CFPB News & Analysis

CFPB News & Analysis

-

Fannie Mae's current tack could help it weather some of the new challenges confronting the government-sponsored enterprises, including the planned expiration of its qualified mortgage rule exemption and rate-driven earnings volatility.

August 1 -

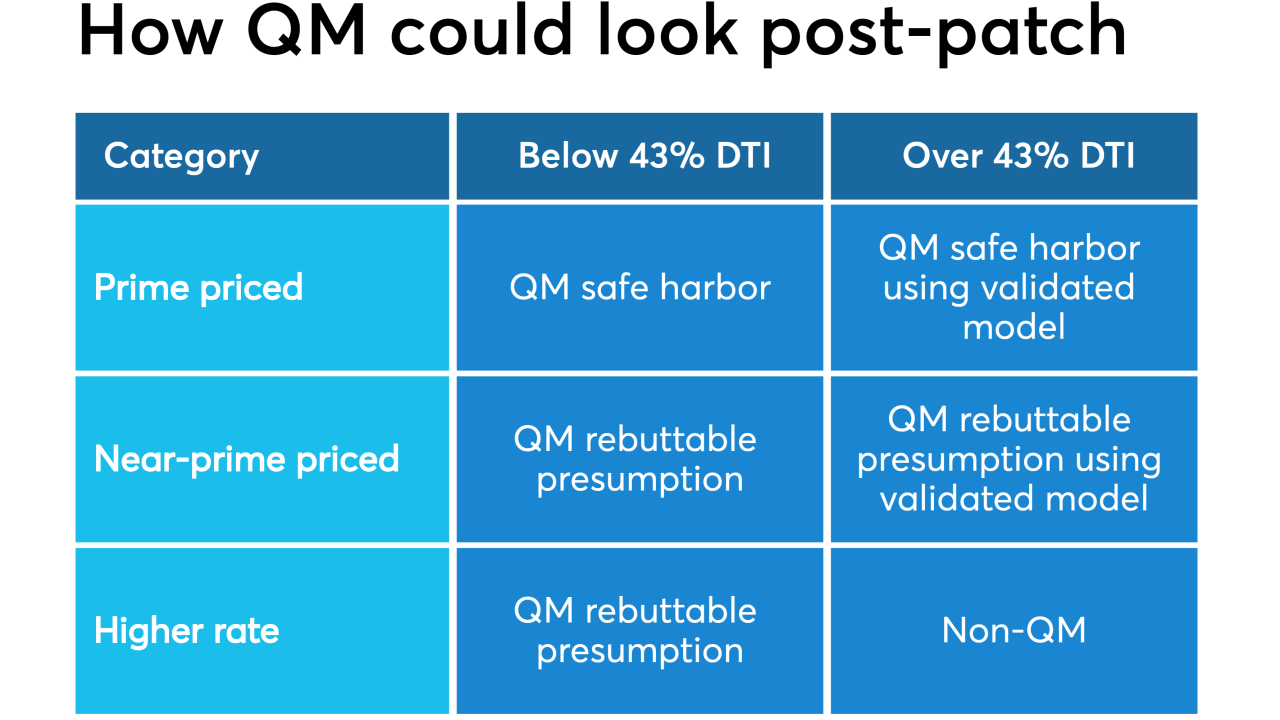

The mortgage industry was caught off guard by regulators’ decision to cease special treatment for Fannie Mae and Freddie Mac in complying with underwriting rules. But how big of an impact will the new policy have?

July 28 -

The agency’s director said it will let a temporary GSE exemption from the “qualified mortgage” regulation expire.

July 25 -

State and federal authorities say the network of firms in upstate New York sought debts that consumers weren't obligated to pay and impersonated government officials, among other things.

July 25 -

A bill by Rep. Patrick McHenry, R-N.C., would give the CFPB authority to oversee cybersecurity efforts at the credit bureaus.

July 19 -

The agency had decided not to challenge a recent court ruling that its structure violates the separation of powers, but newly confirmed Director Mark Calabria now appears willing to the fight the case.

July 9 -

After the government-sponsored enterprise patch expires, "near prime" loans over the 43% debt-to-income ratio should be qualified mortgages if they have compensating factors, according to the Center for Responsible Lending.

July 9 -

The CFPB did not file any fair-lending enforcement actions in the 2018 fiscal year and did not refer any Equal Credit Opportunity Act violations to the Department of Justice.

July 2 -

The CFPB is giving trade groups and consumer advocates another three months to comment on its proposal to change what data is collected under the Home Mortgage Disclosure Act.

June 27 -

Sen. Elizabeth Warren said Eric Blankenstein's past writings disqualify him from working at the Department of Housing and Urban Development.

June 24 -

The mortgage agency has hired Eric Blankenstein, who sparked controversy while at the consumer bureau over past revelations of racially charged writings.

June 19 -

The little-known unit was launched in the wake of efforts by the CFPB and HUD to cut back on fair-lending activities, but the reach of the 10-month-old office is still unclear.

June 18 -

In her first four and a half months, Kathy Kraninger met with lawmakers more than twice as often as her predecessor, but her schedule demonstrates willingness to meet with industry and policy stakeholders from various camps.

June 17 -

The agency announced the series in April as an effort to encourage public dialogue on policy issues.

June 11 -

The CFPB issued a final rule late Thursday to delay the compliance date for mandatory underwriting provisions of the 2017 payday lending rule.

June 7 -

The company intentionally submitted inaccurate borrower information overstating the number of white applicants, the consumer bureau alleges in a consent order.

June 5 -

The industry continues to push for an overhaul of the bureau’s leadership structure, but both parties seem uninterested.

May 30 -

The agency's spring rulemaking agenda includes the process for collecting small-business data as well as underwriting rules for GSE-backed loans. But what's missing from the list may be just as important.

May 28 -

Kathy Kraninger, the bureau's director, is in a standoff with Democrats about her claim that the agency cannot supervise institutions under the Military Lending Act.

May 27 -

All Democrats supported the bill focused on the decisions of former acting CFPB Director Mick Mulvaney, while all Republicans opposed it.

May 23