-

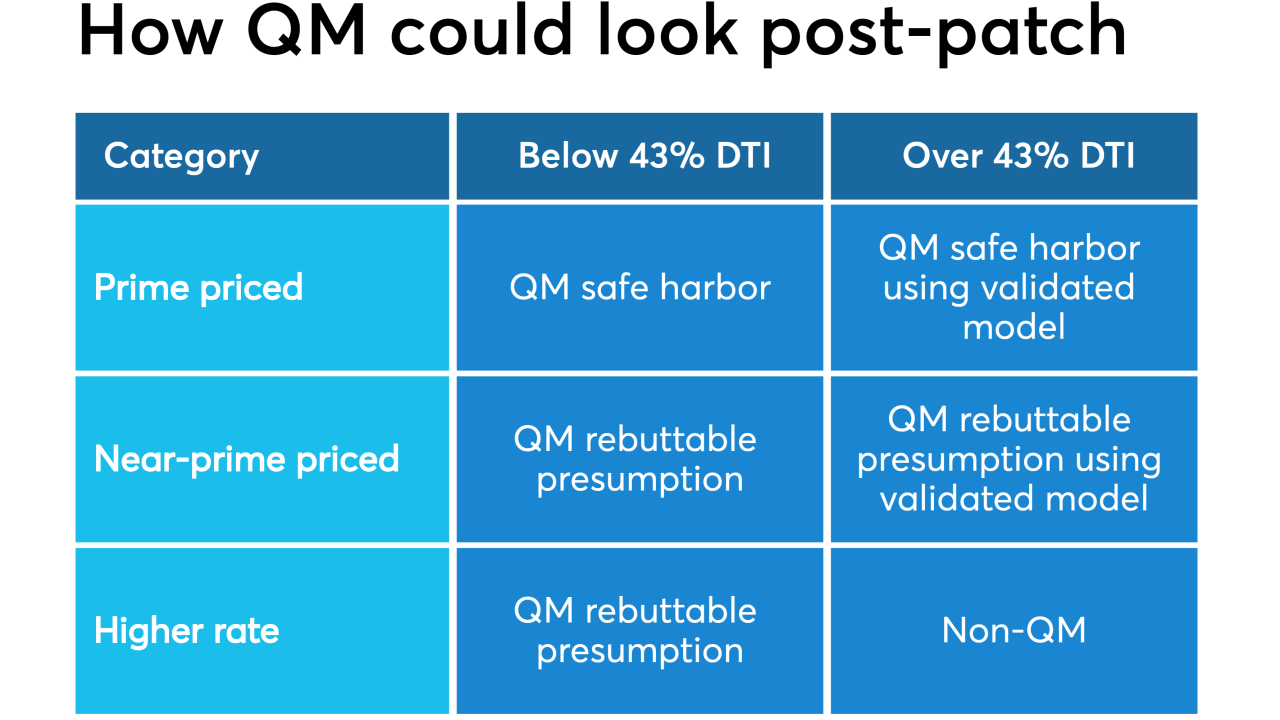

After the government-sponsored enterprise patch expires, "near prime" loans over the 43% debt-to-income ratio should be qualified mortgages if they have compensating factors, according to the Center for Responsible Lending.

July 9 -

While mortgage rate optimism kept consumer confidence about the home purchase market high in June, affordability worries pulled overall sentiment lower, a Fannie Mae survey said.

July 8 -

The post-crisis operational improvements at both Fannie Mae and Freddie Mac have resulted in stronger mortgage loan performance, a Fitch Ratings report said.

July 3 -

Former Freddie Mac CEO Donald Layton has joined the Harvard Joint Center for Housing Studies as a senior industry fellow focused on reform of the government-sponsored enterprises.

July 1 -

Despite rising delinquency levels, borrower performance on the underlying mortgages in GSE credit-risk transfer securitizations is strong enough to warrant ratings upgrades to more than half of nearly 1,200 outstanding note classes.

June 28 -

There is bipartisan agreement in the Senate that Fannie Mae and Freddie Mac are "too big to fail," but some lawmakers are skeptical that a SIFI designation is appropriate.

June 25 -

Although the performance of the government-sponsored enterprises' single-family loans continues to improve, the deeply delinquent totals remain significant in states with court-processed foreclosures.

June 21 -

The unrated notes being issued by the FREMF 2019-KG01 Mortgage Trust are backed entirely by workforce housing loans for green-friendly upgrades of older apartment buildings that fulfill affordable housing needs in communities.

June 21 -

As officials prepare plans for the government-sponsored enterprises' exit from conservatorship, there's no shortage of speculation about what those plans might look like and how they might affect the mortgage industry.

