-

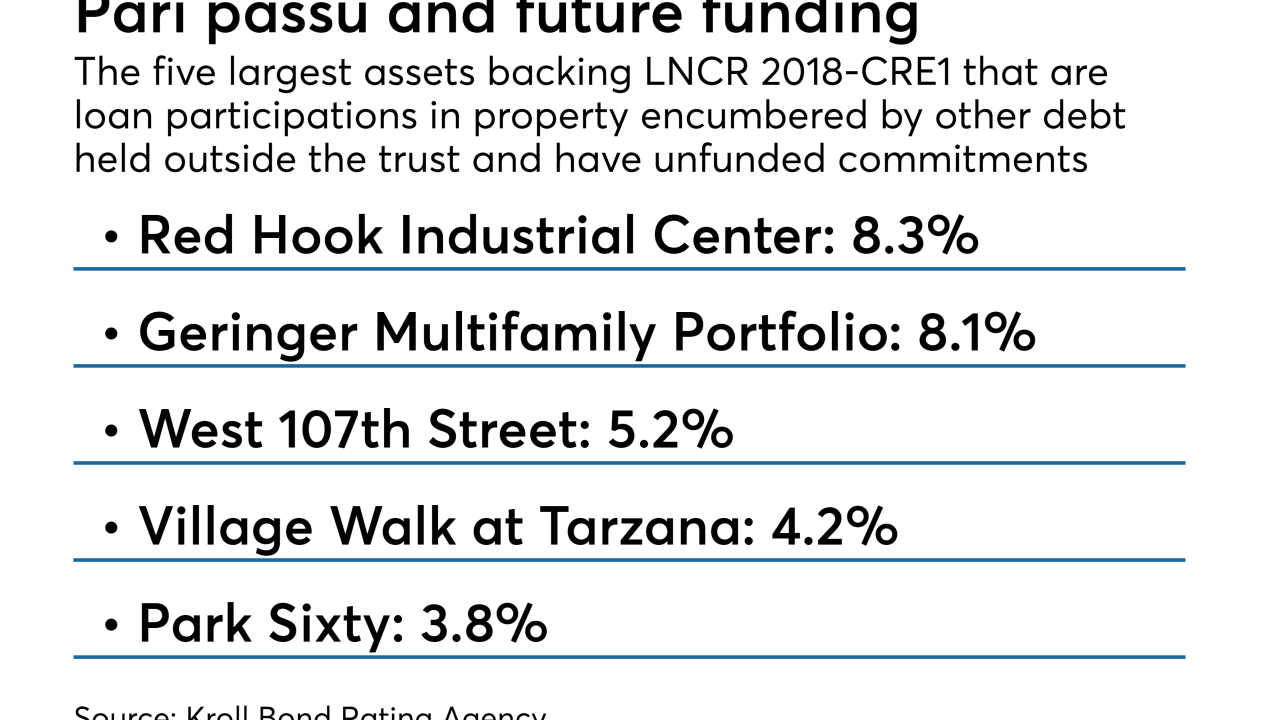

The commercial real estate lender, which is controlled by Canadian and Singapore sovereign wealth funds, included some unusual features in the deal, such as a two-year revolving period.

May 17 -

According to Morgan Stanley, seven of 15 new European CLOs in the pipeline are debut or re-entry deals involving U.S. asset managers.

May 16 -

The London interbank offered rate has its faults, but at least it compensates for counterparty risk; not so the benchmark being touted as a replacement.

May 14 -

A federal appeals court overturned part of the 2010 law’s risk retention rule earlier this year. The legal battle highlights mistakes to be avoided during the next reform fight.

May 10 Loan Syndications & Trading Association

Loan Syndications & Trading Association -

The average AAA note coupon of 103 basis points above Libor widened from 98.4 in March, which had been the tightest CLO spread level in approximately five years.

May 8 -

“We’re comforted by the fact our position in the market is so strong, and our ability to gain [loan] allocation is quite important," co-CEO Kewsong Lee says.

May 2 -

Hunton Andrews Kurth LLP (formerly Hunton & Williams and Andrews Kurth Kenyon) has named Robert A. Davis Jr. as special counsel in its tax and ERISA practice.

April 30 -

After the second-busiest quarter for primary European CLO issuance to start 2018, a two-week April lull in the market was ended with deal pricings by Intermediate Capital and Investcorp.

April 16 -

Jay Huang, a longtime Citigroup veteran who joined in January, is developing a high-tech trading-desk operation to enhance the company's portfolio of CLO investments.

April 16 -

It is backed by $499.8 million of trust preferred securities and subordinated debt issued by 63 banks and $380 million of TruPS and surplus notes issued by four insurance companies.

April 13