-

The Supreme Court dealt hedge funds and other big investors a blow Tuesday by refusing to revive core parts of lawsuits that challenged the federal government’s capture of billions of dollars in profits generated by Fannie Mae and Freddie Mac.

February 20 -

Despite a legislative push by some senators and other stakeholders to jump-start housing finance reform, efforts to form consensus over a bill once again are stuck in neutral.

February 15 -

The Federal Housing Finance Agency said Friday it will give commenters more time to weigh in on a potential update to the credit scoring requirements for Fannie Mae and Freddie Mac.

February 2 -

Housing finance reformers are pushing full steam ahead to get a bill introduced before the political calendar makes passage nearly impossible.

February 2 -

Fannie Mae's multifamily volume hit another record high of $67 billion in 2017 as former top producer Wells Fargo nearly halved its volume and nonbank competitors increased their market share.

January 26 -

Here's a look at what happens at five federal agencies that support the mortgage industry during a government shutdown.

January 19 -

Senate negotiators are working on a bill that would place Fannie Mae and Freddie Mac into receivership and replace them with multiple mortgage guarantors, according to sources.

January 18 -

MountainView is brokering a nonrecourse $3.5 billion package of Fannie Mae and Freddie Mac mortgage servicing rights on behalf of an unnamed seller.

January 5 -

A group of reinsurers has committed to provide up to $650 million of coverage for credit risk on some $21 billion of 30-year, fixed-rate loans that the government-sponsored agency will acquire over the next two years.

January 4 -

The GSEs are on their way to paying back the money they owed the government under the original bailout deal made at the height of the financial crisis, making 2018 an opportune time for an overhaul of the housing finance market.

December 29

-

Fannie Mae and Freddie Mac will be allowed to build capital buffers to protect against losses under an agreement between the Treasury Department and the Federal Housing Finance Agency announced on Thursday.

December 21 -

The two government-sponsored enterprises have relied on the “classic” FICO credit scoring model for the past 12 years. But the Federal Housing Finance Agency is weighing whether the GSEs should upgrade to more recent scoring alternatives.

December 20 -

Freddie Mac is broadening its capital markets vehicles with its first offering of participation certificate securities backed by multifamily tax exempt loans.

December 13 -

Just over half of the collateral for the $883 million deal is eligible to be purchased by Fannie or Freddie; the bank itself contributed nearly half.

December 12 -

The $1.5 billion FREMF 2017-K1 has a in-trust stressed loan-to-value ratio of 120%, as measured by Kroll; that's projected to fall to 108.7% when the deal matures.

December 12 -

Until recently, there was a consensus among policymakers that Fannie Mae and Freddie Mac needed to be eliminated. That just changed. Here's why.

December 8 -

House Financial Services Committee Jeb Hensarling shifted tactics on housing finance reform Wednesday, acknowledging that a bill he’s pushed for years to virtually eliminate the government’s role in the mortgage market lacks the support to become law.

December 6 -

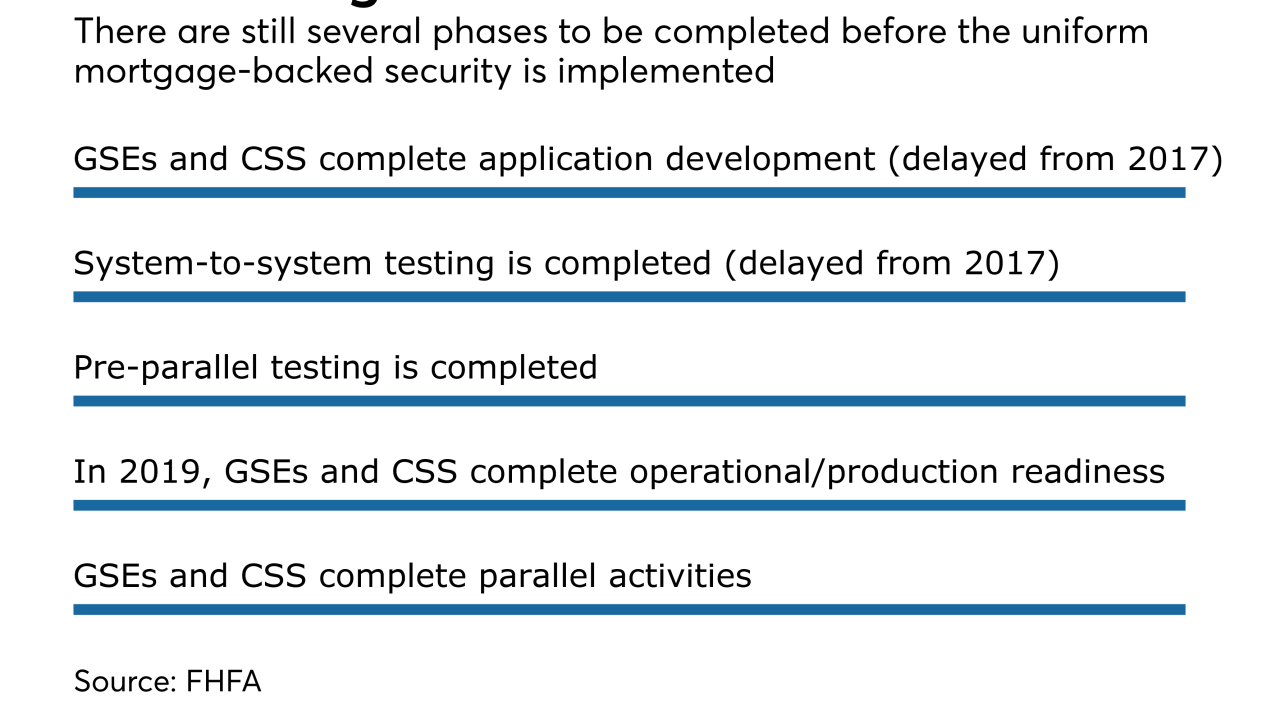

Testing of the common securitization platform is taking longer than expected, but the Federal Housing Finance Agency said it won't delay the 2019 launch of Fannie Mae and Freddie Mac's new single "uniform mortgage-backed security."

December 4 -

A provision in the original Senate tax reform bill would have required companies acquiring mortgage servicing rights to pay taxes upfront for their anticipated servicing income.

December 1 -

The financial services industry has cheered a proposed reduction in the corporate tax rate, but a lower rate could force Fannie Mae and Freddie Mac to write down assets, increasing the odds that the companies will need Treasury support.

November 29