-

The .. also named David Williams as head of U.S. global structured credit solutions capital markets; both executives have been with the firm for over a decade.

June 7 -

Changes that federal regulators are contemplating to the Volcker Rule could pave the way for CLOs to resume investing in high yield bonds, which they currently cannot do without putting themselves off limits to banks.

June 6 -

The volume of "true" new-issue CLOs (excluding reissued deals of existing collateralized loan portfolios) have declined for four consecutive months after February's high-water 2018 mark of $14.7 billion. But JPMorgan maintains its $115 billion-$130 billion annualized forecast.

June 6 -

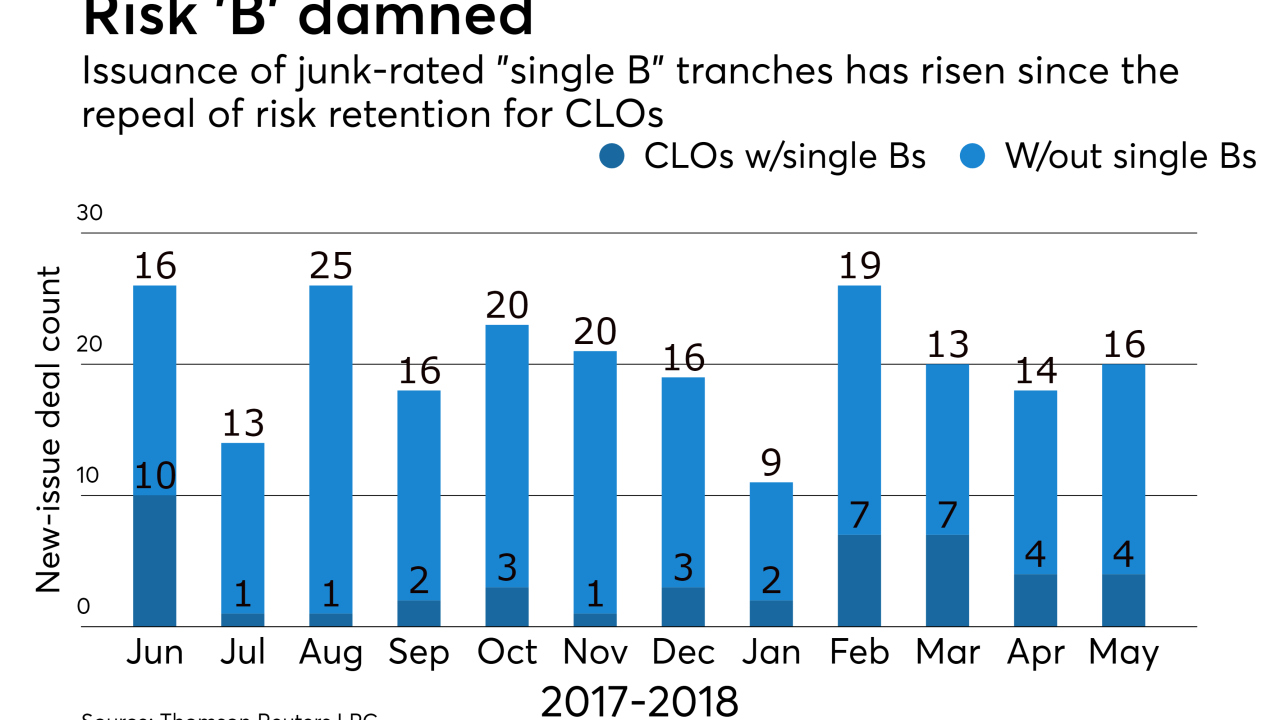

Exempting CLOs from “skin in the game” rules allows managers to unload more of the risk in these transaction; increasingly, they are doing this by issuing a second tranche of speculative- grade notes.

June 5 -

Default risks in retail and media leveraged loans have also risen to the forefront of CLO manager concerns, which a few years ago were centered on oil and gas exposure.

