-

A week after the Office of the Comptroller of the Currency created a new federal charter for fintech firms, California's financial regulator is calling on other states to work together in making their licensing system more palatable to companies.

December 11 -

OnDeck Capital, the New York-based online small-business lender, has obtained a $200 million revolving debt facility from Credit Suisse.

December 11 -

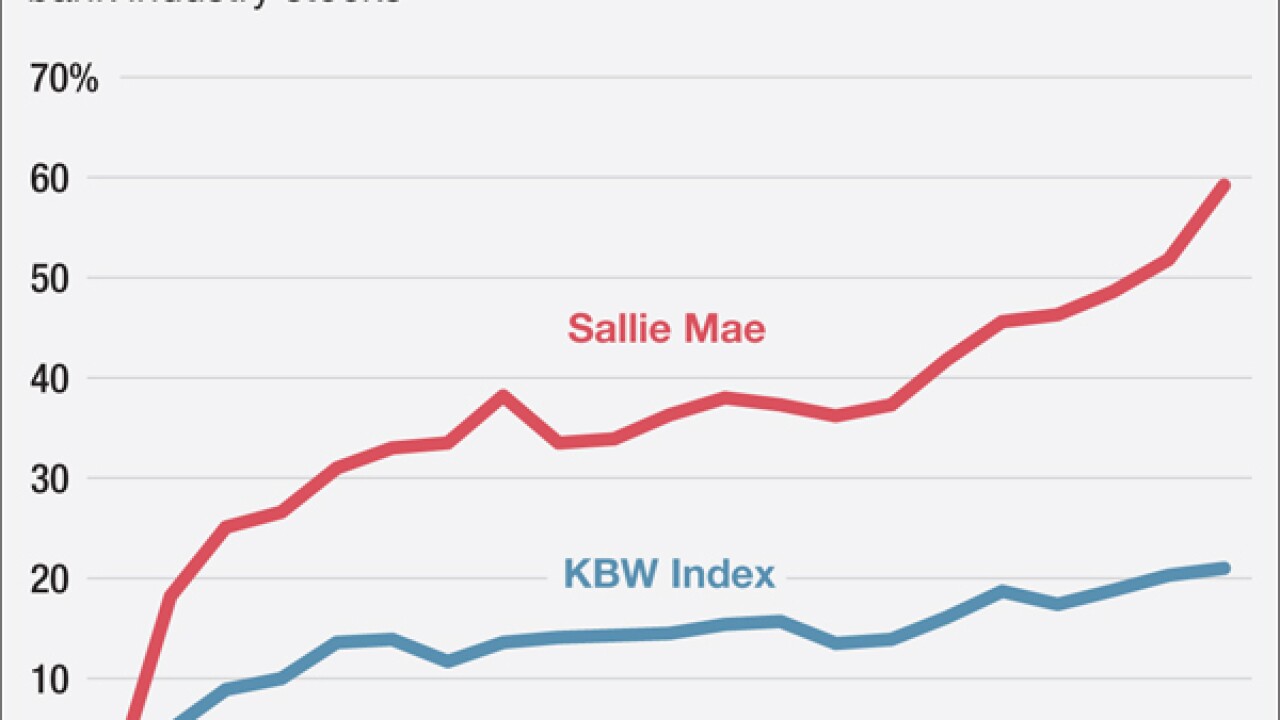

No corner of the banking industry has gotten a bigger near-term boost from Donald Trump's election than private student lenders. And that's saying something.

December 7 -

TCF National Bank's latest prime auto loan receivables securitization is its largest to date, at $505.1 mililio

December 6 -

The credit cycle is getting pretty long in the tooth, but CVC Credit Partners, a private equity firm based in Chicago, is hoping that theres still plenty of appetite for subprime auto loans.

December 6 -

Nearly seven months after the exit of former CEO Raymond LaPlanche, the first rated securitization of Lending Club loans has come to market.

December 5 -

The recent shake-up at CAN Capital could spark greater scrutiny of a sector that has drawn comparisons to the bubble-era subprime mortgage market.

December 1 -

Subprime lender OneMain Holdings is coming to the securitization market for the first time since its predecessor, Springleaf Finance, acquired the OneMain business from Citigroup in November 2015.

December 1 -

Renovate America continues to stretch its regional footprint through its fourth securitization this year of Property Assessed Clean Energy (PACE) bonds supporting green-energy home improvements.

November 30