New rules from Mexico’s banking regulator are an auspicious move for future securitizations from this sector, according to Maria Muller, senior vice president at Moody’s Investors Service.

The regulations are expected to improve data gathering by altering how banks calculate their reserves for mortgage and non-revolving loans. “Obviously data is extremely important in securitization,” Muller said. “To the extent that these rules are going to result in more data gathering in terms of mortgages and other types of loans — it’s a positive for future securitization.”

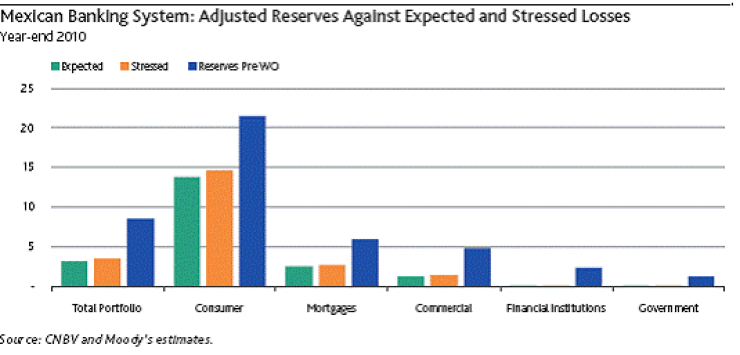

In a report last week, Moody’s said the rules will “allow the banks to rationalize provisioning and ultimately reduce credit costs by acknowledging differences among consumer types.” The graph below compares the adjusted reserves pre-wrote offs against expected and stressed losses.

The greater differentiation has a geographic accent as well. The CNBV — the Spanish acronym for Mexico’s banking regulator — also announced that it would differentiate loss-given defaults for mortgages between Mexican states using Moody’s Contract Enforceability Indicator (EC), which covers the enforceability of legal contracts on a local level. The report also said the regulator acknowledged some best practices among banks, such as arrangements between lenders and borrowers that speed up repossessions by allowing the parties to work around court proceedings that tend to be protracted.

Muller said that the regulator’s acknowledgement may boost the use of these arrangements — including the employment of a trust structure between lender and borrower that greatly facilitates foreclosures — in some types of loans.