-

Onex reset a deal, agreeing to a higher coupon on the AAA-rated senior notes, in order to gain a five-year reinvestment period extension; it substantially narrowed spreads on subordinate notes.

February 15 -

Eliminating the requirement that CLO managers keep skin in the game of deals should boost issuance, but this could result in weaker credit quality of collateral as competition for loans increases.

February 13 -

There could be a pause in new issuance as CLO managers wait to see if the government will appeal; longer term, the pace will pick up as the playing field is leveled for smaller managers.

February 12 -

A three-judge panel for the D.C. Circuit Court of Appeals has sided with the LSTA in its lawsuit seeking to reverse rules requiring CLO managers to hold "skin in the game" under Dodd-Frank.

February 9 -

Players as small as Oxford Lane and as large as the Carlyle Group have money to put to work funding risk retention and investing opportunistically; trends could attract more first-time managers.

February 8 -

The deal is backed by an unusually concentrated portfolio of just 19 loans on properties being rehabbed or converted to a new use; by property type, the biggest exposure is to hospitality, at 19.7%.

February 8 -

Voya Alternative Asset Management is replacing and consolidating seven fixed- and floating-rate tranches with five new variable-rate classes that each gained lower rates than predecessor notes.

February 7 -

The Los Angeles-based distressed-debt specialist has $20.5 billion in dry powder, including over $8.8 billion in uncommitted capital stored in a dormant opportunities fund.

February 7 -

S&P Global Rating's London office made the rare move to downgrade the junior-most notes in a 2016 CLO issued by a Danish credit manager due to a deterioration in portfolio maintenance levels.

February 2 -

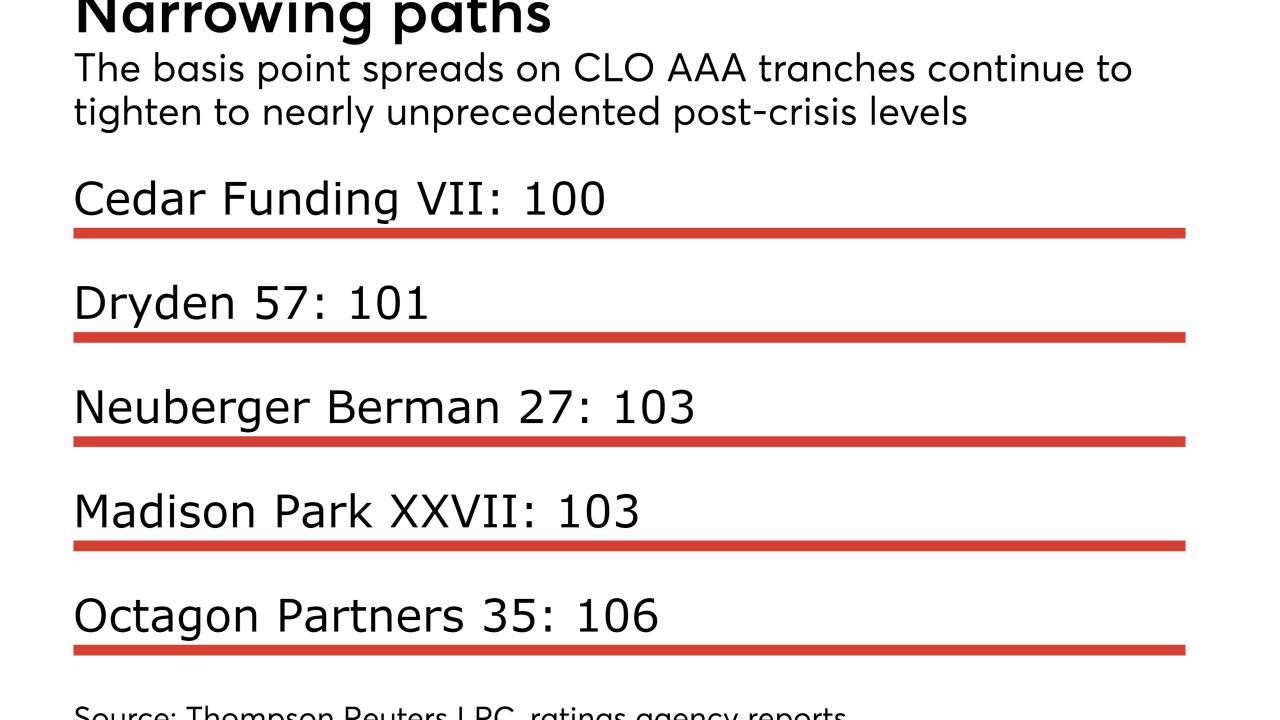

Aegon Asset Management's new Cedar Funding CLO VII is expected to price its senior triple-A notes at 100 basis points above Libor, carrying on a 2017 trend of tightening spreads.

January 31