-

Treasury Secretary Steven Mnuchin was adamant that the Trump administration won’t just let Fannie and Freddie build up their capital buffers and then release the companies. He also said he backed an explicit government guarantee, something only Congress can do.

June 10 -

The Federal Housing Finance Agency has far more authority to upend the status quo than most realize, according to a new report.

June 7 -

Consumers' knowledge of the mortgage process and what it takes to purchase a home has not improved from four years ago and lenders have an opportunity to fill that need, Fannie Mae said.

June 5 -

The consolidation of the two companies' securitization platforms into a single bond market became official on Monday.

June 3 -

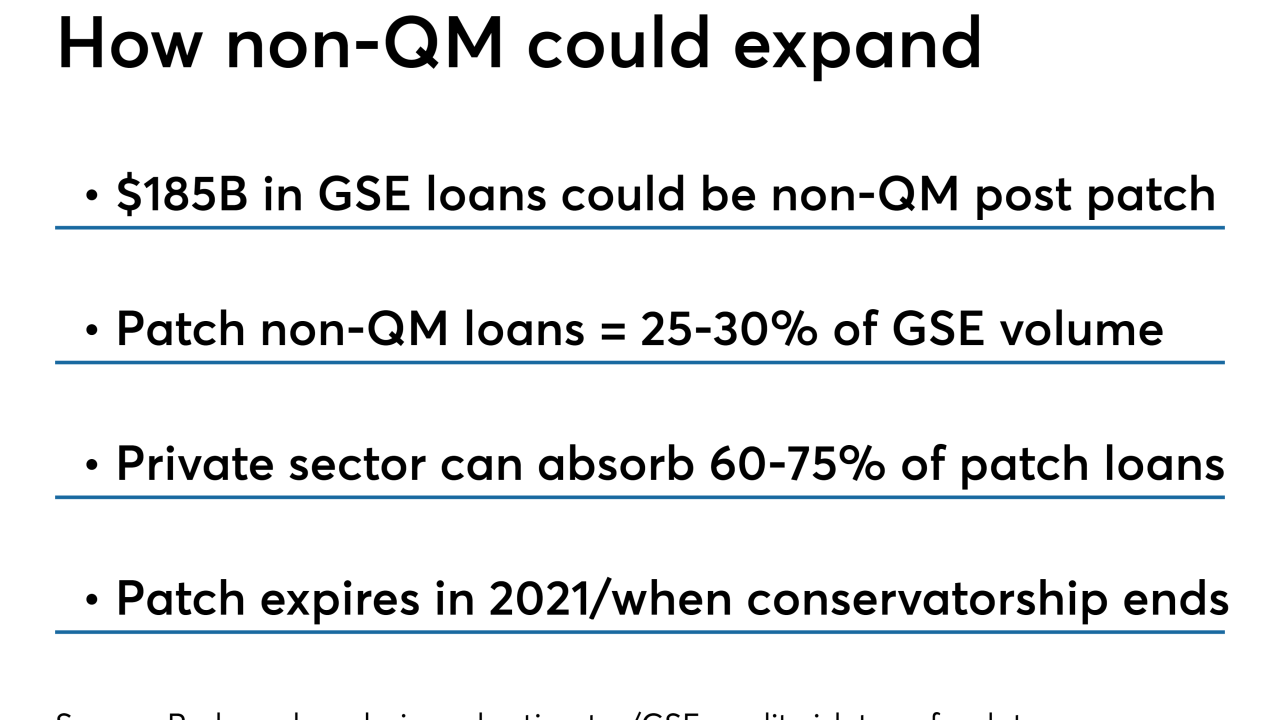

The nonconforming market is ready to absorb most of the government-sponsored enterprise loans covered by the QM patch, but not all of them, according Redwood Trust.

May 31 -

The launch of a combined securitization platform for Fannie Mae and Freddie Mac is meant to ease the transition to a new housing finance system. But questions remain about how the mortgage sphere will adapt to the single security.

May 31 -

Delinquencies associated with the government-sponsored enterprises high loan-to-value ratio programs that target low-to-moderate income homebuyers are slightly better than expected, at least early on, according to Fitch.

May 23 -

Government-sponsored enterprise executives say they want to continue to offer credit risk transfers and guarantee-fee parity after the GSEs are released from conservatorship, but they might not be able to.

May 22 -

Mark Calabria said he wants Fannie Mae and Freddie Mac to take preliminary steps by Jan. 1 toward exiting conservatorship.

May 20 -

His administration is looking at different alternatives to reform the housing finance system.

May 17