-

Declines in mortgage servicing rights valuations at JPMorgan Chase and Wells Fargo point to the resurgence of a dilemma that came up during the last downturn.

April 15 -

Lenders that split their sales of loans and servicing between two different investors may be facing yet another challenge due to the coronavirus outbreak.

April 13 -

Mark Calabria needs to be working to secure a Fed facility for servicer advances and to support, not denigrate, smaller servicers, the Mortgage Bankers Association said.

April 8 -

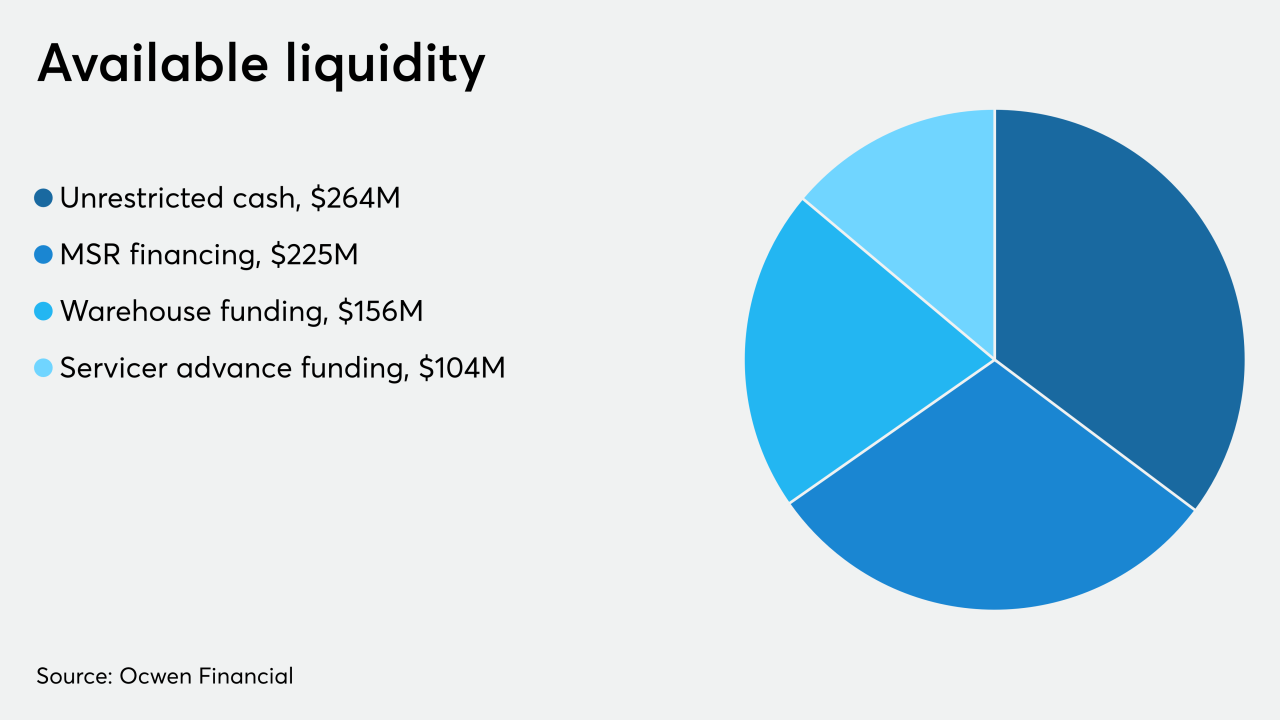

Ocwen Financial has approximately $749 million of liquidity from various sources to deal with servicing issues arising from the coronavirus, a company press release said.

April 3 -

Mortgage servicers need direction from federal agencies on how to implement the forbearance plans called for in the CARES Act, according to the Community Home Lenders Association.

March 31 -

Two Harbors, a real estate investment trust, sold the bulk of its nonagency mortgage-backed securities portfolio to head off margin calls and refocus on its more favorable agency-MBS investments.

March 26 -

Mortgage companies that borrow heavily to keep their operations running may face financial pressure from coronavirus-related market volatility as it affects the valuations of collateral securing their financing.

March 9 -

Mortgage lenders could benefit from the surge in refinancing due to widening market spreads, and that could help offset damage to servicing rights portfolio valuations, according to Keefe, Bruyette & Woods.

March 9 -

The cancellation by New Residential of a money-losing subservicing agreement should benefit Ocwen's financial results going forward, the company said.

February 26 -

The Federal Housing Finance Agency plans to increase liquidity standards for nonbank conforming loan servicers, and at the same time raise the net worth requirements for those that also perform the function for Ginnie Mae.

February 5 -

A trade group is looking into why New York Gov. Andrew Cuomo felt foreclosure risks were too high to sign a bill that would have approved reverse mortgages for cooperative properties.

December 26 -

A federal judge in Florida dismissed the Consumer Financial Protection Bureau's lawsuit against Ocwen Financial Services, stating the agency improperly asserted an excessive number of claims without specifying the particular count to which they applied.

September 6 -

Mr. Cooper Group reported a second-quarter net loss of $87 million as the company took a $231 million fair value hit to its mortgage servicing rights portfolio.

August 1 -

New Residential Investment Corp. took a $32 million net loss in the second quarter as it diversified its business lines and repositioned to protect its mortgage servicing rights from falling rates.

July 30 -

Will the runoff of MSRs leave a hole in the capital of the mortgage finance industry?

June 25 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

The mortgage agency has hired Eric Blankenstein, who sparked controversy while at the consumer bureau over past revelations of racially charged writings.

June 19 -

Prepayment speeds for loans included in agency mortgage-backed securities were up approximately 20% both monthly and annually during May as the decline in interest rates boosted activity, according to Keefe, Bruyette & Woods.

June 11 -

Private-label mortgage securitizations with variable servicing fee arrangements could become more common going forward as issuers look to increase investor cash flow while reducing the loan servicer's economic exposure, Fitch said.

May 6 -

Freddie Mac's latest nonperforming mortgage auction will include one pool targeted to smaller investors like nonprofit organizations.

April 12 -

Caliber Home Loans settled a grievance with the Massachusetts attorney general over allegations of providing distressed borrowers with unaffordable loan modifications.

April 11