Wells Fargo’s next commercial mortgage securitization features heavy exposure to New York City, namely the iconic General Motors Building in Midtown Manhattan as well as a several co-op apartment buildings.

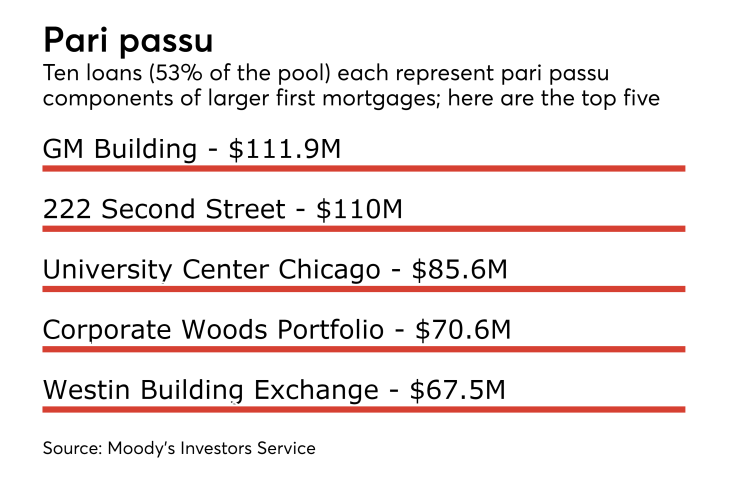

The GM building accounts for 9.2% of the collateral for the $1.2 billion deal, dubbed BANK 2017-BNK7, according to rating agency presale reports.

There are seven other CMBS issued this year with exposure to the skyscraper at 767 Fifth Avenue. In June, the owners took out a $1.47 billion whole loan that was used to refinance existing debt and pay a dividend; the largest portion was securitized in a single-asset transaction.

There are a total of 65 loans secured by 83 properties. The 10 largest loans account for 57.9% of the portfolio.

The GM Building is one of four loans in the collateral pool that have credit characteristics consistent with investment grade debt. The others are the Westin Building Exchange (5.6% of the pool), a data center and office space in Seattle; The Churchill (4% of the pool) and Moffett Place B4 (2.6% of the pool), two cooperative apartment buildings.

There are also a number of other, smaller cooperative loans with investment-grade characteristics.

Together, these loans help lower the pool’s overall leverage; the debt service coverage ratio, as calculated by Fitch, is 1.53x and the loan-to-value ratio is 90.9%. By comparison, the year-to-date average for Fitch-rated conduits are 1.25x and 101.4%, respectively.

Excluding investment-grade credit opinion loans and the multifamily cooperative loans, the pool has a Fitch DSCR and LTV of 1.22x and 106.7%, respectively, in line with the YTD 2017 normalized averages of 1.20x and 106.7%, respectively.

DBRS puts the DSCR at 2.14X, including the “shadow rated” loans, and 1.69X excluding those loans.

Both Fitch and DBRS expect to assign triple-A ratings to the super senior classes of notes to be issued in the deal, which benefit from 30% credit enhancement, as well as to the senior tranche, which benefits from 17.5% credit enhancement. Moody's also rates the super senior tranches Aaa, put has the senior tranche one notch lower, at Aa2.

Wells Fargo Bank, National Association is expected to act as the “retaining sponsor” for this securitization and is expected to purchase and retain on an ongoing basis an “eligible vertical interest.”