-

Online lender Social Finance is planning a second consumer-loan securitization in just over a month with a $480 million notes offering backed by $575 million in prime, high-earner unsecured personal loans.

July 25 -

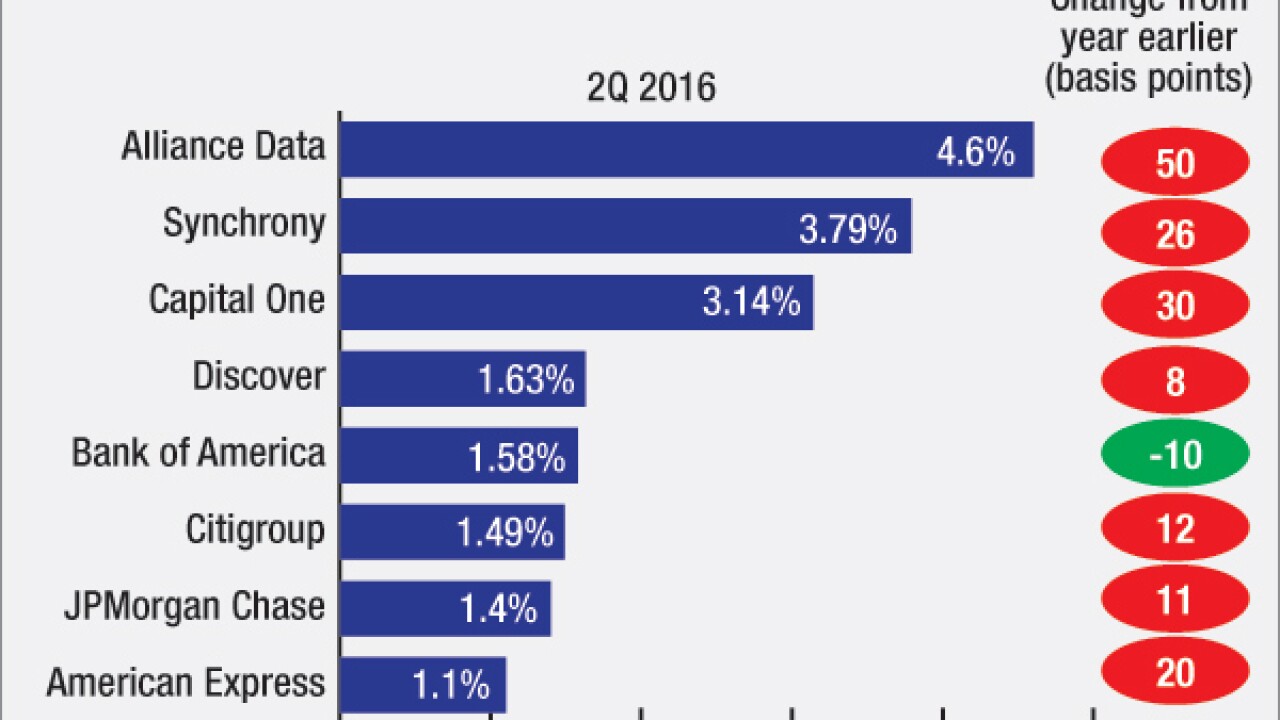

The unusually strong loan performance in the credit card business lasted longer than many observers expected. But today the industry's prolonged post-crisis era finally appears to be over.

July 24 -

One of the nation's biggest banks and the so-called "everything store" have joined forces to extend loan discounts to students.

July 21 -

American Credit Acceptance is preparing $230 million of bonds backed by subprime auto loans, its third term securitization of the year.

July 21 -

Navient is contemplating another securitization of federally guaranteed student loans to borrowers who were once in arrears but are now making timely payments.

July 20 -

The consumer-finance startup CommonBond is doubling down on the education-debt market, which has been a pocket of tranquility in an otherwise volatile online lending sector.

July 19 -

Comenity Bank is marketing $333.3 million of bonds backed by credit card receivables from its World Financial Network Credit Card Master Note Trust, according to Fitch Ratings.

July 18 -

The Consumer Financial Protection Bureau is expected to unveil a proposal on July 28 that would regulate debt collection practices.

July 15 -

Consumer Portfolio Services is planning a third securitization of its subprime auto loan portfolio in 2016, amidst slightly improved underwriting conditions but growing levels of delinquencies on receivables.

July 15 - Europe

Fitch Ratings and Moodys Investors Service have assigned preliminary ratings to a 700 million, 18-month revolving securitization of unsecured consumer auto loans issued and serviced by Banco Bilbao Vizcaya Argentaria, S.A.

July 13