-

Triumph Capital Advisors doubled its business with a risk-retention driven acquisition of Doral Bank's CLO assets in 2015; the same regs spurred its spin-off as a separately capitalized vehicle to Pine Brook under CEO Gibran Mahmud.

July 10 -

With risk premiums on collateralized loan obligations at or near their tightest levels since the financial crisis, there may be nowhere to go but out, according to Wells Fargo Securities.

July 3 -

The liquidation of Veneto Banca and Banca Popolare puts increasing pressure on other banks in the Eurozone to reduce their holdings of bad loans, according to Fitch Ratings; it remains to be seen whether securitization will play a significant role.

July 2 -

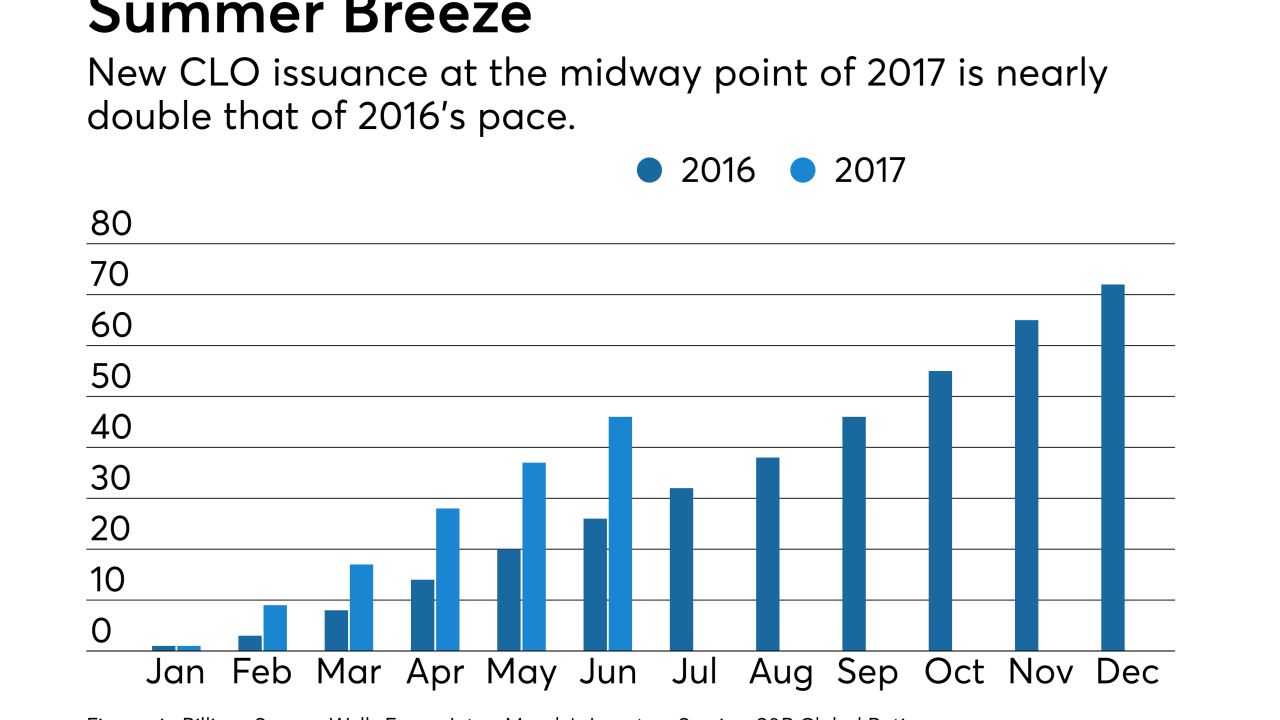

The $15 billion upward revision puts the bank's projection in line with that of JPMorgan; four new CLOs were printed last week, and another six were refinanced or repriced.

June 25 -

CLO managers who accept lower interest payments on loans risk running afoul of deal covenants; but if they take their money back, there are few attractive options for putting it back to work

June 20 -

KKR is undertaking a rare refinancing of a 2014-vintage collateralized loan obligation that does take advantage of a one-time exemption from risk retention requirements.

June 14 -

The Trump Administration’s anti-regulatory agenda has yet to permeate the Securities and Exchange Commission, which remains opposed to relief for collateralized loan obligations.

June 9 -

The $9.8 billion of new collateralized loan obligation issued during the month outstripped the volume of deals being refinanced for the first time this year.

June 6 -

The Massachussetts Educational Financing Authority is issuing $162.23 million of private student loan revenue bonds; Fannie Mae obtains more front-end credit risk transfer; Canadian Tire Bank taps credit card market.

May 25 -

At an industry conference Thursday, three former banking and capital markets regulators including former U.S. comptroller Eugene Ludwig joined in the chorus of industry voices doubting that any near-term relief from Dodd-Frank rules is on the table.

May 25