contributed by 135 originators, including Quicken Loans and First Republic Bank.

September 28 -

Bank of Nova Scota's third overall deal in its brief auto-loan securitization history will feature $500m in U.S.-dollar denominated bonds.

September 25 -

The total includes over $78 billion in new transactions; collateralized loan obligations issued post-crisis have lmited exposure to Toys R Us, which filed for bankruptcy last week.

September 25 -

The latest round of Freddie-backed mortgages for the development, acquisition or rehabilitation or affordable multifamily housing includes 67 properties, with the highest concentration in California.

September 21 -

The San Francisco-based bank's first prime auto loan securitization in two years includes a sizable portion of loans (60% of the pool) with terms exceeding six years.

September 20 -

RREEF America, the real estate investment unit of Deutsche Asset Management, is securitizing an unusual mix of speculative-grade project finance and corporate in a debut $431.3 million collateralized debt obligation.

September 14 -

The €684.8 million transaction is backed primarily by new-car leases to German prime borrowers. It's the 21st German securitization by FCE Bank, Ford's UK-based captive finance arm.

September 13 -

The rental car giant is more dependent than ever on asset-backed financing after being downgraded in May, making high yield bond issuance prohibitively expensive.

September 12 -

The transaction, from Together Financial Services, is backed by nearly 4,500 first- and second-lien non-conforming loans, including those for "buy-to-let" and self-employed borrowers.

September 12 -

The federal savings institution is pooling more than 33,000 well-seasoned auto loans to its armed services-linked membership base.

September 10 -

New issuance of U.S. collateralized loan obligations reached $11.9 billion across 24 deals, taking year-to-date volume past $72.3 billion, according to Thomson Reuters LPC. The eight-month total is higher than the total issuance for all of 2016.

September 10 -

Ford Motor Credit, GM Financial and Fifth Third Bancorp are marketing a combined $3.4 billion in prime auto loan and lease asset-backed securities, according to presale reports published Thursday.

September 7 -

The 4,443 single-family rental homes securing Starwood Waypoint Homes 2017-1 have an average age of 30 years, older than any previous transaction by the sponsor, but are bringing in more than $1,700 apiece in monthly rent.

September 6 -

CVC Cordatus Loan Fund IX is CVC's ninth overall Euro-denominated CLO, and only the second that will price since early June, according to Thomson Reuters LPC.

September 1 -

The $418m OSCAR US 2017-2 transaction is the 7th securitization of prime auto loans originated by Orient Corp. (or Orico) in Japan and packaged into U.S.-dollar denominated securities.

September 1 -

The pricing of BlueMountain Fuji's second-ever transaction pushed the monthly new issuance total to $10.1 billion - only the third time since last November the market has eclipsed the $10 billion barrier.

August 27