-

CLO managers are wording the language of amendments used to refinance deals so as to be able to benefit if risk retention rules repealed.

April 11 -

The LSTA is lobbying the Trump administration to eliminate or modify risk-retention rules on CLOs, preferably through the quickest route possible: the SEC's rule enforcement authority.

April 12 -

Risk retention rules created some big hurdles to creating new collateralized loan obligations. Yet they also opened up new avenues for investing in the market, as many managers serving as fee-for-service agents were compelled to raise the capital necessary to keep skin in the game.

May 4 -

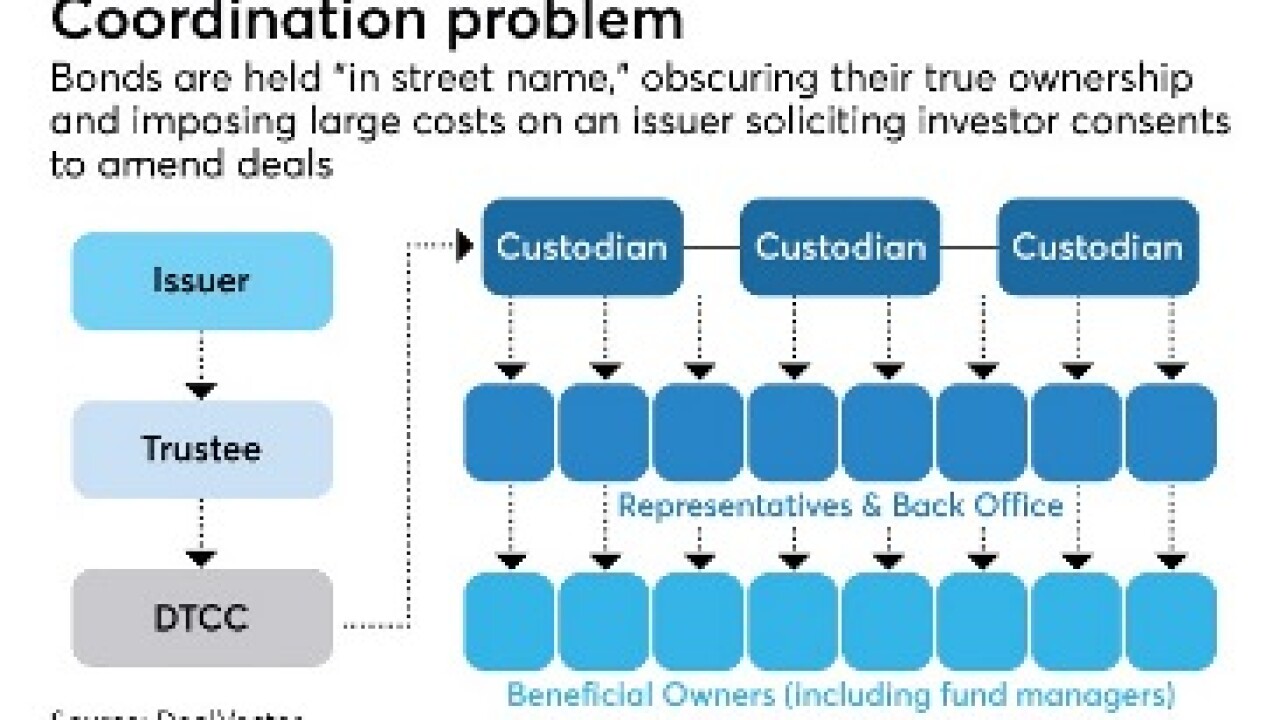

Navient and Nelnet, the two largest student loan servicers, avoided downgrades on some $18 billion of bonds by extending their maturities. Getting the required consents from investors would normally take ages, but recent innovations speeded the process.

May 3 -

Supreme Court Justices appeared exasperated with both sides in a case that would define whether companies that buy distressed debt are covered under a federal statute setting limits on their activities.

April 18