-

The post-crisis operational improvements at both Fannie Mae and Freddie Mac have resulted in stronger mortgage loan performance, a Fitch Ratings report said.

July 3 -

Mortgages using alternative documentation like bank statements for underwriting performed stronger than expected, but uncertainty remains about their default rates in stressed environments, Fitch Ratings said.

July 2 -

Revisions to S&P's CLO ratings methadology and Kroll's launch into rating European CLOs could challenge Moody's as the first choice for managers across the pond.

June 25 -

The two agencies offer fundamentally different views of the level of risk in ABS issuances by Avant, Prosper Marketplace, LendingClub and other online lenders.

May 27 -

Delinquencies associated with the government-sponsored enterprises high loan-to-value ratio programs that target low-to-moderate income homebuyers are slightly better than expected, at least early on, according to Fitch.

May 23 -

Private-label mortgage securitizations with variable servicing fee arrangements could become more common going forward as issuers look to increase investor cash flow while reducing the loan servicer's economic exposure, Fitch said.

May 6 -

Commercial mortgages placed into special servicing grew last year, but default and foreclosure dollar volume fell as legacy loan resolutions outpaced newly distressed loans, according to Fitch Ratings.

April 29 -

The rating agency has developed rating criteria for bonds backed by oil and gas royalties, though such deals would be capped at the 'A' rating category.

February 14 -

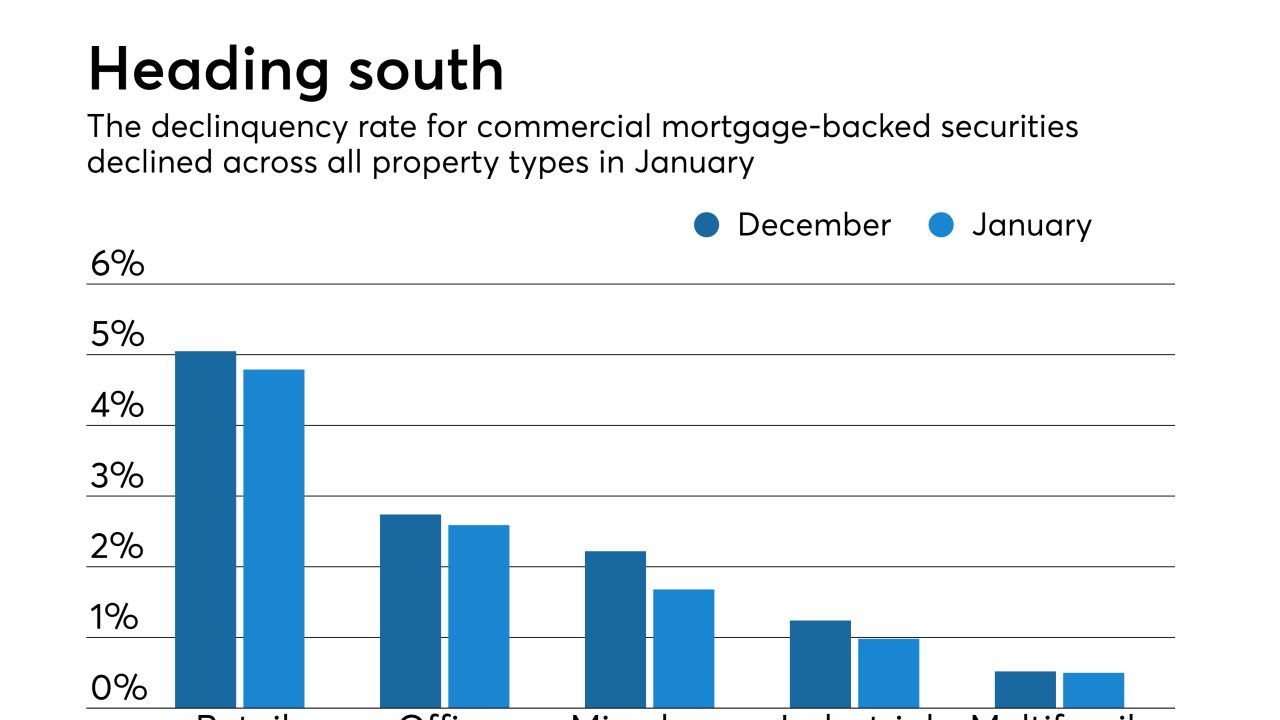

Late payments on loans backing commercial mortgage bonds continued falling at the start of the year, due to strong new issuance volume and continued resolutions for precrisis loans by special servicers, according to Fitch Ratings.

February 11 -

Loans in commercial mortgage-backed securities originated after 2009 by nonbank lenders have a significantly higher default rate than those originated by banks, a Fitch Ratings report said.

January 14 -

Rating agencies are sparring over a new feature in a private-label RMBS that upends the relationship between senior and sub bondholders.

October 19 -

The rating agency feels that “late-cycle credit behavior” is allowing less established issuers to rely on the securitization market more heavily for funding.

October 15 -

Wells Fargo’s first private-label mortgage securitization since the financial crisis doesn’t break any new ground — and that’s probably the point.

October 10 -

Commercial mortgage-backed securities delinquency rates are likely to continue to decrease for the rest of the year, as new issuances outpace maturing loans and precrisis loans continued to get resolved by special servicers, Fitch Ratings said.

September 17 -

The deal, which Fitch did not name in its report, appears to be VCO CLO 2018-1. The agency said the transaction might not even merit a single-A rating, given the high single-sector concentration.

September 12 -

Intensifying margin pressure could spur another wave of cost-cutting at nonbank mortgage lenders, unless other strategies, like consolidation or a mortgage servicing book that could increase in value, offset it.

August 23 -

Nonbank mortgage-backed securities servicers increase their exposure to agency loans as the housing market distances itself from last decade's crash, according to Fitch Ratings.

July 24 -

Frameworks have largely improved since the financial crisis, but there remains a lack of consistency and some recurring weaknesses that are keeping some traditional U.S. RMBS investors on the sidelines.

July 11 Fitch Ratings

Fitch Ratings -

The ratings agency cautions that marketplace lenders' efforts to tighten credit standards during a "solid" macroeconomic environment underscore the volatility their portfolios might face in a downturn.

May 30 -

The future secondary mortgage market entities will receive high investment grade ratings, even as there is no clarity on their scope or form, Fitch Ratings said.

April 10