-

JCPenney released a list of 138 stores that the retailer plans to shutter in an effort to reduce costs and drive sales growth based on its better-performing locations.

March 19 -

Capital Automotive is marketing another $900 million of bonds backed by leases on auto dealerships.

March 16 -

LSTAR Capital Finance is returning to the securitization market with another offerings of bonds backed by high quality, but highly leveraged commercial mortgage bonds.

March 16 -

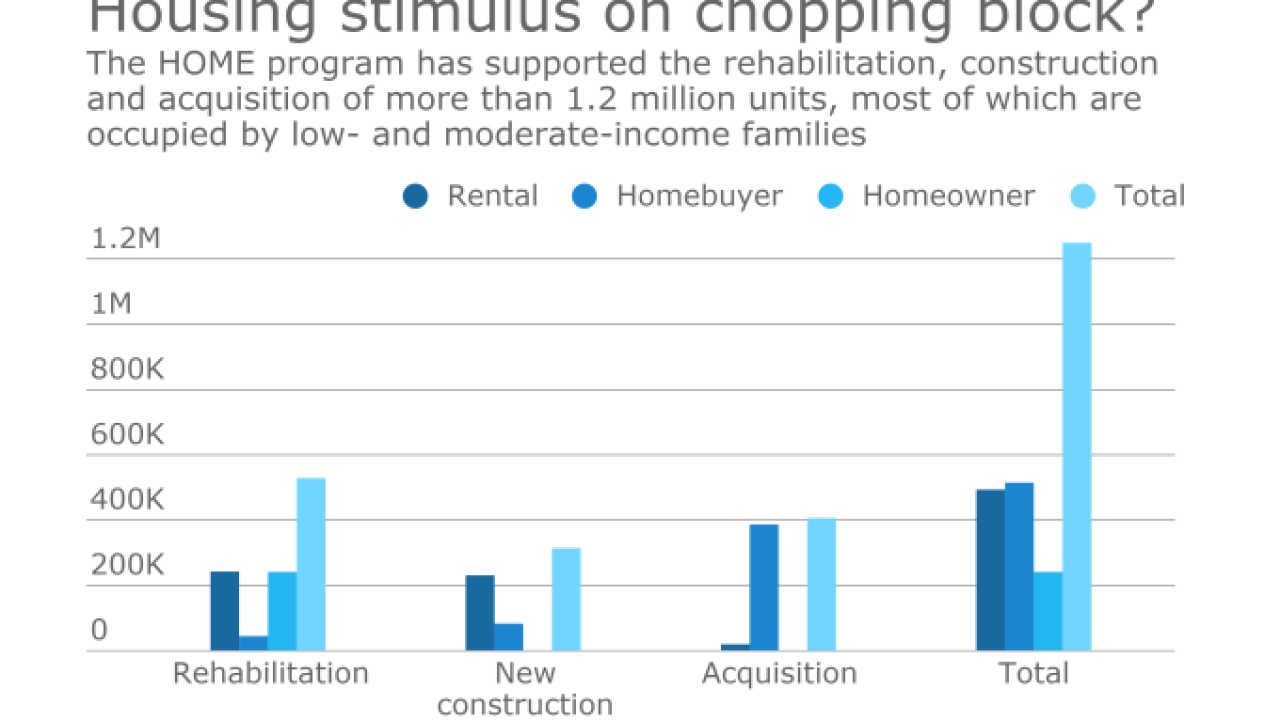

Bankers and housing advocates say many low-income housing projects simply won't get built if the White House and Congress move to eliminate two federal block grant programs

March 16 -

Wells Fargos next offering of commercial mortgage bonds is unusually concentrated in a relatively small number of large loans, though many are high quality properties located in strong markets.

March 15 -

JP Morgan and Deutsche Bank are relying on Massachusetts Mutual Life Insurance Co. to keep skin in their next commercial mortgage securitization

March 13 -

Goldman Sachs is selling $1.02 billion of bonds refinancing the Blackstone Groups acquisition of the Willis Tower, formerly known as the Sears Tower.

March 13 -

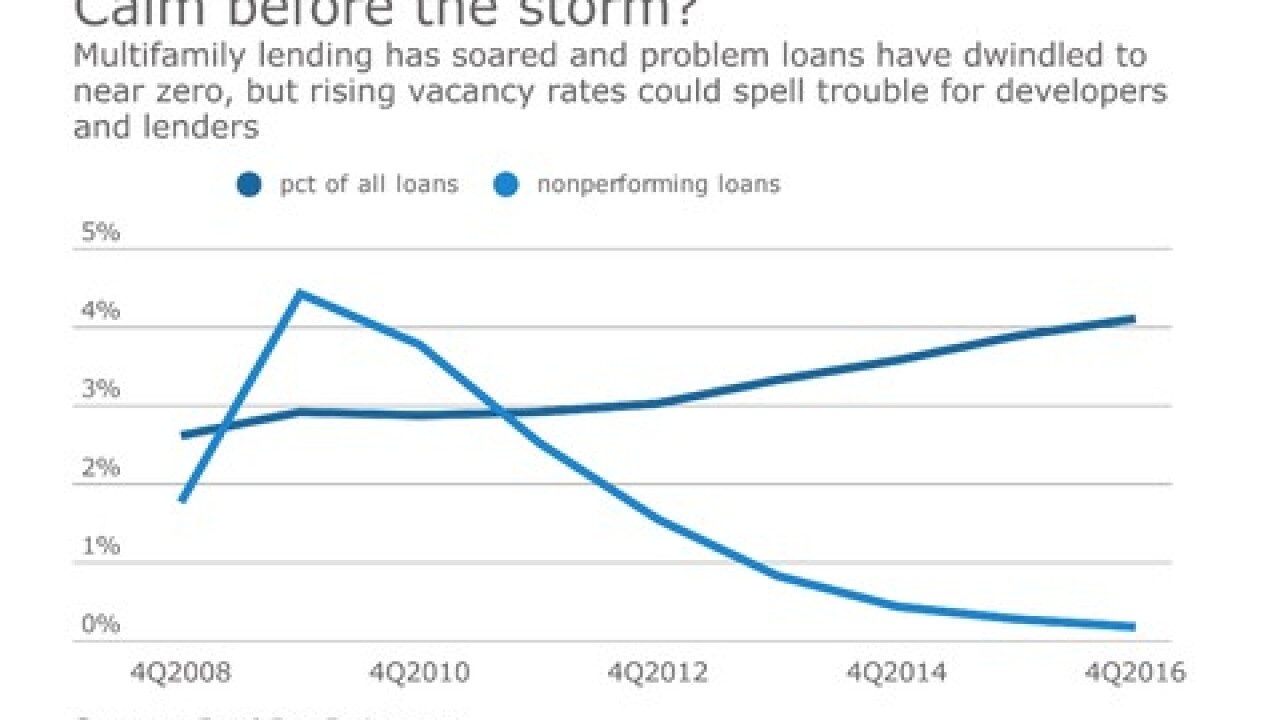

Multifamily is one of four lending subcategories that regulators consider when assessing a banks exposure to commercial real estate. Dozens of banks remain above regulators preferred capital ratio for measuring CRE risk.

March 6 -

Cohen Financial Services is readying a $567.4 million offering of bonds backed by mortgages on office, retail and apartment buildings in a state of transition.

March 5