Provident Funding, a large-scale servicer of agency-eligible mortgages, is sponsoring its first-ever transaction of its own prime-jumbo loan originations.

Provident 2019-1 is the inaugural $337.6 million deal for the company, and includes 947 fixed-rate mortgage loans that meet qualified-mortgage safe harbor loan standards.

The average loan size is $356,491, less than half from similar fixed-rate prime jumbo offerings from sponsors such as JPMorgan Chase and Goldman Sachs. However, Providence’s loans are agency-eligible loans that meet GSE criteria due to the proximity of the properties in high-cost areas with higher GSE eligibility caps such as in Los Angeles, San Francisco and New York. The loan size compares to the average GSE loan size of $230,000 nationwide.

Moody’s Investors Service noted in a presale report the borrowers in the pool “have strong credit profiles demonstrated by strong credit scores, high percentage of equity and significant liquid reserves.”

The notes being offered include several classes of senior, super senior and senior support notes, all with preliminary Aaa ratings from Moody’s. Moody’s also issued ratings six classes of subordinate notes with ratings ranging from Aa3 to Ba3.

The weighted-average mortgage rate is 3.6% on 30-year loans that have recently been originated since August (the pool’s weighted average seasoning is 1.1 months. The WA credit score is 776 and the average loan-to-value ratio is 66.6%.

Moody’s stated approximately 61.1% of the loans (by loan balance) were originated through the broker channel, while 29.1% and 9.8% were originated through retail and correspondent channels, respectively.

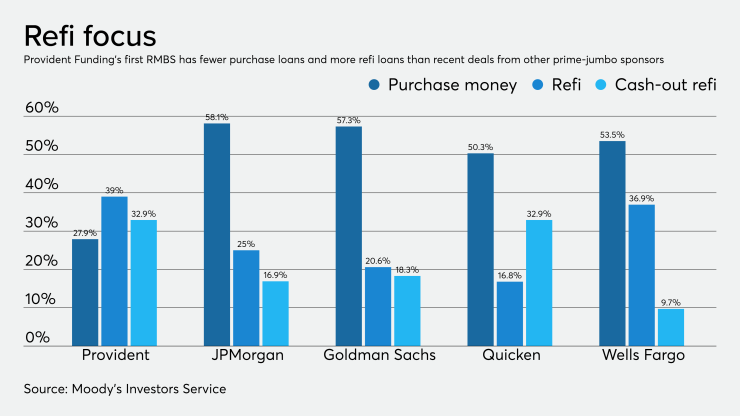

In addition, the loan pool has a lower share of purchase loans (28% by loan balance) compared to recent JPMorgan prime jumbo deals, “which typically contained about 50% to 70% of such loans,” Moody’s presale report stated. About 72% of the pool was made up of refinance loans, including debt consolidation, “with about 34% of the pool as cash-out refinance loans.”

Provident Funding, which services loans for Freddie Mac, Fannie Mae and Ginnie Mae, will act as the initial servicer of the mortgage loans.