-

U.S. CLO issuance gained traction in the second quarter, as the dollar volume of deals more than doubled after a sluggish start to the year. Nearly half the respondents in the survey now project CLO issuance to reach about $45 billion for the full year, well below forecasts made at the start of the year.

June 30 - Europe

An eventual "Brexit" from the European Union could exclude CLO managers and investors from the CLO market under existing and proposed EU rules that restrict risk-retention and market activity to EU regulated firms.

June 30 -

DFG Investment Advisors has raised a $100 million fund that it will use to satisfy impending regulations enacted as part of the Dodd-Frank Act requiring CLO managers to have skin in the game of their deals.

June 22 -

The economics of actively managing a pool of leveraged loans for the benefit of several different classes of investors is not good. So some CLO managers are putting their deals on autopilot.

June 20 - Europe

A spring survey of European asset-backed portfolio managers shows a vast majority expects to increase their securitization holdings in 2016. But many see a muted level of issuance in which to add securities, according to the DBRS polling.

June 16 - Europe

EU Parliament member Paul Tang shocked the regions securitization industry last week when he proposed increasing the amount of skin in the game for asset-backeds, by four-fold, to 20% from 5%. He's giving the keynote at IMN's Global ABS conference

June 15 -

The $2.8 billion in CLOs that have priced this month is not enough to reverse the sluggish 2016 CLO market, which is down over 50% in both deal count and dollar volume compared to mid-2015. But six deals to date in June are pacing toward a third straight month of collateralized loan obligation deal volume topping $5 billion.

June 14 -

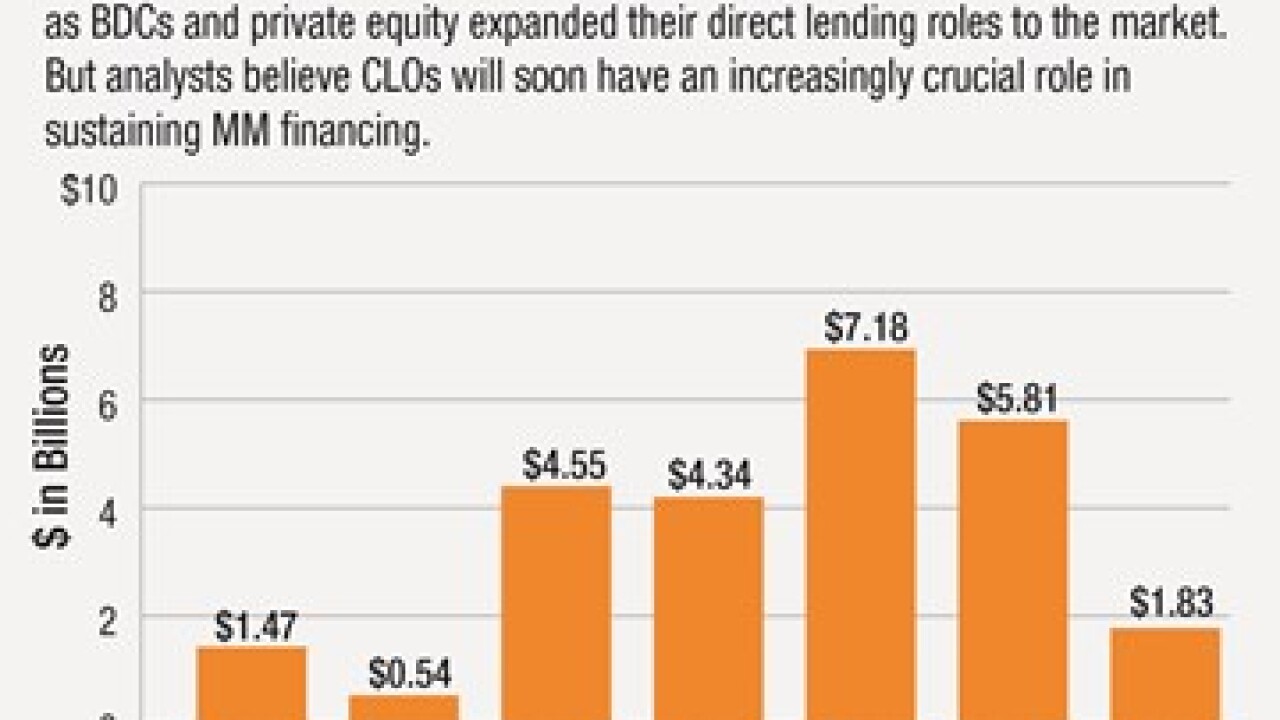

Middle market CLOs have never recovered the role that they played in lending to small and medium-sized companies before the financial crisis; that could change now business development companies and other alternative lenders are under pressure.

May 29 -

In a report published Tuesday, Wells said that retailer loans held by collateralized loan obligations are performing as well, if not better, than most of other loans in CLO portfolios, outside of the oil and gas industries. In addition, only 8% of retail loans in CLOs are trading under $80.

May 24 -

A committee convened by the Federal Reserve to examine potential replacements for widely used interbank offered rate benchmarks has published its interim conclusions, identifying two potential alternatives.

May 22