June 19 -

There are clear actions that regulators at the CFPB, SEC and FHFA can take to help attract investors into the housing market, argues former FHFA Director Ed DeMarco.

June 14

-

Director Mark Calabria urged lawmakers to grant the agency chartering authority similar to that of bank regulators to boost competition in the mortgage market.

June 12 -

Prepayment speeds for loans included in agency mortgage-backed securities were up approximately 20% both monthly and annually during May as the decline in interest rates boosted activity, according to Keefe, Bruyette & Woods.

June 11 -

The Federal Housing Finance Agency has far more authority to upend the status quo than most realize, according to a new report.

June 7 -

The consolidation of the two companies' securitization platforms into a single bond market became official on Monday.

June 3 -

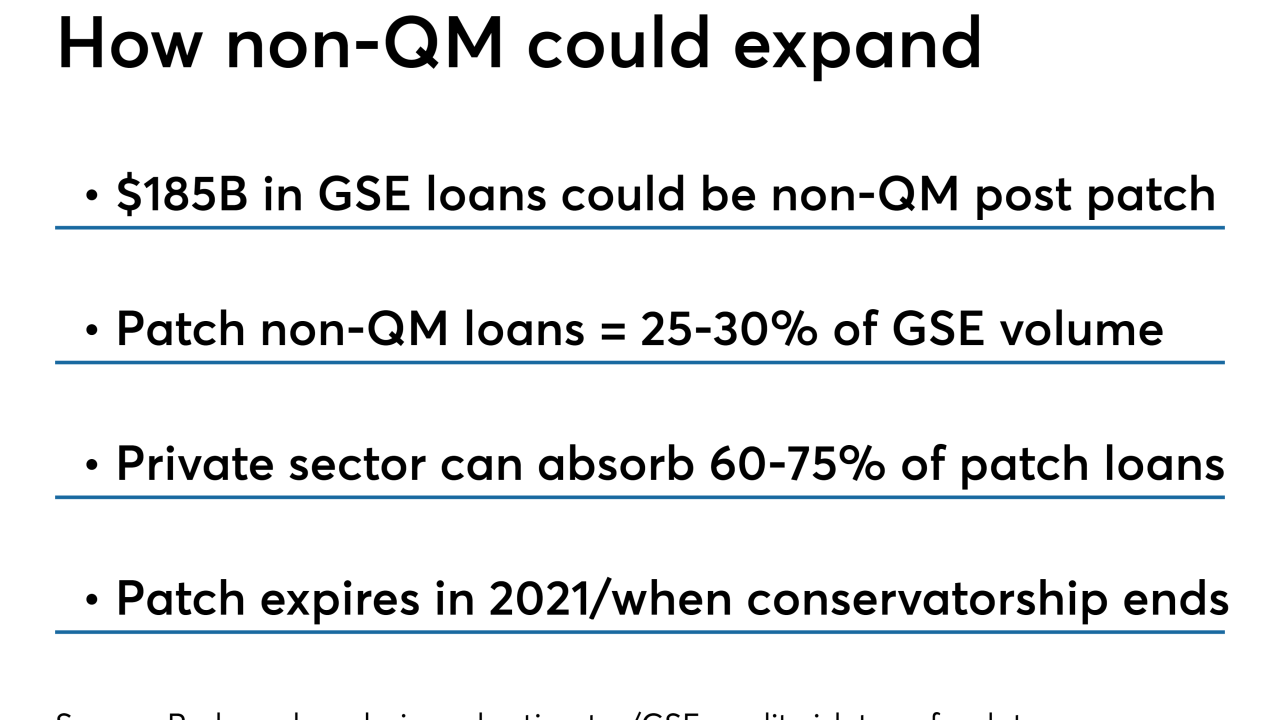

The nonconforming market is ready to absorb most of the government-sponsored enterprise loans covered by the QM patch, but not all of them, according Redwood Trust.

May 31 -

The launch of a combined securitization platform for Fannie Mae and Freddie Mac is meant to ease the transition to a new housing finance system. But questions remain about how the mortgage sphere will adapt to the single security.

May 31 -

Delinquencies associated with the government-sponsored enterprises high loan-to-value ratio programs that target low-to-moderate income homebuyers are slightly better than expected, at least early on, according to Fitch.

May 23 -

Government-sponsored enterprise executives say they want to continue to offer credit risk transfers and guarantee-fee parity after the GSEs are released from conservatorship, but they might not be able to.

May 22 -

With prospects for government-sponsored enterprise reform improving, players in the private residential mortgage-backed securities market are starting to think about how they could better compete against the GSEs while awaiting change.

May 20 -

His administration is looking at different alternatives to reform the housing finance system.

May 17