May 24 -

Despite concerns about credit quality, the only constraints on new issuance appear to be the supply of loan collateral and the capacity of warehouse facilities and rating agencies.

May 24 -

Issuance is strong and defaults remain low; yet CLO market participants are concerned about heavy debt loads of the companies they invest in, as well as the lack of investor protections.

May 23 -

Sean Solis has been a partner at Dechert since 2014, advising collateralized loan obligation managers and arrangers through the hoops on U.S. and European risk-retention regulations.

May 21 -

A continued "oversupply" of CLO deals, along with expectations for new debut or returning managers in the absence of risk-retention requirements, is expected to keep activity flowing.

May 21 -

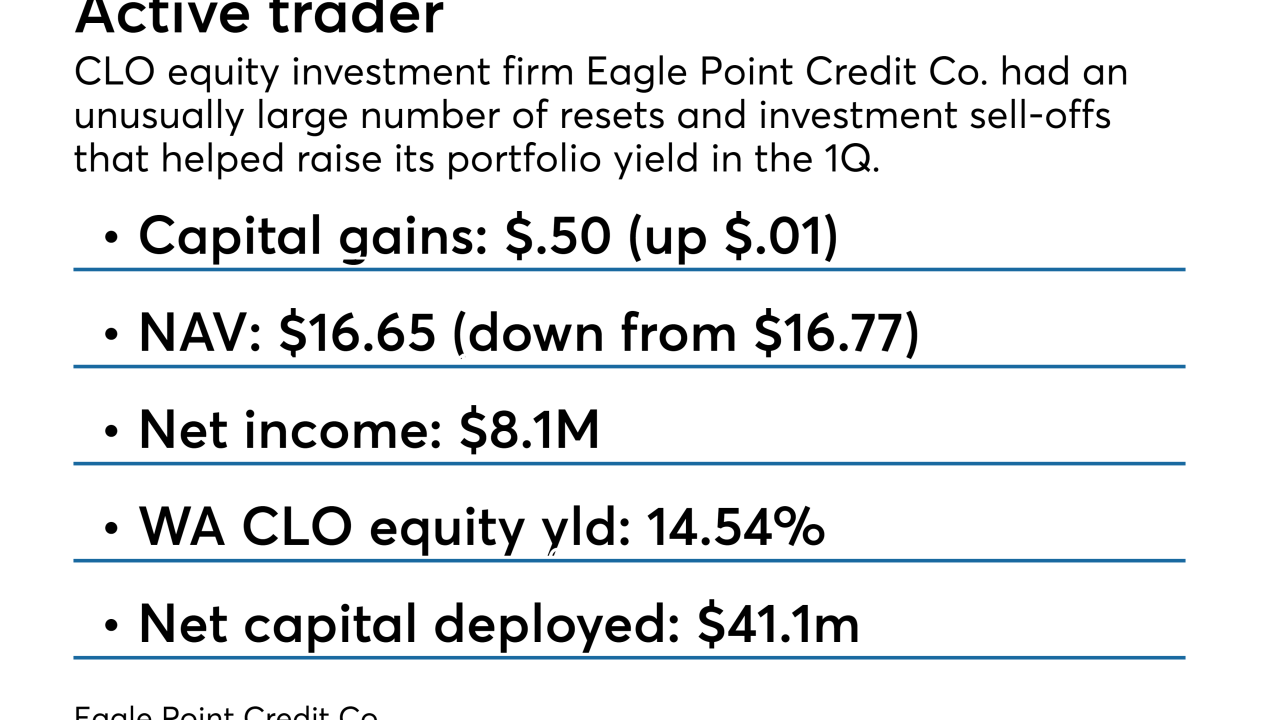

The closed-end fund, a major investor in CLO equity. directed resets of four deals that it controls in the first quarter; this helped end a yearlong slide in its weighted average portfolio yield.

May 18